Private equity firms have acquired many (though not all) of the large MSP software providers in the SMB market. But the M&A game isn't over. Indeed, the stakes may be about to go even higher.

Updated February 25, 3:00 p.m. ET: Thoma Bravo has acquired ConnectWise, fulfilling the thesis that ChannelE2E shared below on February 4, 2019. The article below from February 4 remains unchanged.

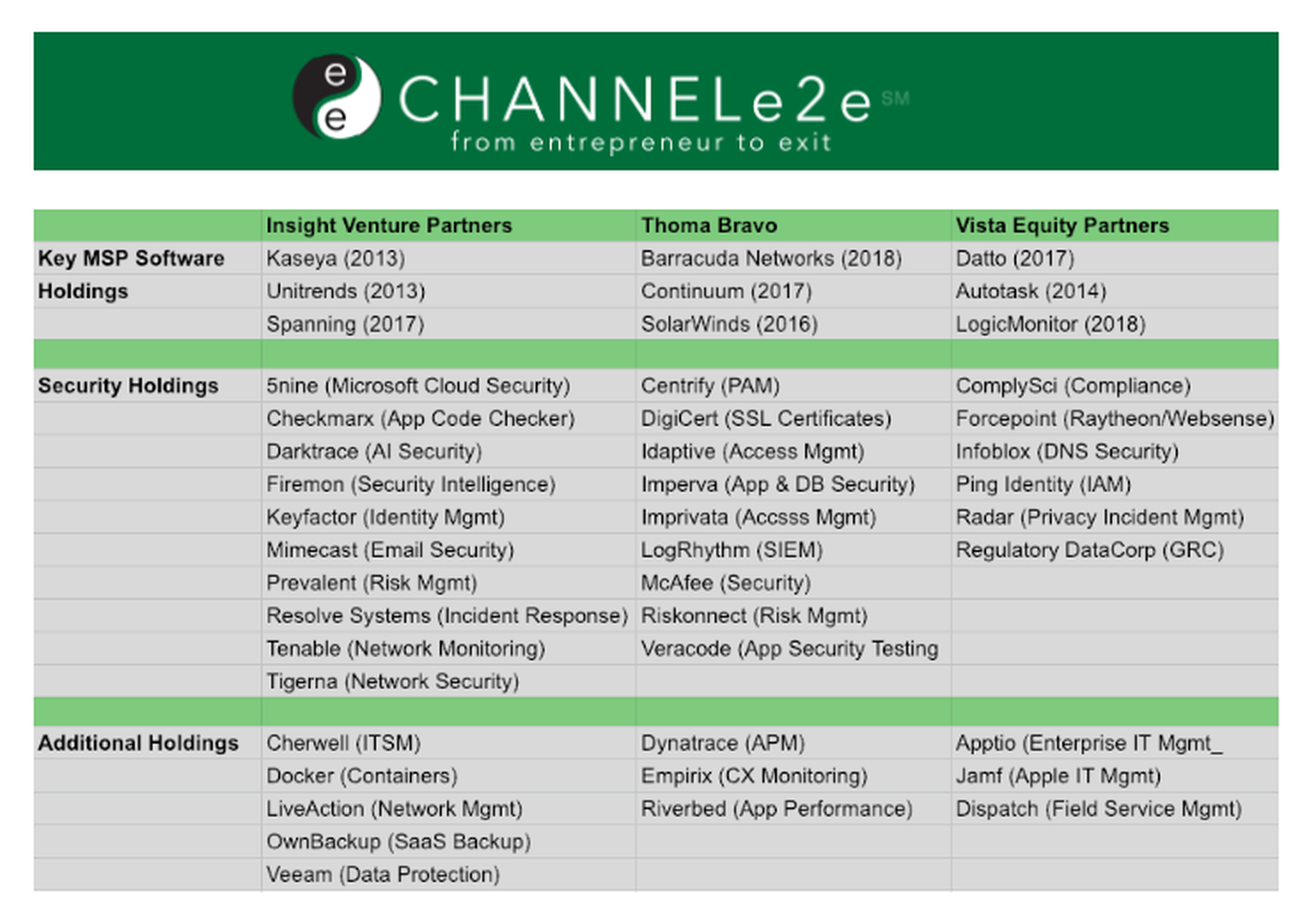

The big private equity players in the sector -- particularly Insight Venture Partners, Thoma Bravo and Vista Equity Partners, among others -- are plotting their next moves. The graph below shows what those PE firms own so far, and hints a potential synergies between the MSP software and security markets.

