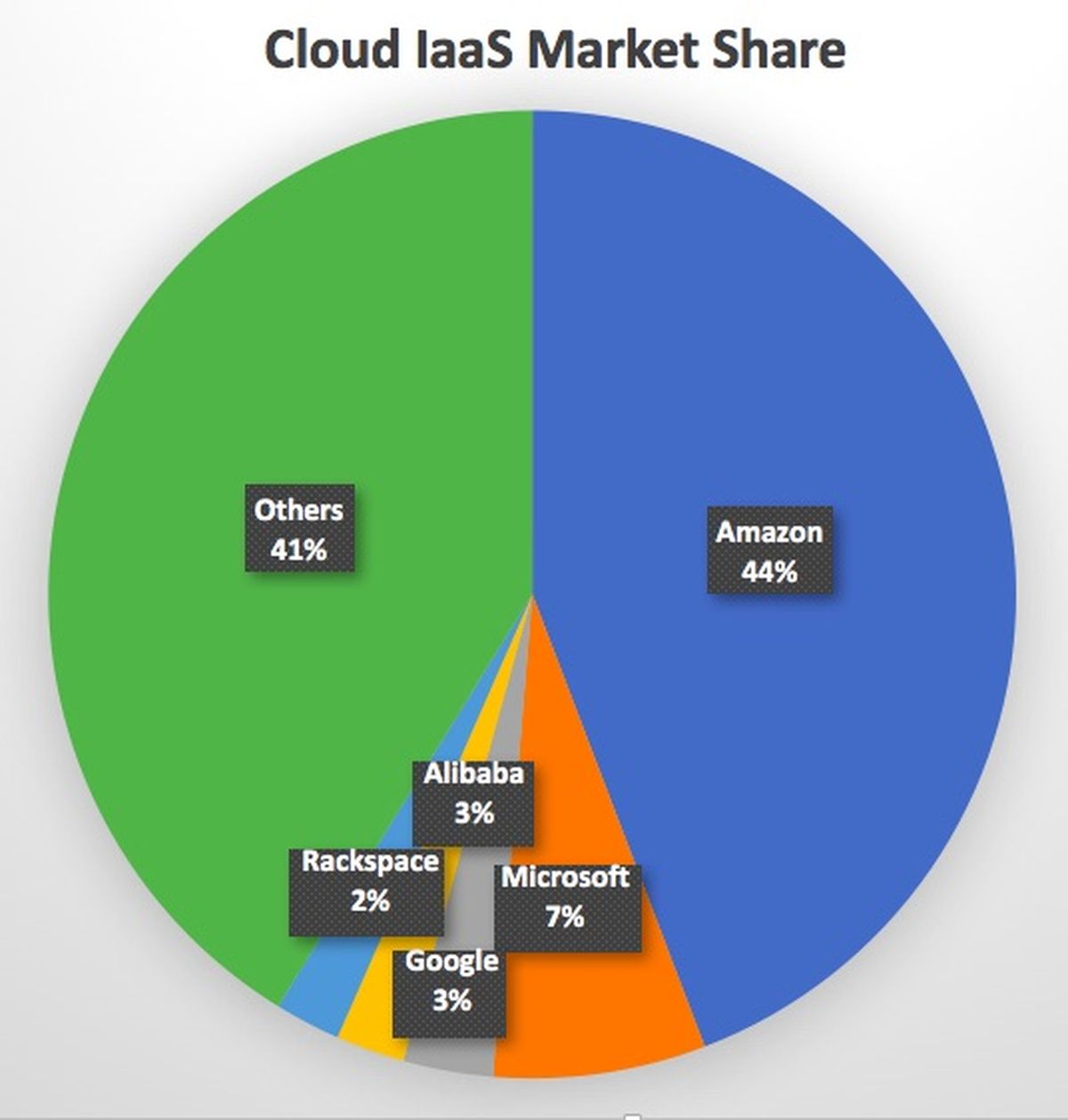

Amazon Web Services (AWS) still dominates the public cloud IaaS market, but rivals like Microsoft Azure, Alibaba, Google Cloud Platform and Rackspace at least have a slice of the market, according to a Gartner research statement in September 2017 covering the 2016 and 2015 IaaS markets.

Noticeably absent from Gartner's latest cloud IaaS market share list: IBM and Oracle.

