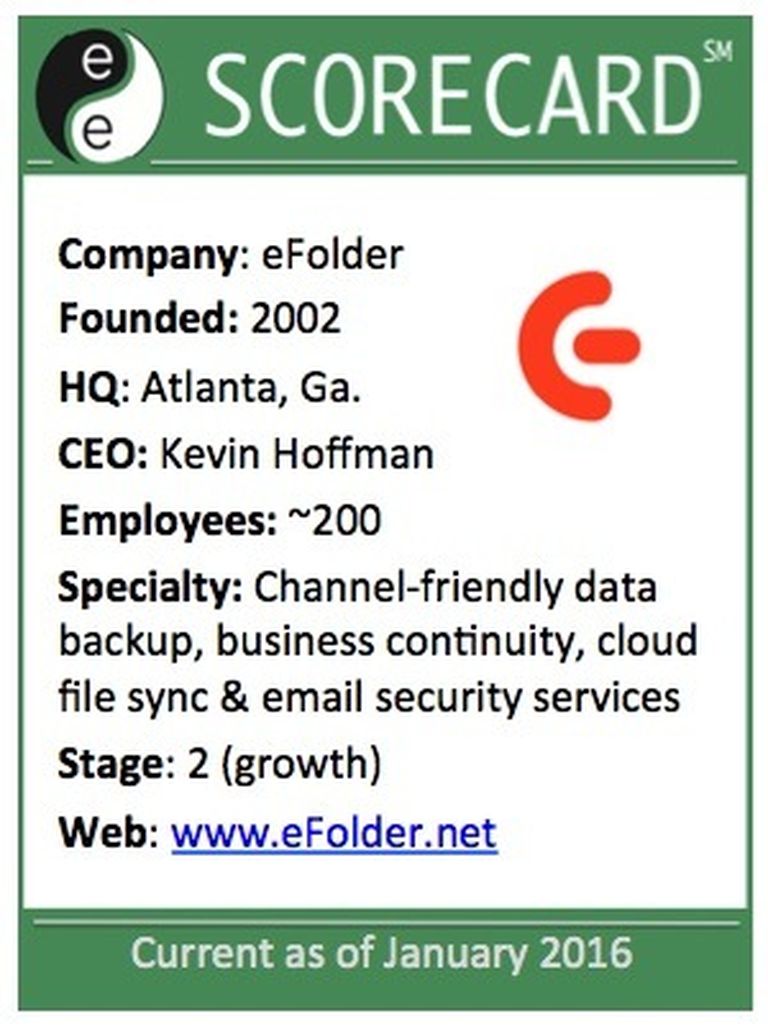

From its humble beginnings in 2002, eFolder has spent more than a decade evolving and transforming into a cloud solutions provider for VARs and MSPs. Take a closer look and you'll discover serious momentum at the data protection, business continuity and mobile productivity specialist.

Three key examples based on eFolder's business performance in 2015 vs. 2014:

- eFolder's backup and disaster recovery (BDR) business grew its bookings 150 percent.

- The company's file sync and sharing business (Anchor) experienced 70 percent year over year user growth, and a 50 percent increase in shared documents per user.

- eFolder's storage cloud has experienced 85 percent year over year growth, and has been adding 2 PB per month of storage to the system.

But how did eFolder get to this point? And where is the company heading next?

Challenging Start

eFolder emerged from a VAR business in Atlanta, Ga., more than a decade ago. The co-founders -- Kevin Hoffman, George Welborn and John Williams -- delivered a cloud backup product by around 2005.

Just as eFolder was getting off the ground the company faced a tragic inflection point in 2007, when co-founder and CEO John Williams died of a rare neurological disease. The CEO post transitioned to Hoffman, and Welborn remains executive VP responsible for strategic relations. Instead of stopping there, the company grew and rounded out its executive management team.

Among the key names to know:

- COO Mike Richey, a former CIO and IT auditor, arrived in 2014.

- Senior VP of Sales Bryan Forrester, plugged in through the Anchor acquisition in 2013.

- VP of Channel Development Jan Spring arrived in 2011.