Private Equity, MSP Software and Security: Who Owns What

Largest MSP Software & Technology Providers

SolarWinds CEO Kevin Thompson

SolarWinds CEO Kevin Thompson

Generally speaking, the five largest MSP software and technology providers in the SMB sector are considered:

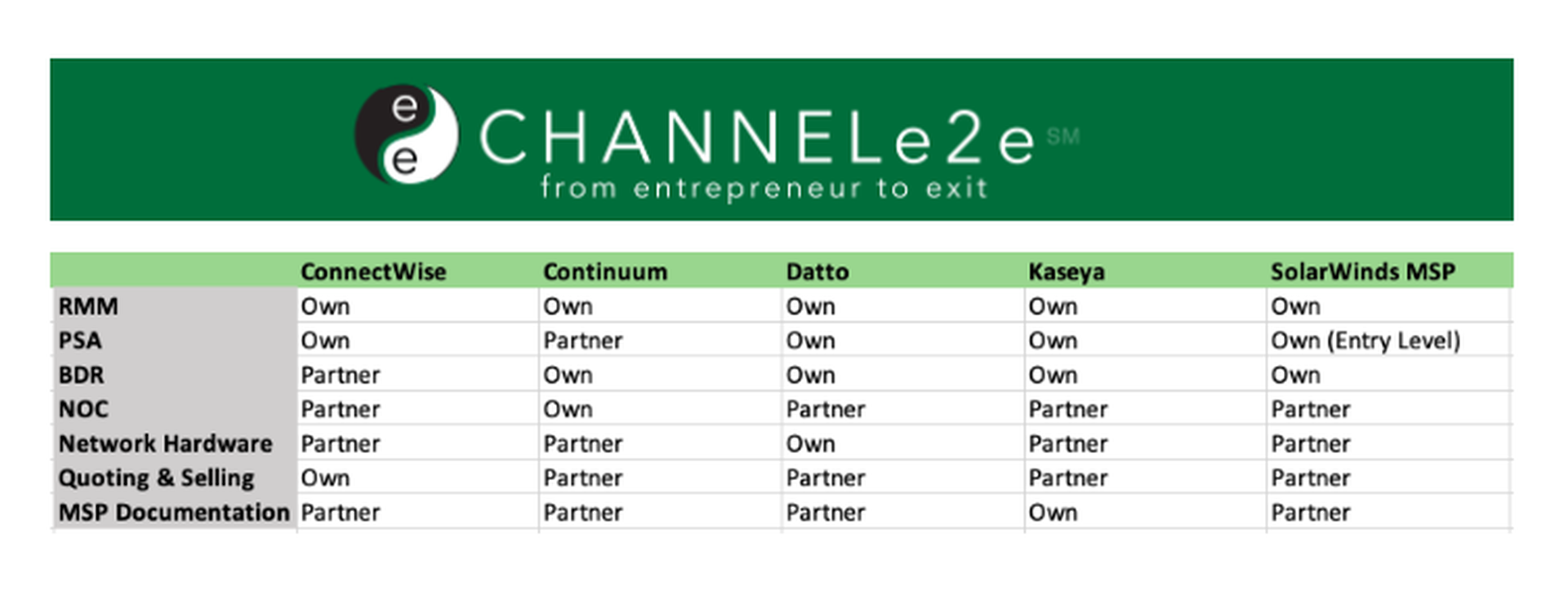

MSP Software & Technology Companies: Product Portfolios

The chart below mentions whether those five technology companies own or partner to deliver such technologies as:

The chart above does not mention security, though all the companies above offer various security or data protection solutions. Many of the firms are acquiring or partnering to deliver software that addresses SIEM (security information and event management), threat detection, endpoint security, SOAR (security orchestration, automation and response), and more.

