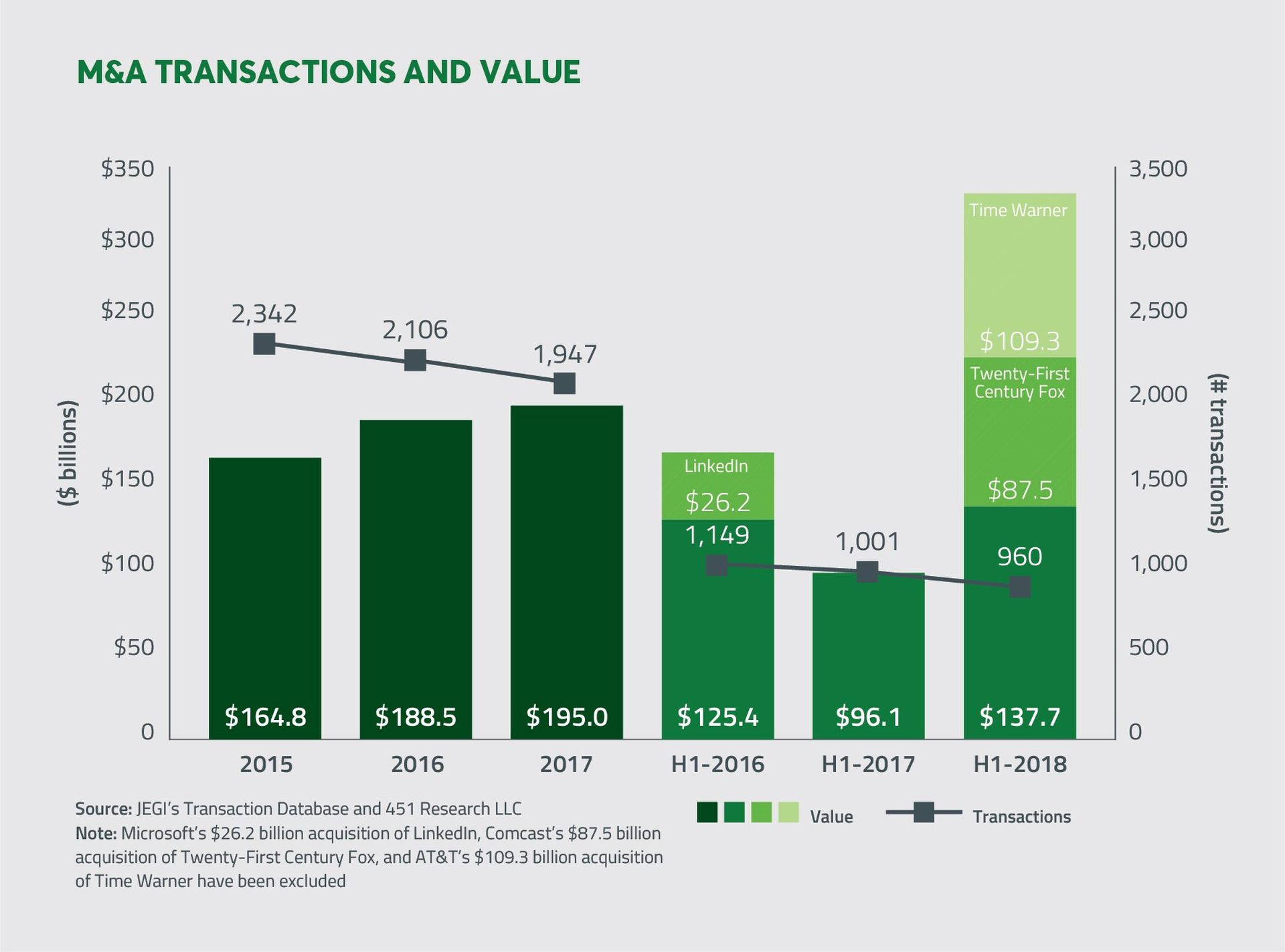

Merger and acquisition (M&A) activity remained strong in the first half of 2018, according to new data from Jegi.

Indeed, mergers and acquisitions across the media, information, marketing, software and tech-enabled services sectors totaled over 950 announced transactions and nearly $140 billion in aggregate transaction value during the first half of the year, Jegi says. Plus, the pace of M&A in 2018 is on track to surpass 2016 and 2017 full-year levels.

Among the key sector highlights:

- Marketing and Technology: In the marketing and technology services sector, M&A volume and value dipped slightly in H1 2018, but the category remains "reliably hyperactive, reflecting on-going consolidation around specialized capabilities and select market themes." Indeed, IT consultancies and IT services firms are leveraging M&A to grab the “digital transformation” and cloud services opportunity, the firm notes. Plus, big IT consulting firms -- names like Accenture, Deloitte, IBM and PwC -- are buying up digital marketing agencies.

- Software: Within the software arena, M&A deal activity rose 25 percent in the first half of 2018, and the total value of those software deals skyrocketed 181 percent, the company says.

Still, the first half of 2017 was an “easy comp” to beat, according to the study’s authors, as M&A activity in the first half of 2017 was dampened in the wake of the US presidential election.

Five Trends Drive M&A Activity

Why are so many companies pursuing M&A deals? The five core reasons include:

- The corporate growth imperative

- Crossing industry lines to find new growth and profit pools

- Private Equity as an enabler of large-scale reorganizations

- Relaxed antitrust environment

- Heightened focus on consumer data security

The third trend, private equity as an enabler of large-scale reorganizations, has made for an especially prominent presence on the pages of ChannelE2E. Just last month, for example, private equity firm Siris Capital Group acquired Web.com Group for $2.0 billion -- a valuation of 10.3 times adjusted EBITDA according to ChannelE2E’s calculations.

Also, MSP-centric software companies -- names like Continuun, Kaseya and SolarWinds MSP -- have leveraged their private equity relationships to acquire various security and business continuity assets, ChannelE2E and MSSP Alert have reported.

Other notable deals, according to the study’s authors, include:

- Adobe’s buyout of Magento for $1.7 billion

- IHS Markit acquiring Ipreo Holdings from Goldman Sachs and Blackstone for $1.9 billion

- Recruit Holdings, a Japanese HCM technology and talent recruitment media company buying Glassdoor for $1.2 billion.

Looking Ahead

We should expect to see the M&A trend continue, according to the study, as general economic conditions remain strong heading into the second half of the year. Notably, the unemployment rate in the US is at 3.8 percent, the lowest rate since April 2000 while nonfarm payroll employment increased by 223,000 in May according to the Bureau of Labor Statistics, well above expectations.

The study says that a number of issues are looming on the horizon that could impact M&A activity in the near-term:

- FTC antitrust clearance on recent major deals could encourage corporations to fast-track plans for larger M&A investments.

- U.S. corporations and investors are holding $2.4 trillion in surplus cash (based on Federal Reserve data), available for large-scale M&A to speed up portfolio transformation, which would also add to divestiture “supply”.

- 10 years after the economic crisis, are ultra-low borrowing costs coming to end?

- Private Equity firms are spending a lot of time on “cycle risk” models…

- Public equity markets remain near record highs, but with historically high levels of volatility. Trade wars and geopolitical factors are in play.

ChannelE2E will continue to track the M&A sector closely, particularly deals involving IT services providers, MSPs and solutions providers.