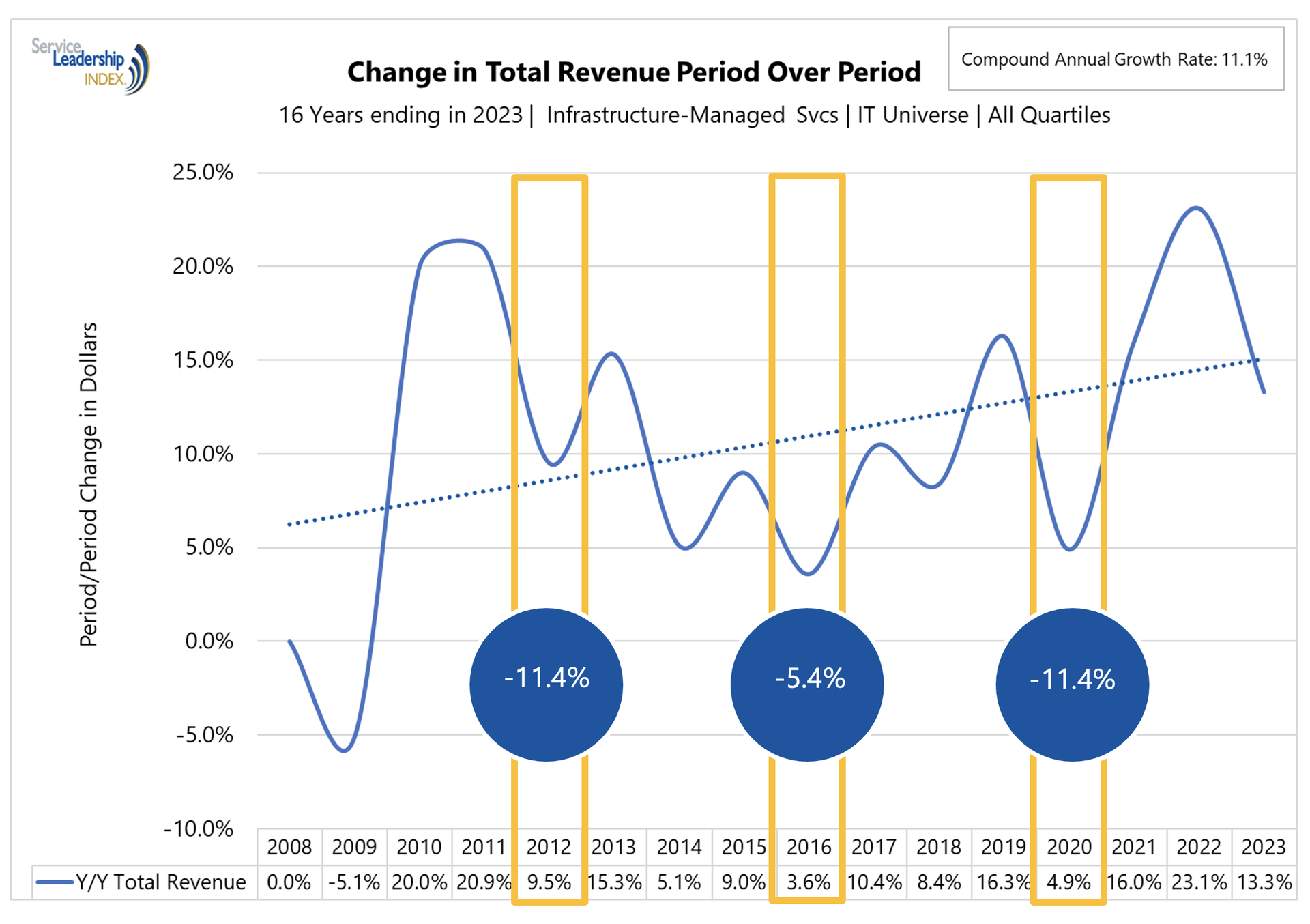

MSPs are experiencing a tougher period when it comes to sales than they have in a while, according to newly released Service Leadership data. Specifically, MSPs are seeing a deceleration in revenue growth.

Service Leadership VP and GM Peter Kujawa told ChannelE2E that over the last 3 to 4 quarters MSPs have said they've had a tougher time growing revenue. There are likely a couple of factors contributing to this deceleration of growth, he said. First, this decline in growth comes after the COVID bubble really accelerated sales for MSPs the last few years as so many companies initiated work-from-home programs and required a great deal of IT help as a result. But that bubble has burst.

The second factor is this: 2024 is an election year, and with the U.S. Presidential election looming, there’s tremendous uncertainty in the market.

Election Years and Market Uncertainty

“Uncertainty makes companies wait when it comes to projects,” Kujawa told ChannelE2E. The data certainly shows that's true (see chart, shared with permission from Service Leadership).

But while every bubble will burst and every election year is likely to lead to caution in spending, there are some bright spots when it comes to managed service provider businesses, Kujawa told ChannelE2E. One of them is profitability. The Service Leadership report shows that MSPs' average adjusted EBIDTA increased to 14.1% globally, the highest in eight quarters.