- VP of Marketing Ted Hulsy arrived from Dell SonicWall in 2011.

- VP of Product Pierre Tapia arrived via the Anchor deal in 2013.

Admittedly, I've condensed the eFolder timeline and history. The company has grown and evolved quite a bit in a decade. But take a closer look at that eFolder executive timeline, and major eFolder inflection points surfaced in 2011 and 2013.

2011: What's Ted Doing?

I remember the call, though I don't remember the date or location. Dell SonicWall veteran Ted Hulsy had reached out to me sometime in 2011, seeking to meet for a drink at an IT conference.

Hulsy revealed that he was set to join eFolder, a promising data protection company that had an emerging channel following. I checked the company's website. I spoke with a few sources. Partners liked eFolder -- but the company's online branding, imaging and marketing looked like it was stuck in the 1990s.

Privately, I wondered if Hulsy was making a mistake. Dell had a growing partner program. SonicWall was a solid brand. Why walk away from that relative safety? But I watched. And I learned. And I watched some more.

Instead of emerging as a "storage" company, eFolder had grander ambitions. "We never wanted to become a storage company," says Hulsy. "Instead, we're a software and services company in backup, disaster recovery and file sync. We have a scalable cloud infrastructure that can meet those blanket needs. And more."

Hulsy credits numerous team members for eFolder's growth and success. And he specifically points to Hoffman and Spring for eFolder's focus on the right technology and partners.

2013: Competing With Box?

Still, eFolder didn't rest on its data protection laurels. By 2013, the company raised $26 million and acquired Anchor Networks -- a scrappy provider of file sync and sharing services.

At the time, it had been around two years since I quietly questioned Hulsy's career move. This time, I was skeptical of eFolder's overall M&A strategy. Why would a small channel company want to compete against Box and Dropbox -- two consumer giants that were growing fast, attracting big venture capital dollars... and losing money?

Here again, the simple answer involved technology and the channel. Anchor was specifically designed for channel partners, and it didn't suffer from the consumer shortcomings of Box and Dropbox.

"Anchor was made for the channel," Hoffman told ChannelE2E during a meeting at IT Nation 2015. Neither Box nor Dropbox have true multi-tenancy or policy features for partners to effectively manage multiple end-customers, he added.

2014-2015: Innovation, Integration and Growth

Managing M&A isn't easy. You know it. I know it. For 2014 and 2015, most of the eFolder rally cry involved integration -- and keeping a healthy focus on eFolder's growing portfolio of services.

While eFolder integrated Anchor Networks into the business, the company also solidified its cloud disaster recovery strategy. Among the key priorities: Remaining like Switzerland in the market. That meant being vendor neutral and partnering up with the five of the leading providers of image-based backup:

- Acronis

- Dell AppAssure

- Replibit

- StorageCraft (recently acquired by TA Associates, by the way)

- Veeam

"If you look at the use of image-based backup, those are the biggies," says Hulsy. "We deliver a cloud service for each of them. It's all about serving the partners with an end-to-end solution."

That vision, Hulsy says, was validated in 2015 as eFolder's BDR service bookings grew 150 percent year over year. Along the way, eFolder has also overhauled its branding and marketing -- delivering a consistent image across each of its products and services.

2016: The Next Rally Cry

Every six to 12 months, eFolder's team focuses on a key rallying cry. For most of 2015 the big priority was integration. This year, the rally cry is, "Partner Success Comes First."

In some ways that's old news. eFolder has always been a channel-centric technology company. But this year is about doubling down on existing partners and making them even more successful, Hulsy asserts. The overall vision: Make eFolder the most profitable vendor relationship that MSPs have.

Of course, intense competition looms around every corner. Within the SMB channel, dozens of backup, storage and file sharing companies are now in the market. Plus, plenty of consumer and enterprise companies are obsessed with potential SMB opportunities.

How will eFolder respond? On the one hand, much of the strategy involves those existing MSPs. But on the other hand, stay tuned. I get the sense that eFolder is getting ready to add a new chapter to its channel playbook...