Here Comes Barracuda Networks

Some big names are marching into the market.

For instance, Barracuda Networks has aggressively shifted its partner program toward an MSP model through organic and M&A moves. The strategy extends all the into Barracuda's boardroom, CEO BJ Jenkins told ChannelE2E in the fall of 2018.

With subscription services for MSPs in mind, Barracuda has also extended beyond security into backup and disaster recovery (BDR) and now remote monitoring and management (RMM). The RMM move involves acquiring Managed Workplace, a niche offering that has had multiple owners since Level Platforms sold the code in 2013.

Most MSPs leverage a combination of BDR, RMM, PSA (professional services automation)and security solutions to automate, protect and manage business systems. Hmmm... could Barracuda be evaluating a potential PSA acquisition? We're watching and listening for clues.

Related Update: Carbonite acquired Webroot on February 7, 2019, adding another major multi-platform player to the MSP software market. The company offers cloud- and appliance-based backup and disaster recovery (BDR), endpoint security, network security and cybersecurity training.

Private Equity: Shuffling the MSP Software Deck?

Meanwhile, private equity firms are taking a closer look at their MSP software and technology portfolios -- trying to decide where to invest more, what to acquire, and what to potentially jettison.

One potential starting point: More synergies between MSP software platforms and security offerings (see chart further above).

Among the additional variables to keep in mind...

Yes, additional PE firms are in the market. We'll offer a deeper report on those additional names soon.

Meanwhile: In Tampa, Florida

The biggest wildcard remains ConnectWise. Still privately owned and closely held by its founders, the company has declined private equity investments in recent years. Is that about to change? I don't have any firm info. But my latest thoughts are spelled out below.

ConnectWise Co-founder and CEO Arnie Bellini, brother David Bellini and a handful of rival executives largely pioneered the early days of MSP software.

Former executives from Autotask, GFI Software, Kaseya, Level Platforms, N-able Technologies and Zenith Infotech, among others, also come to mind as MSP market pioneers. (I apologize to those I failed to mention.)

But while many of those executives have moved on, Arnie Bellini is the only executive to lead his company through every stage of the MSP software industry's evolution.

ConnectWise and Tech Giants

During my 10-plus years blogging about the MSP market, I've always believed that ConnectWise would one day be acquired by another technology company -- perhaps by 2025 or so.

My best guess always pointed to Tech Data as a potential ConnectWise buyer. My reasoning: ConnectWise and Tech Data are neighbors in Florida. And ConnectWise's business is extremely complementary to distribution. And former Tech Data CEO Steve Raymond sits on ConnectWise's board.

Still, the ConnectWise-Tech Data combo was always just my hunch. A guess based on little more than a shared hometown and potential business synergies.

Other pundits have asked me if Cisco will eventually acquire ConnectWise. I don't think that's the case, though the two companies have had a tight business relationship for more than a year.

Evolved Thinking: ConnectWise and Private Equity

In recent weeks, my M&A gut has evolved a bit -- especially as private equity continues to flood the software market.

For the first time in my blog career, I now think ConnectWise may eventually get acquired by private equity. I wouldn't be surprised if a PE firm like Thoma Bravo one day, perhaps sooner rather than later, becomes the buyer.

Bellini, at age 60, is still plenty young to drive ConnectWise forward for years to come. But the company recently promoted Jason Magee into the president position. And private equity firms like Thoma Bravo (among others) are flush with cash that they need to put to work. ConnectWise could be a tempting target...

Just the Facts

Admittedly, the blog above is chock full of speculation. But some facts are indisputable. The biggest one of all: Private equity firms are flush with cash, and they've got their eyes on more M&A deals in the MSP software market. We look forward to reporting the next moves, and the implications for MSPs worldwide.