When SolarWinds MSP unveiled N-central 11 today, the launch focused most heavily on RMM-BDR (remote monitoring and management-backup and disaster recovery) integration. But take a closer look at current and forthcoming enhancements, and you'll notice how SolarWinds MSP is evolving its suite to address PSA (Professional Services Automation), security and plenty more.

John Pagliuca, general manager of SolarWinds MSP, describes the continued integrations as an evolution rather than a revolution. The SolarWinds MSP product portfolio includes offerings from the former N-able Technologies and LogicNow, which SolarWinds acquired in 2013 and 2016, respectfully. By aligning the acquired sales and development teams, SolarWinds MSP is accelerating and deepening the integrations across its product families, Pagliuca asserts.

MSP N-central 11, for instance, integrates MSP Backup & Recovery (part of the LogicNow acquisition) with the RMM platform (part of the N-able acquisition). With a few clicks, MSPs can deploy the software to their managed devices, select files and folders—or a full system--and back up those resources to the cloud, the company asserts.

Similar integrations across the broader SolarWinds MSP portfolio (RMM; backup; MSP Manager for help desk and lightweight PSA; MSP Mail; MSP Risk Intelligence; and MSP Anywhere for remote control) are either in place, arriving now, or on the development roadmap.

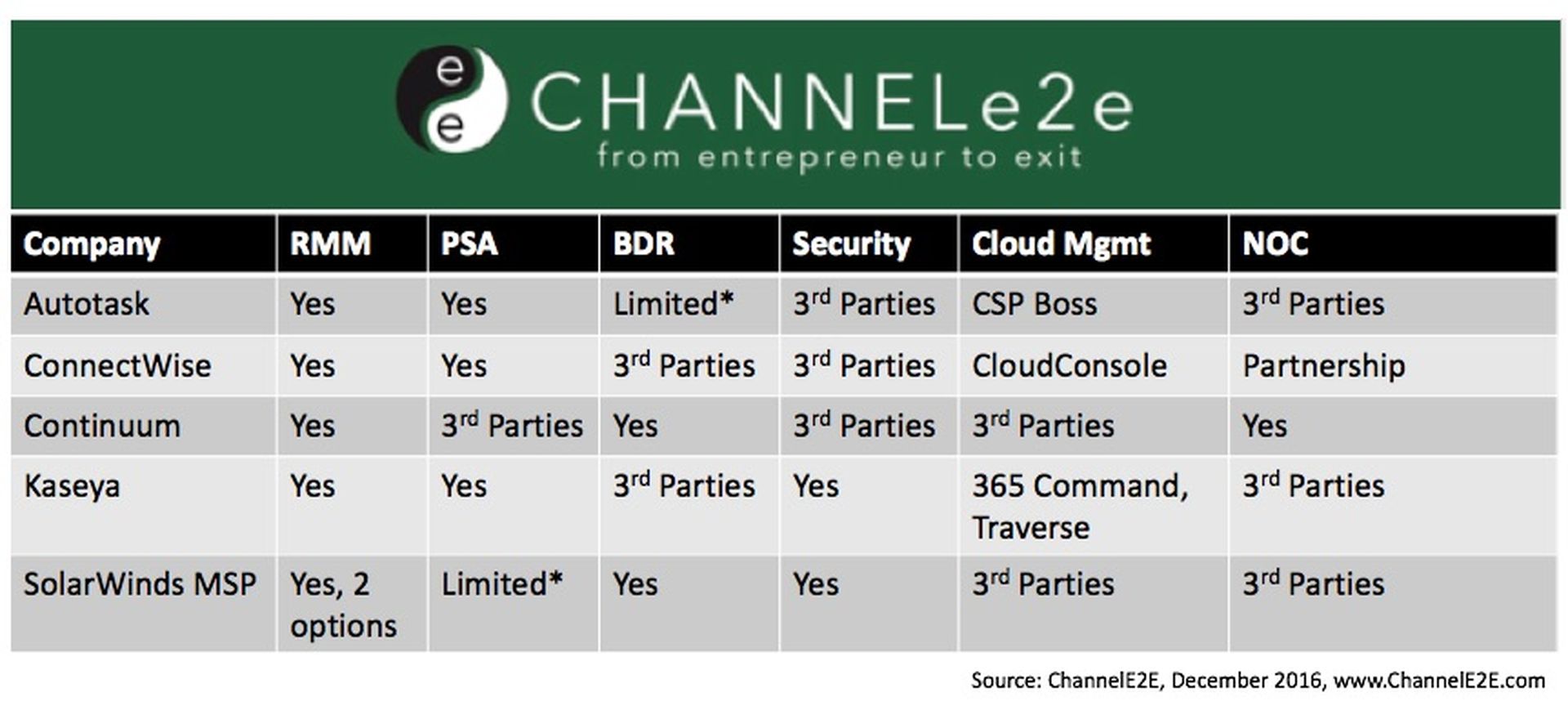

SolarWinds MSP & Key Rival Offerings

Of course, SolarWinds MSP has plenty of competition on the MSP software suite and product integration fronts. Rivals like Autotask, ConnectWise, Continuum and Kaseya each offer growing software portfolios for MSP automation, management and monetization. The lineup looks something like this...

A few extra notes about the chart:

SolarWinds MSP: Next Moves

SolarWinds MSP's new fiscal year starts on January 1, 2017. Pagliuca's game plan will remain consistent. He'll take the best of the former N-able and LogicNow offerings, enhance them, and blend them into green (i.e., money producing) opportunities for SolarWinds MSP and the company's partner ecosystem. "N-central 11 is the perfect balance of that approach," he says, pointing to the RMM and integrated BDR capabilities.

Over time, MSPs will notice that the screens, filters and naming mechanisms are the same across each of the SolarWinds MSP products. That, in turn, means it's easier to get an MSP's tech support team up to speed on the complete offerings.

The company also is working on anti-ransomware tools, along with service desk/help desk enhancements, and new risk intelligence capabilities. "The roadmap is pretty chock full," he says. "It's the most challenging roadmap we've ever had in terms of what we're developing, but we have the resources and the funding to go deliver on it."

On the sales side of the house, SolarWinds MSP is about 60- to 90-days ahead of schedule in terms of coordinating the N-able and LogicNow sales initiatives. Everyone, he says, is aligned behind the company's MSP software vision. And the sales teams have been working collaboratively since October 2016. Pagliuca credits seasoned sales leaders like JP Jauvin and Mike Cullen for the smooth execution so far.

MSP Software: Upstarts, Alternatives

Poke around and it sounds like November was one of the strongest months ever for SolarWinds' overall MSP business. But the competitive threats aren't limited to large companies.

The modern MSP software market also includes a range of cloud- and mobile centric upstarts. Anecdotal evidence suggests newcomers and disrupters like Atera, Auvik Networks, NinjaMSP and Pulseway (among others) have gained momentum with MSPs.

Also, SolarWinds and its four closest rivals (Autotask, Continuum, ConnectWise, Kaseya) face coopetition (competition and cooperation) from a range of security- and storage-centric companies -- where names like Barracuda Networks, Carbonite and Datto come to mind.

Still, the overall MSP market remains in growth mode. And so far, SolarWinds MSP sounds like it's executing on the recent LogicNow buyout.