Levementum is combining a business pivot and private equity funding to drive the digital consultancy forward. Among the key moves: Selling off its SugarCRM consulting practice; doubling down on its Salesforce Platinum Consulting Partner Status; and raising $4 million Inoca Capital Partners, a private equity firm.

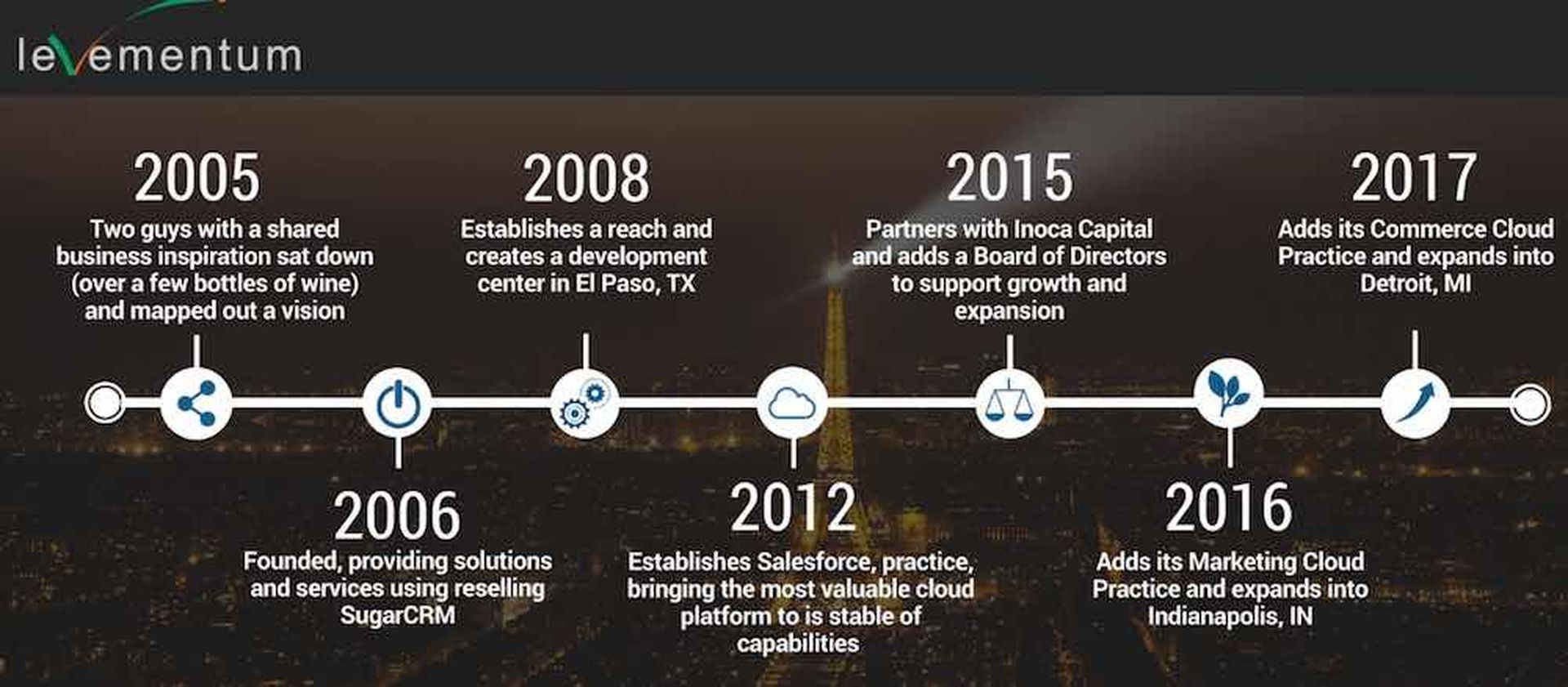

Levementum is a familiar name to me. Founded in 2006, Levementum has offices in Arizona, California, Indiana, Michigan,and Texas. I first blogged about the company in the 2010 timeframe or so, helping readers to understand how partners can monetize cloud-oriented CRM.

Fast forward to present day, and the company sounds obsessed with consumer-facing marketing, customer management partnerships and consumer engagement.

Business Pivot Drives Growth

Indeed, a pivot toward digital marketing, e-commerce, and servicing consumer requests drove 255 growth for Levementum last year, according to Senior VP Michael Burton -- though he didn't share actual revenue or profit figures. The company's B2C clients represent several vertical markets -- including health and life sciences, entertainment, retail, financial services and hospitality.

Michael Burton

Michael Burton

Describing Levementum's evolution and current focus, CEO Doug Guilbeau added:

"Lev's early years of growth were a direct result of our strong partnership with SugarCRM. However, now's the time to completely focus our attention on our strategy to become the top digital consultancy focused on consumer engagement. The sale of our Sugar practice, coupled with an additional growth investment has given us the fuel to step on the gas and take the firm to new heights."

Among the key business moves: Expanding into Michigan in late 2017, and creating up to 175 positions in Indianapolis by 2021, the company has indicated.

So what's next? It sounds like Levementum is seeking to make quite a few hires -- while increasingly competing with major IT consulting brands like Accenture, Deloitte and Pierry...

Salesforce Partner Funding

Focusing purely on Salesforce customers could have M&A upside for Levementum. After all, quite a few Salesforce partners have been acquired in the past year. Examples include:

- Silverline, a Salesforce platinum cloud consulting partner, receiving a private equity investment from Pamlico Capital in March 2018.

- Simplus raising $9.3 million and acquiring its fourth Salesforce partner in December 2017.

- BV Investment Partners acquiring Apps Associates, an Oracle, Salesforce, SAP and NetSuite partner, in December 2017.

- Capgemini acquiring Lyons Consulting Group, a 300-person Salesforce partner, in September 2017.

- Accenture acquiring Phase One, its seventh Salesforce partner acquisition, in June 2017.

PS: We're checking to see what company or investor acquired Levementum's former SugarCRM practice.