If you walk into Carbonite CEO Mohamad Ali's office, you might notice a large white board diagram. Take a closer look, and quite a few of the boxes within the diagram are checked off. A new business plan, perhaps?

Actually, no. In reality, the diagram dates back more than 2.5 years -- from the time Ali joined Carbonite as CEO in December 2014. "Yes, there is a bigger strategy here," Ali recently told ChannelE2E. "My vision has always been to fill a large niche -- there's no single dominant provider of data protection."

When Ali got serious about joining Carbonite, he began to formulate the larger strategic plan. It included organic R&D and potential acquisition targets. And plenty more. Ali described the plan to ChannelE2E in June. Then I disappeared for a vacation and two IT conferences. Now I'm back with this report. And it starts with Carbonite's position in the changing SMB technology market.

SMB IT Market Evolution

There was a time that the SMB technology sector was toxic, Ali concedes. Many enterprise businesses tried -- and often failed -- to scale down their offerings for SMB customers. Ali saw that firsthand while working for IBM's software business. On the flipside, consumer offerings often were considered toys that lacked SMB technical requirements. But that reality began to change as cloud services took hold -- and business offerings from Hubspot, GoDaddy and more took hold in the SMB sector, Ali asserts.

When Ali arrived at Carbonite in late 2014, a basic plan could have involved scaling the company's consumer backup service higher and higher into small businesses. But that conservative strategy would have done little more than expand a small technology into a midsize midsize company.

Ali had grander visions. Through R&D, acquisitions and channel partnerships, he wanted to build the de facto data protection leader for SMB and midmarket customers. Moreover, he wanted to vastly reduce Carbonite's customer churn, That, in turn, promised to drive up the company's valuation over the long haul.

Carbonite had three things Ali valued before he started at the company:

Midmarket Technology, Enterprise Horsepower

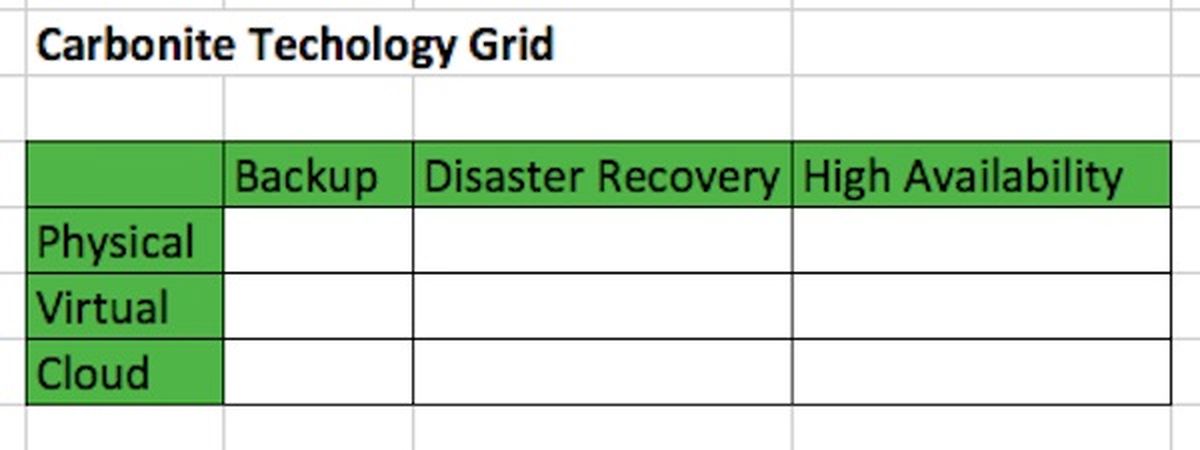

Still, Ali saw at least one company product and service gap in 2014. "We were missing the Ferrari engine," Ali concedes. So, Ali and the Carbonite team set out to find that Ferrari engine along with additional technologies to round out a 3X3 grid that involved the following areas:

There are roughly 240 companies in the data protection market, Ali estimates. Many of them, apparently, are listed on Ali's wall. At some point the company spotted EVault -- a Seagate-owned cloud platform that also had on-premises appliances. By December 2015, Carbonite acquired EVault at a fire sale price. At the time of the deal, EVault's technology required considerable time for partners to configure and install. But within nine months of the buyout, the EVault appliances were far easier to deploy right out of the box, he asserts.

Related: PhoenixNAP's Bojana Dobran explains DoubleTake deployment.

Related: PhoenixNAP's Bojana Dobran explains DoubleTake deployment.Fast forward to early 2017, and Carbonite was back in the market for another acquisition. This time the deal involved Double-Take Software, a high availability specialist.

“Double-Take dramatically expands our solution offering for midsized businesses,” Ali said at the time of the deal. “Carbonite now offers customer a wide variety of solutions that protect data that resides on end points and servers; enables failover to a virtual instance of their infrastructure within hours or minutes; and provides continuous availability for mission critical systems with Double-Take Software.”

The offering has since been rebranded as Carbonite DoubleTake.

The Channel Strategy: One Carbonite

Meanwhile, a partner strategy also has come into focus. Carbonite has long dabbled in the IT channel. But a purer partner strategy has emerged under Ali over the past two years or so. His theory: It's not efficient to have a big direct salesforce unless each team member can carry a quota of at least $2 million to $3 million per year.

That type of math doesn't work for Carbonite's business. Amid that realization, a strategy called One Carbonite has emerged. It involves one partner portal that enables partners to discover, buy, use and support the company's software.

Evolving Rivals

No doubt, Carbonite is moving fast. But the competitive landscape also is evolving quickly. Just last week. eFolder and Axcient merged. Elsewhere, rivals like Datto, Veeam and Barracuda continue to expand their MSP bases.

So what's next for Carbonite? Just a hunch, but I suspect Ali will offer a One Carbonite update during the company's upcoming earnings call, which is scheduled for Aug. 3.