Private equity firm Insight Partners has completed its buyout of Veeam Software, which values the data protection software company at $5 billion, or roughly 5X annual revenue.

This was technology M&A deal number 28 that ChannelE2E tracked this year. See the complete technology M&A list here.

So what's next for Veeam? Here are eight developments for partners to watch, along with potential M&A moves by Veeam's existing and emerging rivals.

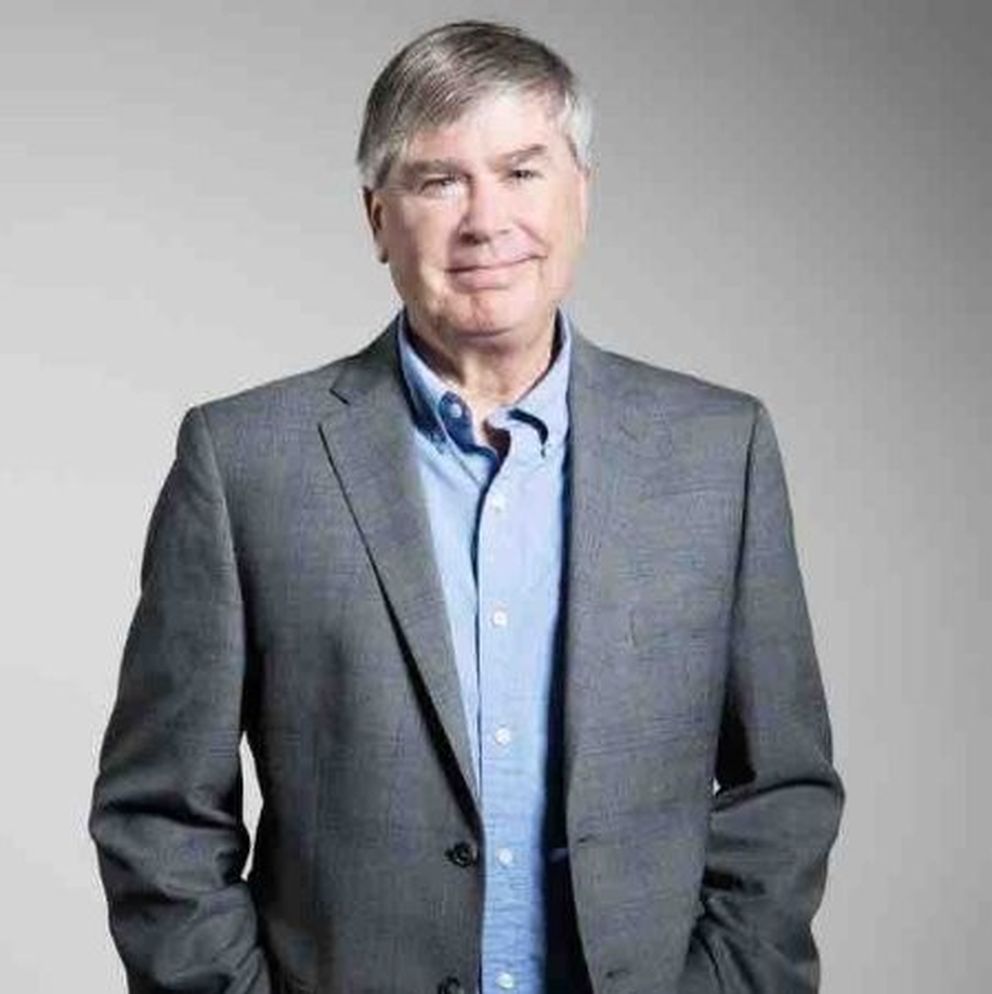

1. New Veeam CEO: William H. Largent is now CEO. He previously was executive VP of operations. Here's what you need to know about Largent.

2. New Veeam CTO, Same Partner Strategy: Danny Allan has been promoted to Chief Technology Officer (CTO). Allan says Veeam will remain 100 percent partner focused.

3. New Veeam CISO: Gil Vega, previously managing director and CISO at CME Group, and the associate CIO & CISO for the U.S. Department of Energy and U.S. Immigration & Customs Enforcement in Washington, DC, has been appointed CISO.

4. New Board Members: Nick Ayers, of Ayers Neugebauer & Company, a member of the World Economic Forum’s Young Global Leaders and former chief of staff to the Vice President of the United States, joins Insight Partners Managing Directors Mike Triplett, Ryan Hinkle, and Ross Devor on the Veeam Board of Directors.

5. New Headquarters: Veeam relocated its headquarters to the United States. Here's why.

6. Cloud Strategy Evolution?: Partners should keep a close eye on Veeam's cloud strategy. To date, the company has relied on third-party cloud service providers (CSPs) and MSPs to run and manage Veeam's software on their own. The big question: Will Veeam host and run its own cloud? Such a move might be popular with smaller MSPs -- many of whom prefer to consume third-party SaaS services rather than launching and managing their own. But a Veeam-hosted cloud service could also potentially alienate the company's existing midmarket and enterprise cloud partners.

7. Private Equity Synergies?: Insight Partners also owns Kaseya, the IT management and business automation software provider for MSPs and midmarket IT professionals. Kaseya already owns multiple data protection solutions (namely, Unitrends and Spanning.) Will we may see some Kaseya-Veeam synergies emerge? Perhaps we'll see answers at the Kaseya Connect IT Global 2020 conference, set for May in Las Vegas.

8. Veeam Conference: It's safe to expect strategic and partner updates during the VeeamOn 2020 conference, which is scheduled for May 4-6 in Las Vegas. Still, readers should check in with Veeam regularly in case the coronavirus conference potentially impacts the agenda or overall conference plan.

Private Equity and Data Protection: Next Moves

Insight Partners has acquired Veeam amid an inflection point in the data protection market.

Indeed, multiple BDR (backup and disaster recovery) software providers are up for sale or rethinking their ownership status. Some of them could be potential tuck-in targets for MSP platform providers like Barracuda, ConnectWise, Datto, Kaseya and SolarWinds — though we don’t sense such a deal will happen.

Among the software firms to watch:

Insight Partners and Veeam: Executive Perspectives

Amid all of those market variables and rivalries, Insight Partners and Veeam express plenty of optimism for their own business developments.

In a prepared statement, Veeam CTO Danny Allan said:

"Veeam has become the No. 1 market share leader in EMEA over the past decade, where approximately 50% of our current business comes from. With the Insight acquisition completed today and our recent release of the new Veeam Availability Suite v10 – the next generation of data protection – we have our sights set on extending that leadership position into the US, where we can leverage the growth opportunity for cloud data management in the enterprise."

Among the business metrics Veeam points to: