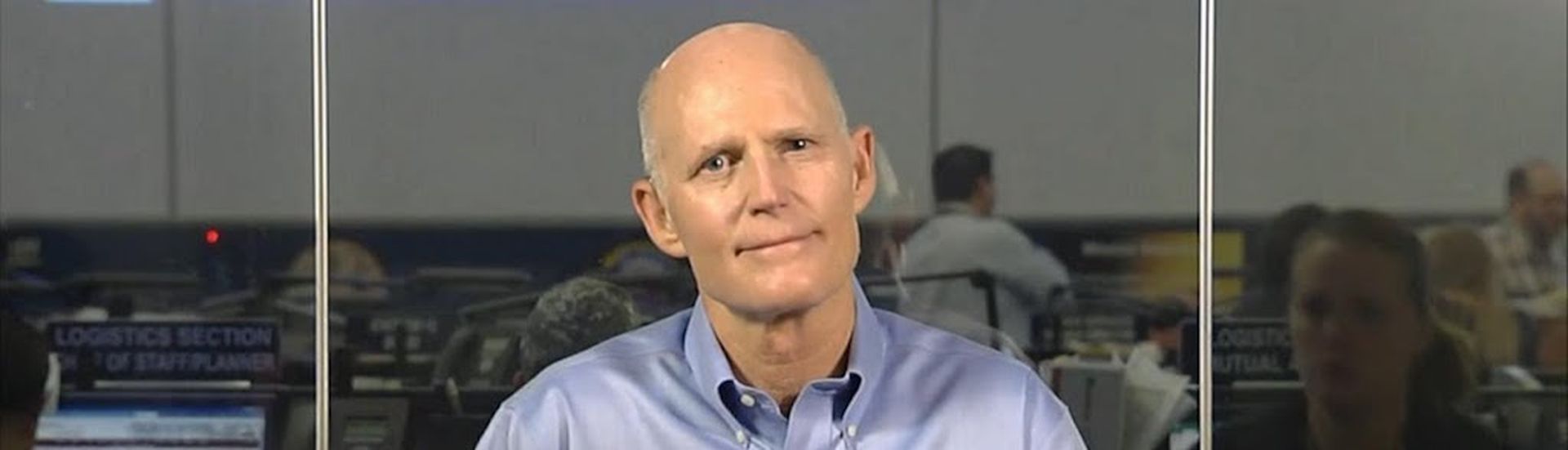

Amid Hurricane Irma's aftermath, Florida small businesses and the MSPs who serve them may soon face another daunting challenge: Unpaid contracts that squeeze cash flow. Florida Governor Rick Scott has activated an interest free, short-term small business loan program. But does it go far enough?

No doubt, the biggest concerns in Florida right now include power, clearing roadways, fuel, food and phone/broadband connections, notes Arlin Sorensen, CEO of HTG Peer Groups -- which has multiple MSP members across Florida.

Power has been coming on for folks over the last 24 hours more rapidly, Sorensen notes. He's right, according to this Florida Map of Power Outages. But fuel is still a big issue for many Florida residents and small business owners, and some hard-hit areas may not have power restored for weeks, local utilities have warned.

Some Small Businesses Are Dark

ChannelE2E has seen some of the challenges first-hand. We've been on the ground in The Villages -- about 90 minutes north of Orlando -- since Monday, Sept. 11.

At first glance, Irma left the area relatively unscathed. But take a closer look and you'll notice strip malls in nearby Ocala, Florida, that are still dark. The lifeless retail storefronts are home to real estate firms, insurance agencies, legal firms, dentists, healthcare providers, restaurants -- in other words, bread and butter clients for MSPs.

Now, apply that example to small business strip malls across the state -- particularly those in central and southern Florida, where the damage is more extreme.

The big question: How will MSPs and their small business customers deal with managed services contracts -- especially when some folks on both sides of the table were dark for portions of September and perhaps beyond?

Will Distressed Florida Businesses Pay Their MSPs?

There is lots of debate about how to deal with contracts, Sorensen concedes. No doubt, many area MSPs and customers will reread their service agreements in the days ahead to see who has Act of God clauses, and what they involve. In the meantime, payments are not flowing into many area MSP businesses right now, making cash flow tight, Sorensen concedes.

"Many have employees living paycheck to paycheck so making sure payroll happens and money gets to their team is a high priority," he says. "There will be some small businesses that don’t recover which will make the problem worse."

Indeed, a deeper darkness could arrive within the next one to six months as some small businesses vanish and MSPs struggle to get paid, Sorensen predicts. "It won’t be a big deal to some, but will really put stress on others. We expect the final impact on HTG members to be somewhat minimal in long term impact – we won’t lose many if any – but the short term stress and pressure is real and will continue for some time to come."

Big Business Impact? The problems could ultimately extend beyond SMBs. Think of it this way: If Florida's small business customers aren't paying their MSPs, how are those MSPs going to pay their monthly PSA, RMM, backup and cloud services bills?

More Challenges Further South

A reminder: I'm in the healthy part of Florida -- about a 90-minute drive north of Orlando. Travel south, and the situation grows more challenging.

Just ask Ulistic, an MSP marketing firm in Sebring, Fla. The company activated its business continuity plan ahead of Irma and has been performing well. CEO Stuart Crawford relocated to Alabama ahead of the storm. But the situation back home is unsettling.

According to a blog from Crawford today:

"As I write this, we are in day four of our recovery, with no news from Duke Energy when power is going to be resumed in Sebring. Did I say that Sebring was hit very hard? You will never see mention of it on the news anywhere. But, according to some of our staff, Sebring looks like a war zone. I guess that’s better than some of the spots in the Florida Keys that look like a nuclear bomb went off. At least my house is still standing and in one piece. You can’t say that for places on the keys or in Naples."

Hurricane Irma and Small Business Loans

Florida Governor Rick Scott is aware of the challenges. Earlier today, Scott activated a loan program designed to support small businesses affected by Hurricane Irma. Small businesses (two to 100 employees) can apply for loans ranging from $1,000 to $25,000.

That's a start. But it's a safe bet more help is on the way. One example: Autotask, which is set to host a conference in Hollywood, Florida starting Sept. 18, has vowed to donate money to the post-Irma recovery effort. I believe details are still pending.