Alex van Lent, M&A Professional, Evergreen Services Group

Macroeconomic shocks, namely COVID-19, have caused shifts in key economic measures such as inflation and interest rates that indicate we are in a very different economic landscape from just a few years ago. If you are a self-proclaimed “econ nerd” like me this may be interesting enough on its own, but as a business owner you may be wondering how the changing economic tides impact your business and its value. In this article, I’ll describe reasons for some of these shifts and peel back the curtain on how higher interest rates can alter the way investors think about valuations.

Why did interest rates increase?

Historically, periods coming out of a downturn are met with an increase in inflation as demand outpaces supply and thus increases prices. This can be elevated in a health pandemic scenario as government restrictions further impact the supply chain and production capabilities making them take a longer time to return to normal and catch up to surging demand. To mitigate this supply and demand mismatch, the Fed can enact monetary policy, in this case raising interest rates, to curb demand. Raising interest rates does many things, but some of the goals are to make it more attractive to save money instead of spending it and less attractive to borrow money, which should both slow the economy and reduce demand.

So, what does this mean for valuations?

Generally speaking, increasing interest rates will put downward pressure on valuations. Most of this can be attributed to the fact the acquirers, especially private equity firms and financial buyers, are using debt to finance their deals. Debt is a powerful instrument to increase your yield, as you can complete a transaction while using less equity. Yield is a measure of how much cash flow is generated from the amount you invested. By borrowing money, a buyer reduces the amount of capital that they must personally put into the acquisition but the cashflow is not proportionally decreased. It is worth noting that using leverage does also increase the risk of an investment as a buyer will be responsible to pay back the debt regardless of the business’s performance.

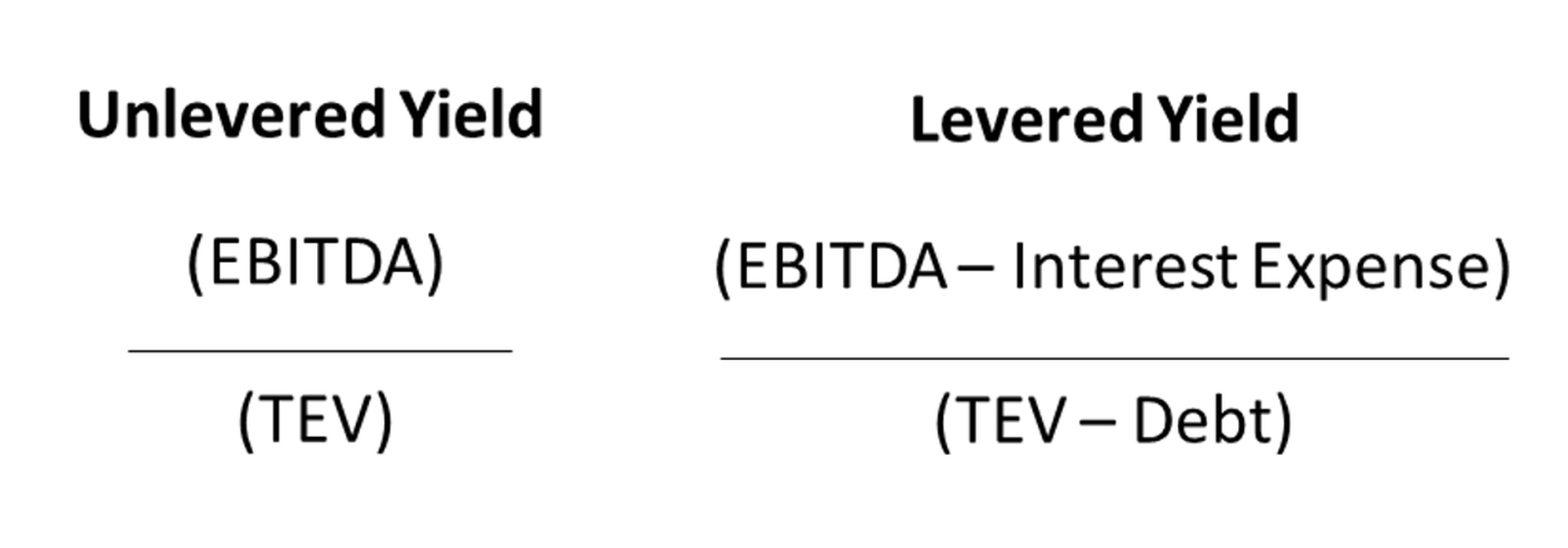

A simple way to calculate yield is to think of it as cash flow (often thought of as EBITDA) divided by equity. When you are using debt, you calculate levered yield using the same figures, but the cash flow will be post-interest payments and the equity number will be smaller by however much debt you are using in the deal.