In terms of overall cloud IaaS market share, AWS commands 44 percent of the sector, followed by Microsoft Azure at 7.1 percent, the research says. No other company has more than 3 percent of the sector. And it's safe to say IBM and Oracle each have 2 percent or less of the IaaS market, based on what Gartner said -- and didn't say.

In fairness to IBM, that company focuses mainly on hybrid cloud services -- attempting to help customers balance on-premises and off-premises private clouds with public cloud workloads. As for Oracle, that company focuses most heavily on the SaaS sector. CEO Mark Hurd has repeatedly stated that Oracle intends to rank among the top 2 SaaS application suite providers. Hurd has not publicly predicted which rival will occupy the other top-two SaaS slot, though Microsoft, SAP and Salesforce are certainly in the running.

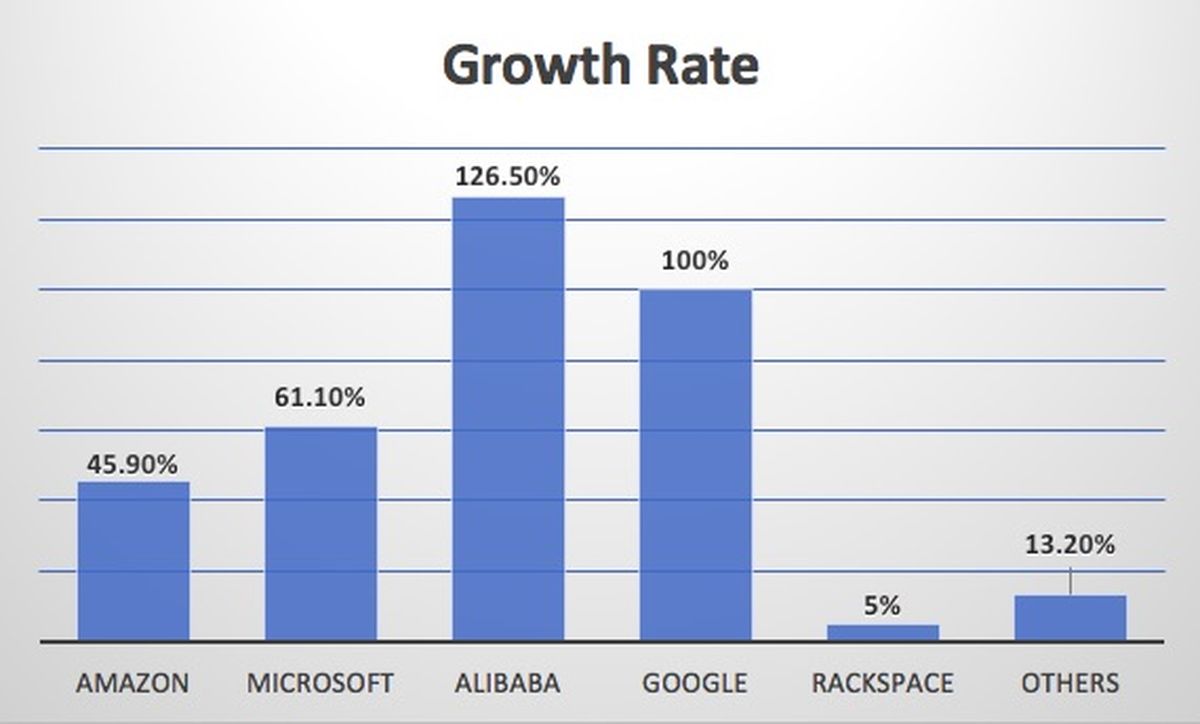

Cloud IaaS Growth Rates: 2016 vs. 2015

In terms of IaaS growth rates, Alibaba is growing fastest (up 126.5 percent) followed by Google Cloud Platform (100 percent), Microsoft Azure (61.1 percent) and Amazon (45.9 percent), according to Gartner's estimates of 2016 vs. 2015 revenues.

Still, those growth rate figures can be misleading -- especially since Amazon's growth rate is based on a much larger revenue base than those of rivals.

