Office Depot's pending $1 billion CompuCom buyout was met with cautious optimism by Forrester Research and skepticism on Wall Street last week. The deal's frothy valuation (more than 10 times CompuCom's annual EBITDA, according to ChannelE2E's exclusive reporting last week) seems expensive vs. comparable IT service provider buyouts.

So What's New?: Now, Office Depot is pulling back the curtain a bit more. Office Depot today (October 12) scheduled a lender presentation to discuss a possible $750 million term loan syndication, proceeds from which would be used to refinance the outstanding debt of CompuCom, according to an SEC filing.

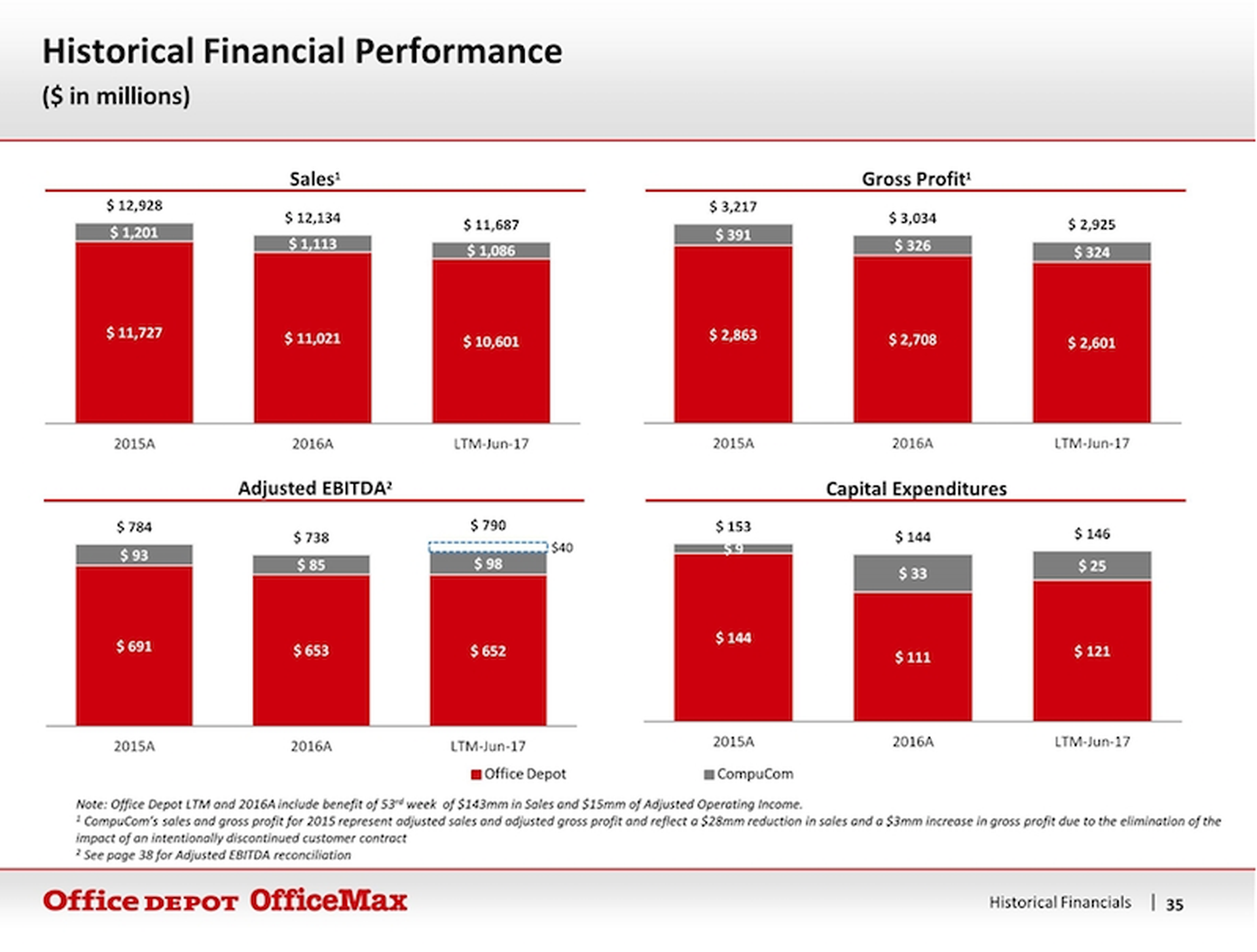

Dig a little deeper into that filing and you'll find a 40-page Office Depot financial presentation. It makes some strong points about CompuCom deal synergies across retail, SMB IT services, managed services, cloud services and more. But the challenges are clearly displayed in black, red and white:

Office Depot-CompuCom Financial Metrics

Among a few sample graphics from the report...