*TEV stands for Total Enterprise Value which can be thought of as the purchase price for a business

In most instances, the decrease in cashflow, driven by the addition of interest payments, has a smaller impact on the numerator than the change in the denominator. However, when the price of debt goes up via the interest rate, it increases your interest expense leading to a decrease in post-interest cash flow while the amount of equity used stays the same. The decrease in the numerator and constant denominator causes the ratio and thus levered yield to decrease. To offset this change, a buyer would seek to lessen the amount of equity used in the deal and the action they have the most control over would be to lower the total purchase price.

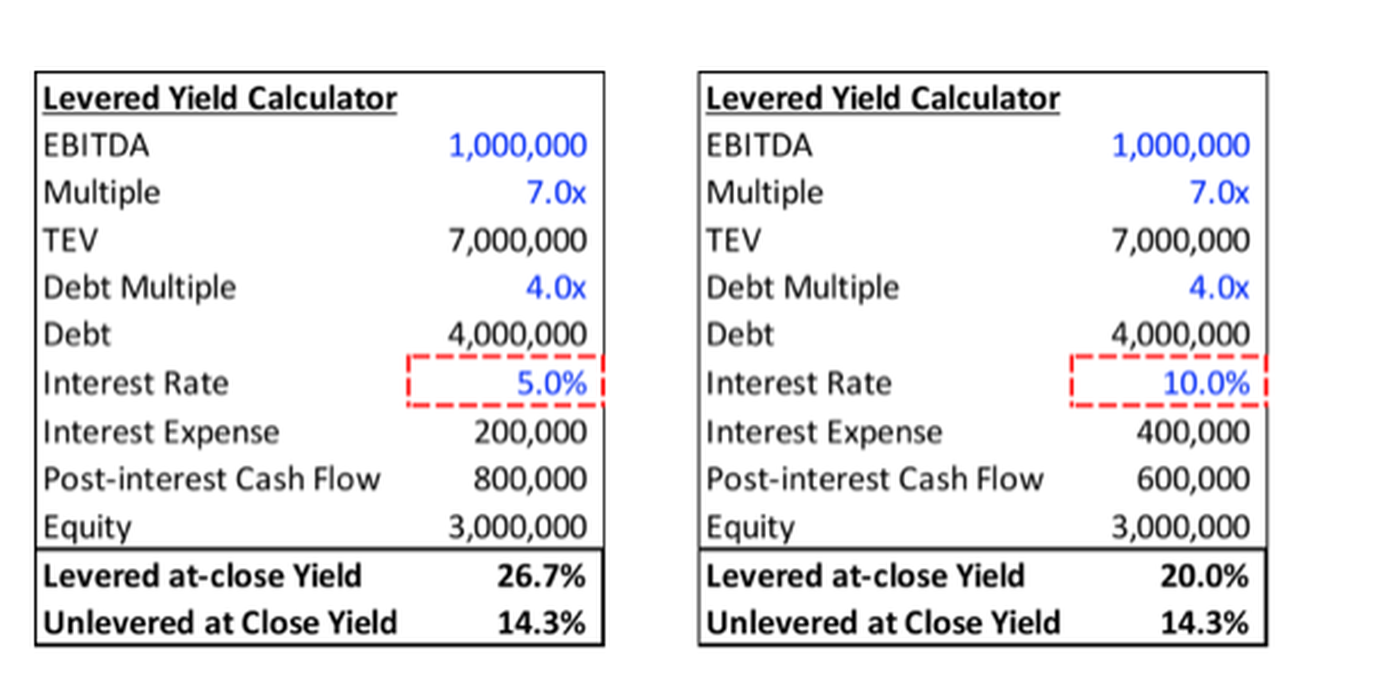

Sample transactions:

To make this scenario a little more tangible, let’s take a look at the below sample transactions. In both cases, EBITDA, purchase price, and amount of debt used are all the same. The only difference is that the interest rate is 5% on the left and 10% on the right. You can see that just this change causes a downward shift in levered at-close yield from 26.7% to 20.0%.

Takeaways:

Alright, that was a lot of economic theory and calculations. Here are some of the key things to take away and think about moving forward in times with increased inflation and higher interest rates.

- An increase in inflation is often combatted by monetary policy from the Fed in the form of raising interest rates.

- Increased interest rates aim to put downward pressure on prices throughout the economy and do so as well when it comes to business valuations.

- When using debt to finance a transaction the interest rate can be a key factor in your expected return. Increases in the price of debt can be offset by a reduction in purchase prices to maintain target yields for investors.

It is crucial to note that this downward force from interest rates does not necessarily dominate the overall behavior of valuations. There are many factors from the macroeconomy, MSP industry trends, and most importantly your business’s performance that will lead to a valuation.

A lot of these changes may not be felt on the day-to-day, but I hope that this has helped shine a light on how acquirers view transactions and the impact of economic changes.

Guest blog courtesy of Evergreen Services Group and authored by Alex van Lent, M&A Professional, Evergreen Services Group. Read more Evergreen Services Group guest blogs here. Regularly contributed guest blogs are part of ChannelE2E’s sponsorship program.