In addition, Service Leadership's data showed that fewer MSPs are operating at a loss. In Q2 just 16% of MSPs operated at a loss compared with 19% in Q1. As ChannelE2E has previously reported, the average product gross margin reached 26.3%, the highest in eight quarters. Additionally, the average managed service gross margin rose to 46.2%, the highest in over a year. However, project/professional services gross margin experienced a decline, dropping to 19.4% from 24.6% in Q1, likely due to lower growth in project/professional services revenue during Q2.

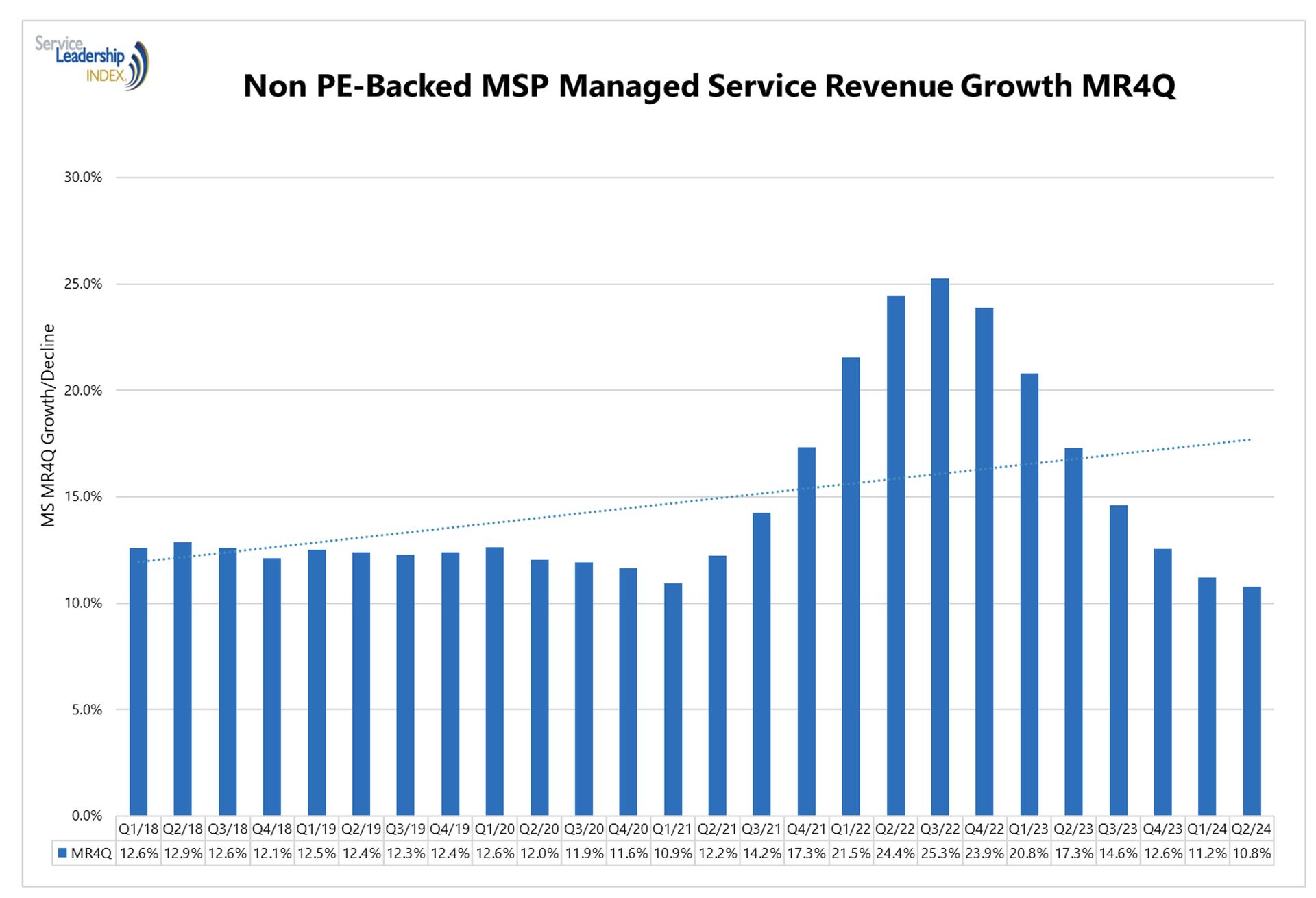

That COVID Bubble

As part of the Service Leadership Q2 report, the ConnectWise organization also shared this revealing graphic about the COVID bubble for MSPs, with the bars reflecting an average over quarters to smooth the data.

Kujawa noted that the chart shows that MSP revenues are tracking back to pre-COVID normalized levels now.

PE-backed MSPs vs. Non PE-Backed MSPs

In addition to the macroeconomic trends, Service Leadership's most recent report demonstrated definitively something we all probably suspected was true. Private equity-backed MSPs grow faster than MSPs that grow organically. Kujawa said the data shows that these PE-backed MSPs grow 3 to 4 times as fast as MSPs without PE backing. That's due to the fact that PE-backed MSPs are acquiring other companies.

What's in Store for 2025

A few factors make 2025 look to be a more prosperous year for MSPs. First, the election will be over, ending any uncertainty that led to cautious spending. Second, it's likely that interest rates will ease in the new year. Any large interest rate cuts in the new year, however, will take 12 to 18 months to have a real impact on the economy. But trends will move in a positive direction again.