Private equity firms and MSP software companies are mulling another round of mergers, acquisitions and investments ahead of the U.S. presidential election, multiple sources indicate.

The chatter goes something like this: Private equity firms were sitting on a record US$1.48 trillion in dry powder as of July 2020, according to Preqin, an analytics firm that tracks the private equity market. Yes, that's trillion -- not billion.

Some of that dry powder -- i.e., unspent cash that is waiting to be invested -- was locked away for safe keeping during the first few weeks of the coronavirus pandemic in the United States. And for good reason: The MSP software market contracted a bit in late March and early April 2020. But by July or so, there were signs that revenue was rebounding across the MSP software market -- giving investors and negotiators confidence to resume exploratory & due diligence discussions, ChannelE2E has heard.

Still, some investors are worried about the coronavirus pandemic triggering repeat economic shutdowns. Other investors are concerned about the upcoming U.S. presidential election -- and wildcards like a potential contested election.

Amid all those variables, M&A discussions between multiple private equity firms and MSP software companies have heated up in recent weeks, ChannelE2E has heard repeatedly. Simply put: Some dealmakers want to achieve their own business clarity ahead of the U.S. presidential election.

Private Equity and MSP Software: The Current Landscape

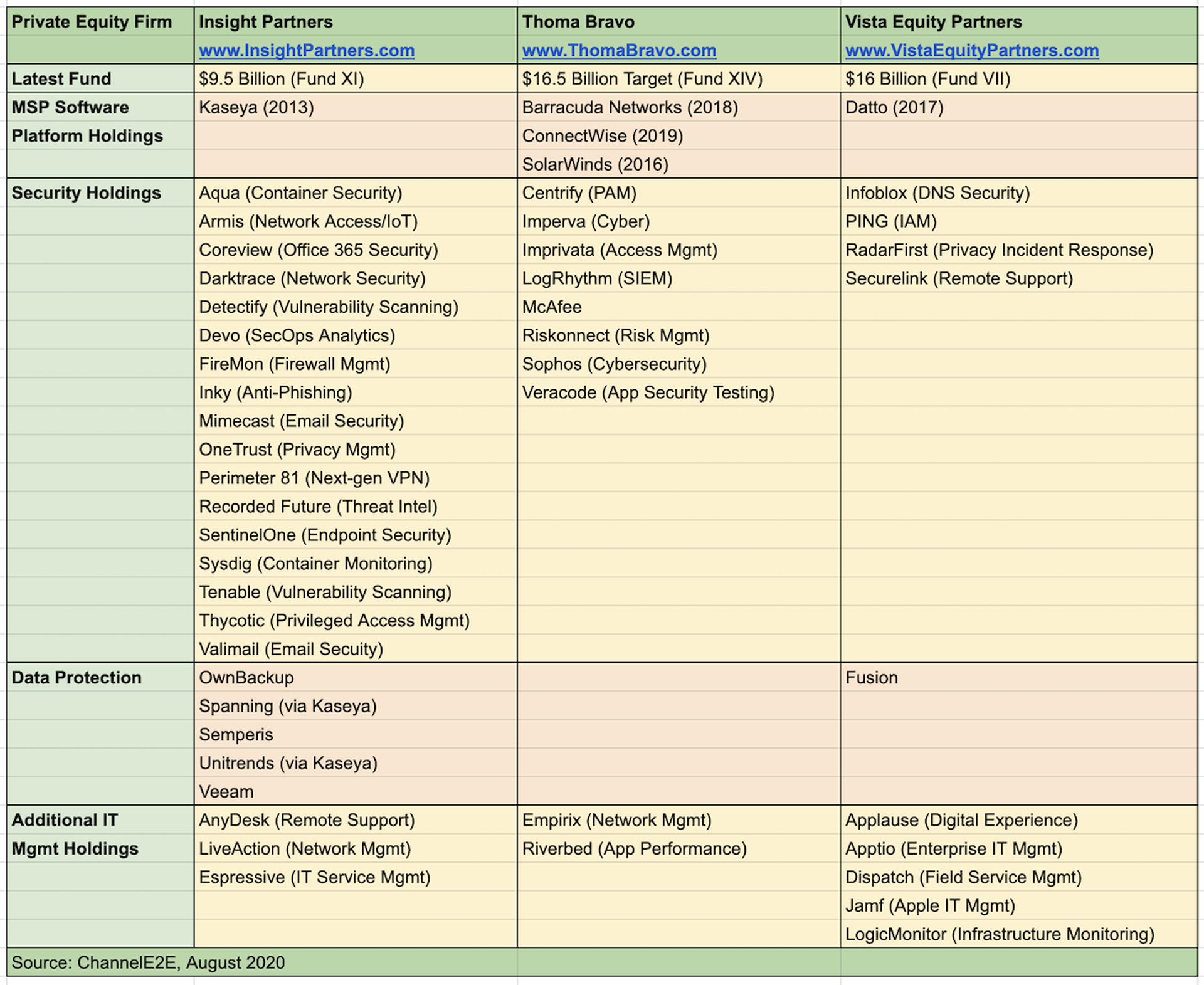

Now, take a look at some of the major private equity firms that already own MSP software platform providers. Some private equity names to note in and around the MSP software sector include:

1. Insight Partners: Owns Kaseya, SentinelOne and Veeam. Insight Partners this year raised $9.5 billion for its Fund XI. That fund will focus on investments of $10 million to $350 million -- though larger deals are possible, insight says.