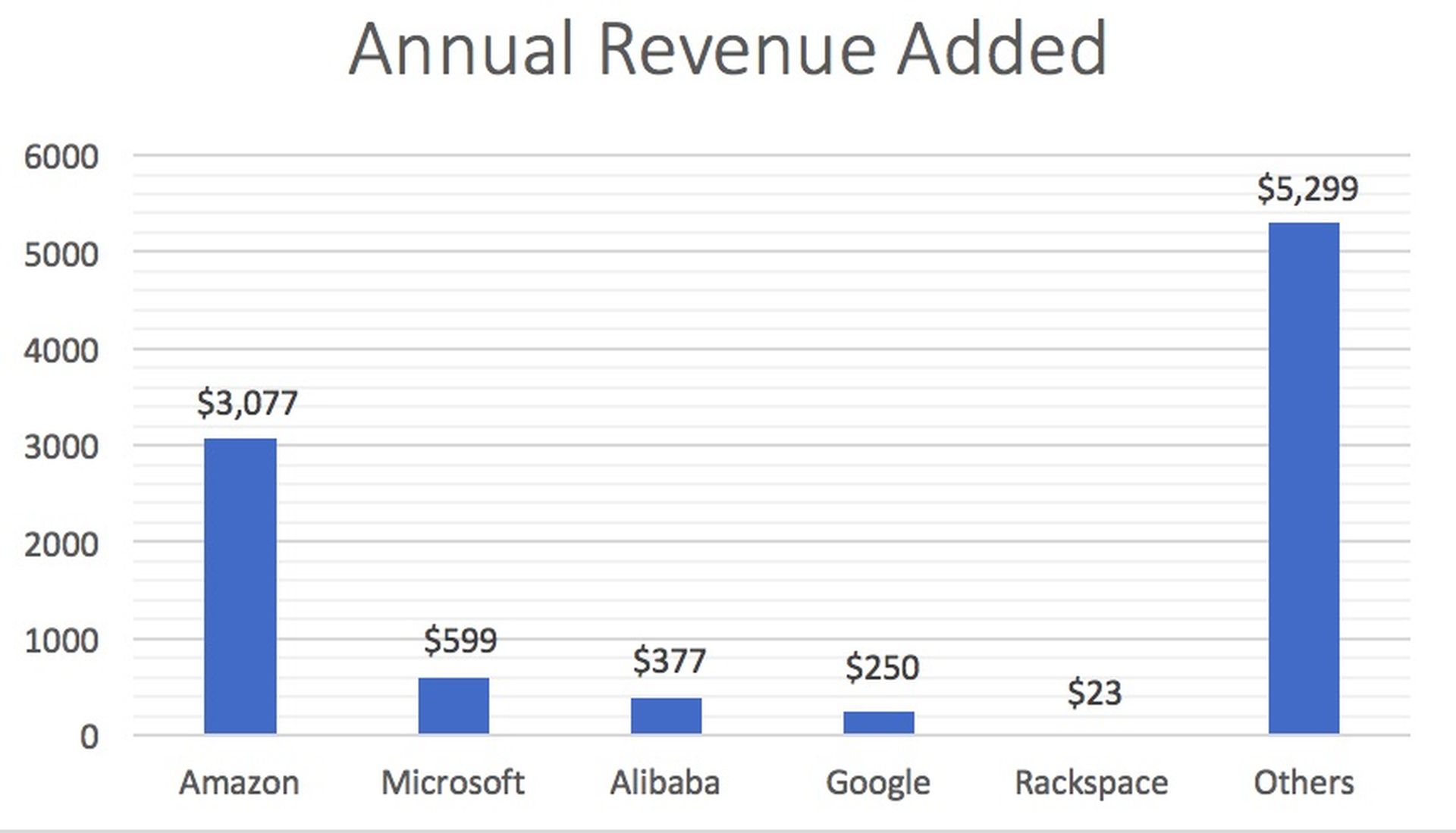

Cloud IaaS Actual Revenue Growth: 2016 vs. 2015

When you shift from revenue growth percentage rates to actual dollar growth, the picture becomes far clearer. Amazon had the biggest IaaS revenue base in 2015, and added the most additional IaaS revenue in 2016, according to Gartner.

Indeed, Amazon added more than $3 billion in IaaS revenues in 2016, far ahead of IaaS revenue growth at Microsoft (up $599 million), Alibaba (up $377 million) and Google (up $250 million).

The bottom line: At least through the end of 2016, Amazon was the largest IaaS provider and the company's revenues in that sector were growing faster than all of its major rivals -- at least in terms of pure dollars and cents.

Still, these figures overlook other hot sectors -- particularly SaaS, where Microsoft is the perceived leader with Office 365. On a related note, check out the Top 25 SaaS applications for 2016.