Private equity firms and MSP software companies are mulling another round of mergers, acquisitions and investments ahead of the U.S. presidential election, multiple sources indicate.

The chatter goes something like this: Private equity firms were sitting on a record US$1.48 trillion in dry powder as of July 2020, according to Preqin, an analytics firm that tracks the private equity market. Yes, that's trillion -- not billion.

Some of that dry powder -- i.e., unspent cash that is waiting to be invested -- was locked away for safe keeping during the first few weeks of the coronavirus pandemic in the United States. And for good reason: The MSP software market contracted a bit in late March and early April 2020. But by July or so, there were signs that revenue was rebounding across the MSP software market -- giving investors and negotiators confidence to resume exploratory & due diligence discussions, ChannelE2E has heard.

Still, some investors are worried about the coronavirus pandemic triggering repeat economic shutdowns. Other investors are concerned about the upcoming U.S. presidential election -- and wildcards like a potential contested election.

Amid all those variables, M&A discussions between multiple private equity firms and MSP software companies have heated up in recent weeks, ChannelE2E has heard repeatedly. Simply put: Some dealmakers want to achieve their own business clarity ahead of the U.S. presidential election.

Private Equity and MSP Software: The Current Landscape

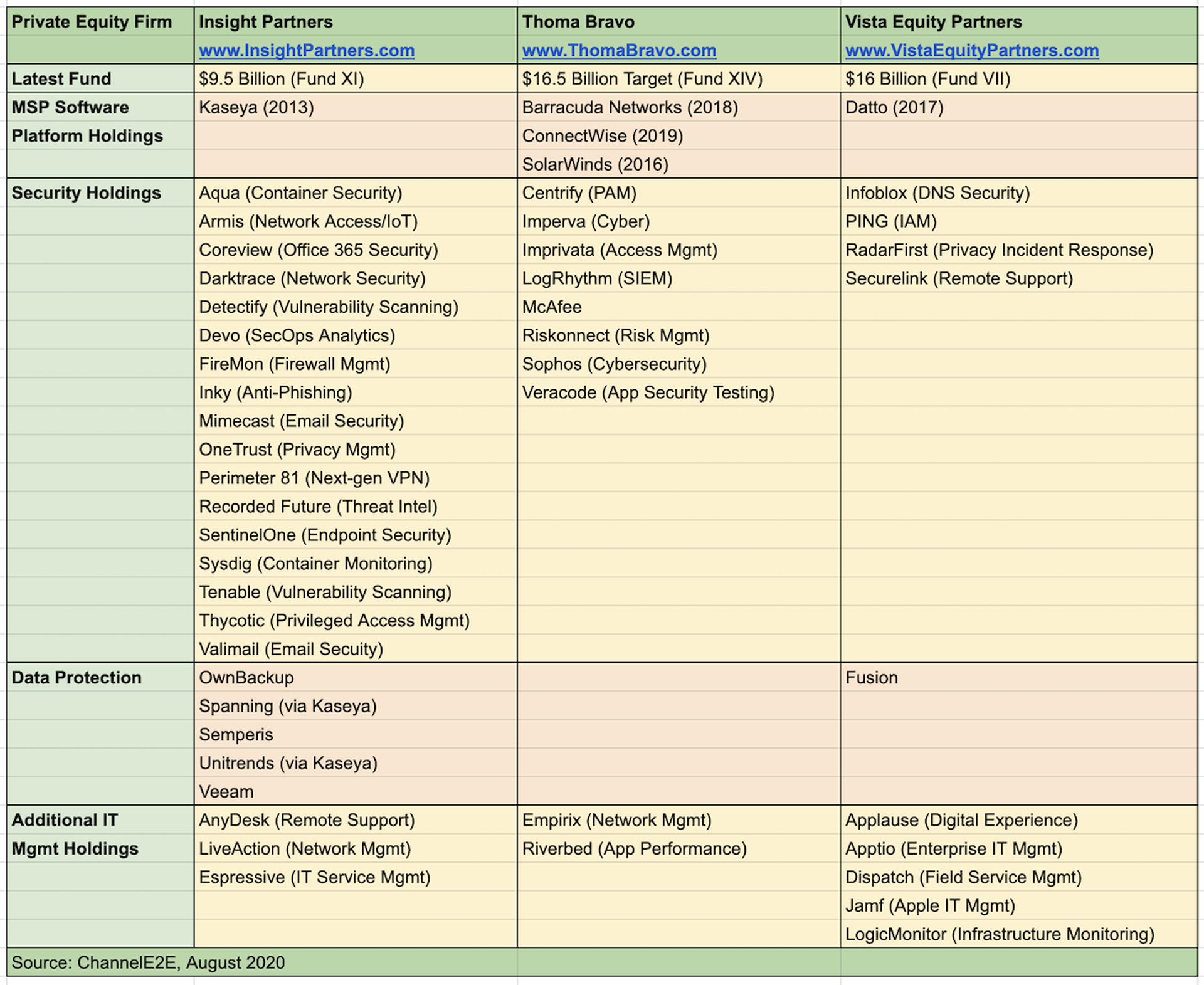

Now, take a look at some of the major private equity firms that already own MSP software platform providers. Some private equity names to note in and around the MSP software sector include:

1. Insight Partners: Owns Kaseya, SentinelOne and Veeam. Insight Partners this year raised $9.5 billion for its Fund XI. That fund will focus on investments of $10 million to $350 million -- though larger deals are possible, insight says.

2. Madison Dearborn Partners: Owns Intermedia and Navisite.

3. Thoma Bravo: Owns Barracuda Networks, ConnectWise, SolarWinds & Sophos. Next up, Thoma Bravo expects to raise US$16.5 billion for its Fund XIV.

