Dell has spent roughly eight years opening its arms to channel partners. But a lot of those partners don't realize Dell also is willing to open its wallet to help VARs and IT service providers with financing deals.

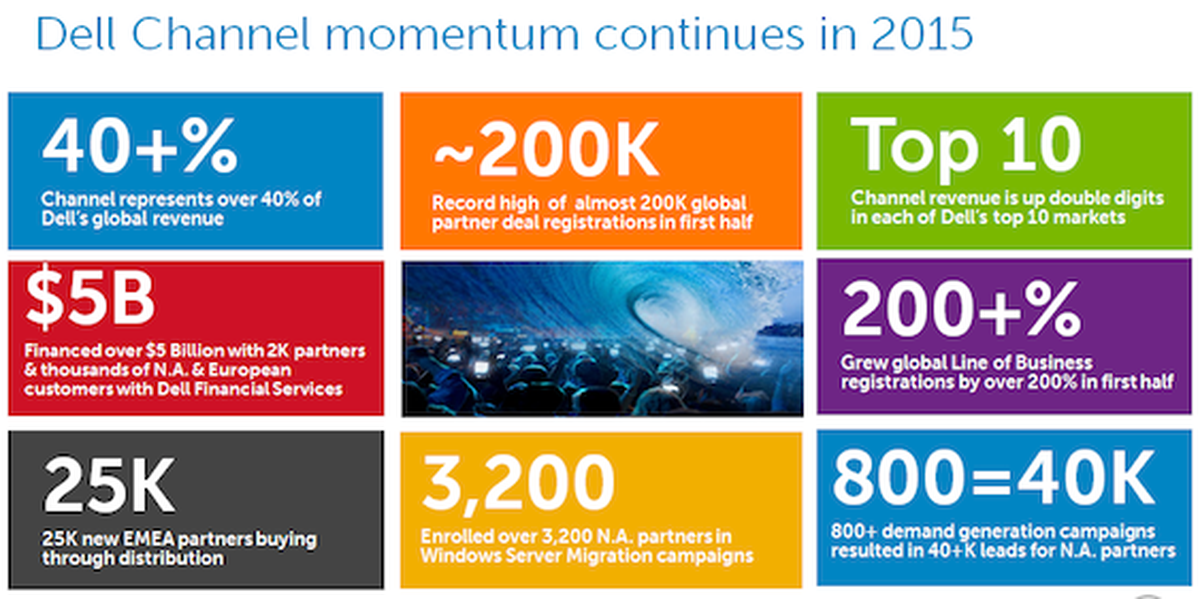

Indeed, Dell Financial Services has "really ramped up its presence" with roughly $5 billion financed via 2,000 partners across North America and Europe this year, estimates Frank Vitagliano, VP of North American Channels at Dell. He says the financing organization has become a "really, really important piece of our business" as partners seek to scale engagements with customers.

On a related note, Vitagliano pointed to Dell Scalable Cloud Payments for service providers. It features a "Pay As You Grow option so payments increase as the business grows, a Provision and Pay option with cyclical deployment and payment plan, and a Scale on Demand option with cloud payments based on usage," Dell has previously indicated.

Dell's financing programs have become more important as more partners and customers shift IT budgets from CapEx to OpEx models. On the one hand, Dell doesn't expect the majority of customers to embrace hardware as a service (HaaS). But on the other hand, Dell now offers total solutions (desktops, servers, software, converged data center, etc.) that can often benefit from special financing packages. "We have a unique perspective here," says Vitagliano. "We have a a financing arm that understands the business of IT."

Some potential rivals -- say, Cisco Systems Inc.'s Cisco Capital arm -- can make similar claims. But Dell's ability to scale from small business PCs and servers up to major data center projects potentially allows the company to wrap financing around solutions that other companies can't quite match on their own.

Dell PartnerDirect Channel Trends

During a wide-ranging conversation with ChannelE2E yesterday, Vitagliano described a range of Dell PartnerDirect milestones and themes for the company's current fiscal year -- which wraps up at the end of January 2015. They included...

On Dell's Distributor Relationships: Vitagliano has been impressed with how distributors evolved from "pick, pack and ship" to multiple specialties that attract and empower partners. "Their ability to help us drive sales -- both in terms of inside sales talent and outside sales talent -- is impressive. They're really helpful for calling on top partners as well as the SMB partners that no vendor can get to on a consistent basis. Then, there's the pre- and post-sales tech support and marketing activity -- all of which they do very well.

On PartnerDirect's Overall Momentum: "We're pretty happy," he says. "The channel continues to be a major focus. The overall Dell channel business now represents over 40 percent of our global business. And that has continued to grow, and it has grown dramatically over the past couple years. It was about 33 percent of the business two years ago. We committed significant investment in channel incentives and tools and IT changes. That has resulted in really contributed to the growth."

Dell's channel revenue is up "double-digits" in each of the company's top 10 markets this year. Also, partners are earning record rebates from the company. In North America, partner payouts have grown 60 percent year over year, he estimates.

On Ease of Engagement: Vitagliano says Dell has significantly improved its deal registration process. But he concedes that Dell needs to make ongoing progress with better tools and ease-of-engagement improvements to make the Dell-partner relationship even more seamless.

Dell Hardware and Software

On Dell Product Mix: Dell continues to see storage partners pushing into servers and clients as part of a cross-sell and up-sell strategy. "What we envisioned a few years ago -- real end-to-end best in class solutions -- we're really seeing our partner base really embrace that," he asserts.

On Dell Software: It has been reorganized into four areas: Systems and Information Management (SIM); Security Solutions; Boomi; and Statsoft. Vitagliano points to the SonicWall business, in particular, continuing to attract and retain really loyal partners.

On the Overall Journey: Vitagliano, an IBM and Juniper veteran, joined Dell nearly three years ago. "It's been a thrill a minute," he quips -- though he's serious about the statement. "I came here because of a few things. First, I believe Dell is an iconic company based on everything they stood for and accomplished. Second, I was extraordinarily impressed with the acquisitions and the transition toward selling end-to-end outcomes for customers. And thirdly, I thought I could help for the continuing evolution into the channel. All of those things have continued in an accelerated way."

During Dell's transition from a public to private company in 2013, the team remained "focused like a laser" on execution for partners and customers, he says. We didn't discuss the pending EMC buyout during our call yesterday. But Vitagliano will surely push to maintain a similar focus as Dell strives to complete the EMC and VMware acquisition in 2016.