2. Madison Dearborn Partners: Owns Intermedia and Navisite.

3. Thoma Bravo: Owns Barracuda Networks, ConnectWise, SolarWinds & Sophos. Next up, Thoma Bravo expects to raise US$16.5 billion for its Fund XIV.

4. Vista Equity: Owns Datto and LogicMonitor. Vista Equity raised $16 billion for its Fund VII in late 2019.

5. Summit Partners: A minority investor in NinjaRMM. Summit recently raised two funds with combined capital commitments of $2.2 billion.

This chart offers a more detailed look at three of those players -- Insight Partners, Thoma Bravo and Vista Equity Partners -- and their current holdings:

Private Equity and MSP Software: Signs of Movement

Jason Magee, CEO, ConnectWise

Jason Magee, CEO, ConnectWise

Of the major MSP software platform providers, three -- Datto, Kaseya and SolarWinds -- have raised their hands to indicate that they're preparing for potential financial events. Indeed:

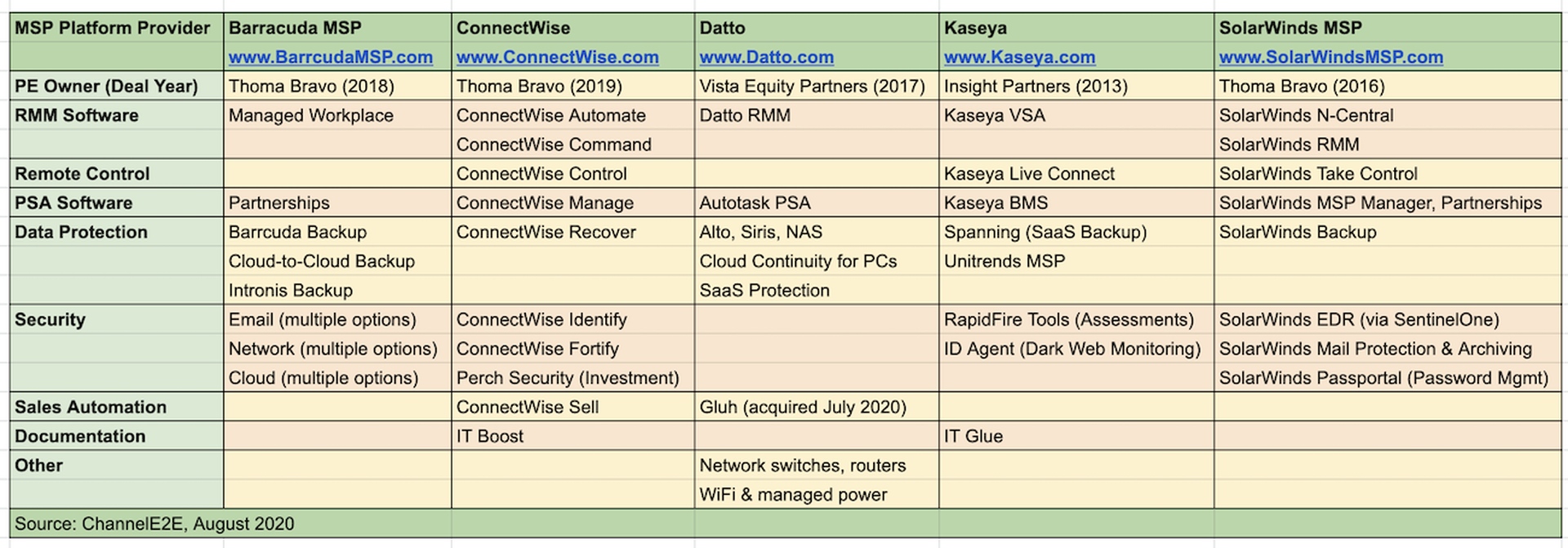

The chart below offers a more detailed look at each of those MSP software players and their current portfolios:

At first glance, many of the MSP software providers in the chart above have overlapping products and services. But pundits tracking the private equity market say M&A deals involving product overlap are still possible -- because combined market share or other synergies may trump concerns about overlapping tools.

MSP Software: Disrupters and Upstarts

Meanwhile, disrupters and upstarts in the MSP software sector continue to gain traction -- even as private equity firms seek to. consolidate the market. Some names to note include...

MSP Software and Private Equity: When Will Next M&A Deals Happen?

Re-read the blog above, and you'll notice I didn't mention a specific M&A deal that's imminent. Why? Because all of the chatter I'm hearing remains fluid. Key sources apparently are at the negotiating table -- sorting through potential business combinations, strengths, challenges, synergies and more.

Assuming M&A deals emerge before the U.S. presidential election, I hope those involved manage to:

In the meantime, our eyes and ears remain open -- watching and listening for signs of the latest M&A discussions. Shhhh... Did you hear that? ...