4. Vista Equity: Owns Datto and LogicMonitor. Vista Equity raised $16 billion for its Fund VII in late 2019.

5. Summit Partners: A minority investor in NinjaRMM. Summit recently raised two funds with combined capital commitments of $2.2 billion.

This chart offers a more detailed look at three of those players -- Insight Partners, Thoma Bravo and Vista Equity Partners -- and their current holdings:

Private Equity and MSP Software: Signs of Movement

Jason Magee, CEO, ConnectWise

Jason Magee, CEO, ConnectWise

Of the major MSP software platform providers, three -- Datto, Kaseya and SolarWinds -- have raised their hands to indicate that they're preparing for potential financial events. Indeed:

- Datto: Datto filed for a potential IPO (initial public offering) in July 2020. That doesn't guarantee an IPO will occur. But it does put the wheels in motion toward a potential financial event. And it may also attract potential suitors to Datto's front door for M&A discussions.

- Kaseya: Kaseya in January 2020 declared that the company had a $2 billion valuation, and CEO Fred Voccola at the time predicted the company would be publicly held by mid-2021. The statements, ChannelE2E believes, could be designed to attract potential suitors to Kaseya's front door -- though we don't know if or how the company's plans have changed during the coronavirus economy. Kaseya was also targeting one or more acquisitions in time for the company's May 2020 conference -- but the gathering got postponed amid the pandemic. We wonder if a deal will surface at the company's IT Connect 2020 Virtual Conference, which kicks off August 24.

- SolarWinds is exploring a potential SolarWinds MSP spin-off, the company disclosed in early August 2020. No decision is expected until 2021, and CEO Kevin Thompson says SolarWinds has no plans to sell-off the MSP business unit to another owner. Instead, Thompson sees a potential spin-off -- led by SolarWinds MSP President John Pagliuca -- as a way to make SolarWinds MSP more nimble for potential tuck-in acquisitions.

- ConnectWise: Meanwhile, ConnectWise has been busy digesting Continuum -- though multiple sources indicate that the company could be looking to resume M&A activity soon.

