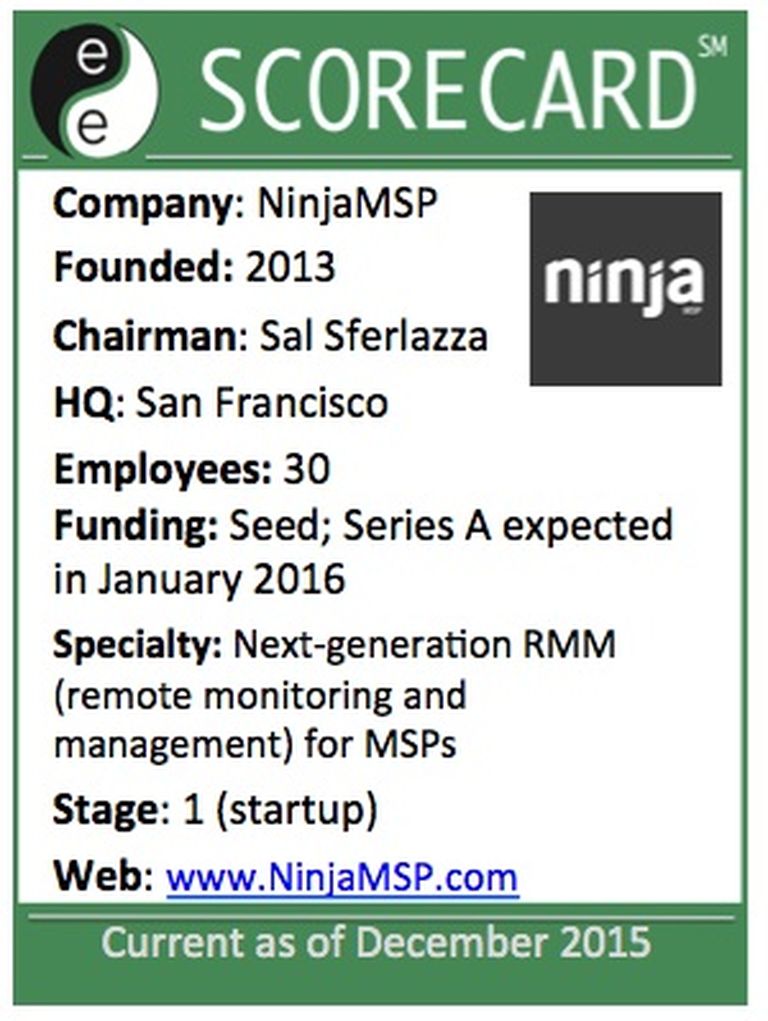

NinjaMSP, the start-up provider of RMM (remote monitoring and management) tools for MSPs, may announce Series A funding around January 2016, ChannelE2E has learned. The pending move is part of an aggressive strategy to move as close as possible to MSPs -- without playing favorites across the software landscape.

NinjaMSP's founders and team members include veterans from PacketTrap (an RMM platform that Dell acquired and later killed), Anchor Networks (file sync and sharing, now owned by eFolder), GFI Software and several other channel-friendly companies. "Getting the band back together in some ways is an unfair advantage" over entrenched MSP software companies with legacy software and startups that lack MSP experience, asserts NinjaMSP Co-founder and Chairman Salvatore Sferlazza.

Still, that doesn't mean Sferlazza is taking the competition lightly. Nor is he taking MSP support for granted. During an interview today, ChannelE2E spoke with Sferlazza and several other NinjaMSP team members about their business strategy. The conversation included:

NinjaMSP's RMM and MSP Strategy

Overall, NinjaMSP's business strategy is quite simple -- and that's why it just may work amid an entrenched crowd of RMM rivals. Instead of trying to build an end-to-end MSP platform across RMM, PSA, security, storage and more, NinjaMSP is striving to:

"For me, having done three other start-ups in the MSP space, there's still a good opportunity for market disruption," says Sferlazza. "A lot of the other players are on 10- or 15-year-old technology stacks or they have grown through acquisitions."

"The big players today want you to buy all of their products and you wind up using only 25 percent of the offering," adds Reumann. In stark contrast, NinjaMSP wants to offer the best RMM platform, with the deepest integrations to third-party MSP toolsets.

Similar to how Apple built the App store, NinjaMSP wants to be the fabric through which all MSP software products integrate. Instead of inking a deal to work exclusively with a specific security vendor or backup provider, NinjaMSP will leverage a Switzerland strategy -- remaining vendor-neutral and building integrations wherever MSPs demand them.

"MSPs have strong religions when it comes to the tools they use," says Sferlazza."They don't want someone to dictate which tools they have to use."

The secret sauce? NinjaMSP claims to have developed an integration process that allows the company to build third-party integrations five-times faster than rivals. Predictably, the first integrations involve serving large installed bases -- such as Autotask and ConnectWise. A Tigerpaw Software integration is coming soon, and eight to 10 more integrations are on the drawing board.

Instead of leaning on MSP software vendors to write the integrations, NinjaMSP has a "self-describing data framework" that allows the company to rapidly build integrations on its own. As NinjaMSP's own installed base grows, the company expects the integration conversation to flip-flop -- that is, companies will want to integrate their products with NinjaMSP in order to potentially tap into the company's installed base.

Building NinjaMSP

Building and activating NinjaMSP's cloud service wasn't an overnight journey. Sferlazza started thinking about a potential RMM market reboot when he exited Dell in 2013. He realized endpoint monitoring was required but merely "table stakes." The NinjaMSP platform had to offer cloud infrastructure monitoring, network monitoring and other deep-dive features that are "free" inside the platform, rather than paid add-ons.

Leveraging the network-level monitoring, Sferlazza believes NinjaMSP can greatly reduce time to remediation. And based on hundreds of users who are already leveraging the system, Sferlazza believes the company is on the right track.

A handful of angel investors provided seed funding to date, allowing the company to grow to about 30 employees. Next up is a potential Series A round of funding -- which sounds like it could close in the first week of January 2016. "The past year has been about building the platform and validating it in the market," says Sferlazza. Next, the company plans to use Series A funding to scale the business. If everything goes according to plan, NinjaMSP expects to have more than 1,000 MSPs running on the platform by the close of 2016.

Entrenched Rivals, Disruptive Startups

Of course, NinjaMSP faces plenty of entrenched rivals -- several of which have suite approaches (i.e., one throat to choke), which numerous MSPs prefer. Among the key players to track:

Startups are also quite active in the RMM and MSP software markets. For instance, Auvik Networks has focused heavily on network-centric RMM for MSPs. And LogicMonitor is betting heavily on mid-market MSPs.

There's also lots of talk about Application Performance Management (APM), where upstarts like AppDynamics and New Relic are helping service providers and DevOps to monitor and optimize application performance.

NinjaMSP is aware of the APM wave, but believes tools like AppDynamics and New Relic are designed more for application writers and businesses that develop their own software. In stark contrast, NinjaMSP can help service providers to monitor and manage off-the-shelf applications like Exchange Server or mainstream cloud applications.

But NinjaMSP won't stop there. The Series A funding sounds like a nearly done deal for January 2016. And more integrations and feature upgrades apparently are set to surface in Q1 2016 or so...