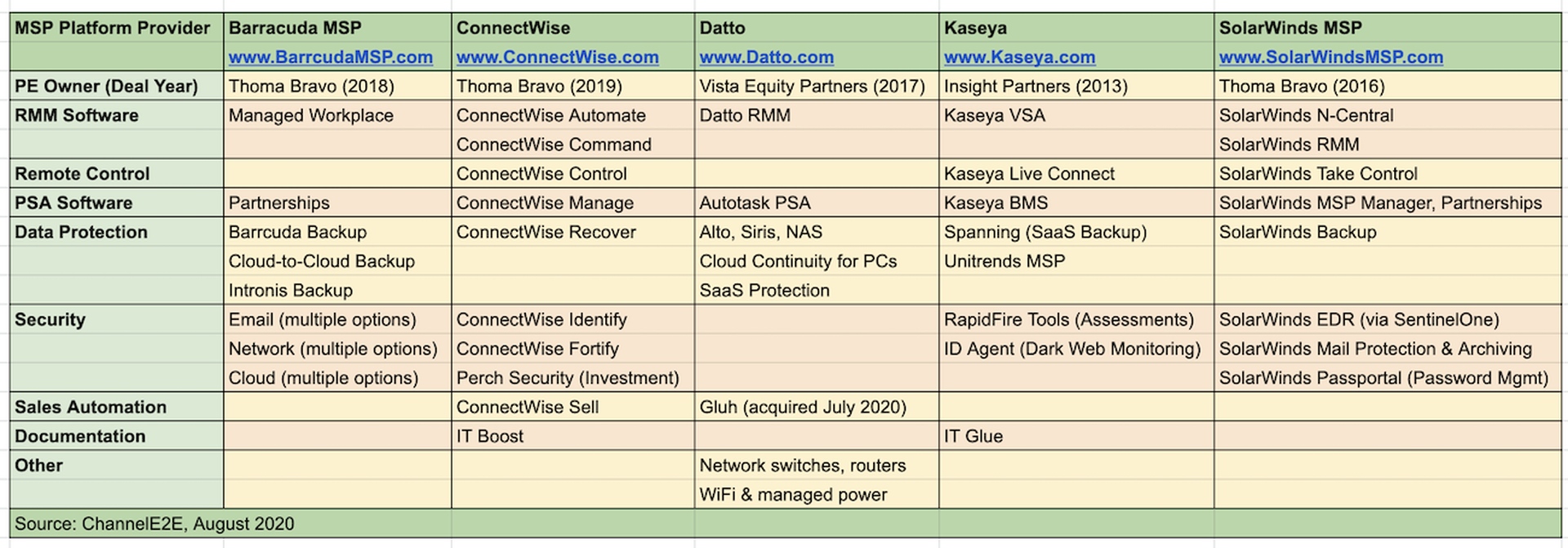

The chart below offers a more detailed look at each of those MSP software players and their current portfolios:

At first glance, many of the MSP software providers in the chart above have overlapping products and services. But pundits tracking the private equity market say M&A deals involving product overlap are still possible -- because combined market share or other synergies may trump concerns about overlapping tools.

MSP Software: Disrupters and Upstarts

Meanwhile, disrupters and upstarts in the MSP software sector continue to gain traction -- even as private equity firms seek to. consolidate the market. Some names to note include...

- NinjaRMM remains in growth mode. Instead of going into M&A mode, CEO Sal Sferlazza and the R&D team are known for home-grown code that blends ease of use with cloud-scale capabilities. Armed with a recent minority investment from Summit Partners, it's a safe bet the NinjaRMM R&D team is working on some new surprises. Updated August 17, 2020: NinjaRMM has launched Ninja Data Protection.

- Data Protection & Security Converge: I'd be remiss if I didn't mention potential M&A activity in the data protection market. Acronis, backed by Goldman Sachs, remains in acquisition mode -- tucking security companies into the data protection business. M&A chatter has also popped up from time to time around such data protection companies as Arcserve, Axcient and StorageCraft--each of which has private equity backing. Other potential suitors in the SMB market include OpenText -- which is converging Carbonite and Webroot into a cyber resilience suite. Updated August 17, 2020: And as mentioned above, NinjaRMM is now a competitor in the BDR market.

- PSA and RMM Upstarts: Atera and Syncro both promote pure cloud RMM-PSA software platforms that are catching on with MSPs. Also in both cases, the software companies typically offer simplified pricing models and rapid onboarding. We've heard considerable chatter about Syncro gaining traction this year, with Atera gaining traction in Europe.

MSP Software and Private Equity: When Will Next M&A Deals Happen?

Re-read the blog above, and you'll notice I didn't mention a specific M&A deal that's imminent. Why? Because all of the chatter I'm hearing remains fluid. Key sources apparently are at the negotiating table -- sorting through potential business combinations, strengths, challenges, synergies and more.

Assuming M&A deals emerge before the U.S. presidential election, I hope those involved manage to:

- Clearly articulate each deal's value to MSPs.

- Emphasize and demonstrate continued investments in service and support for MSP partners.

- Provide a clear, unified product roadmap with delivery dates.

- Assign a single sales contact to each MSP account -- ensuring that MSPs aren't flooded with overlapping sales calls from the same vendor.

- Remember that MSPs, at times, have grown frustrated with vendor M&A that doesn't live up to the hype.

In the meantime, our eyes and ears remain open -- watching and listening for signs of the latest M&A discussions. Shhhh... Did you hear that? ...