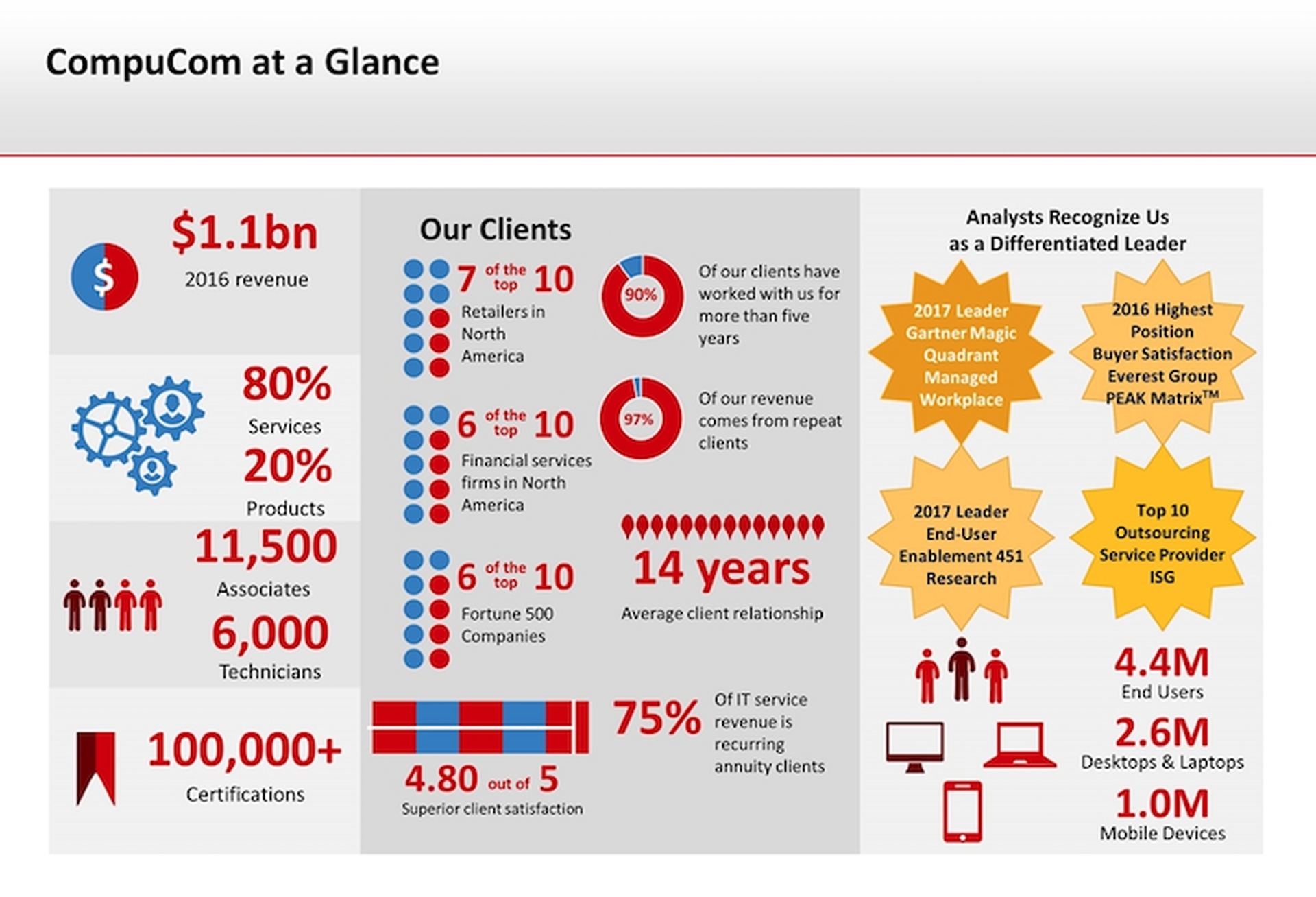

1. CompuCom's Strengths

Office Depot describes CompuCom's strengths in many areas, pointing out $1.1 billion in revenues, a heavy focus on services (rather than products) and strong customer satisfaction scores.

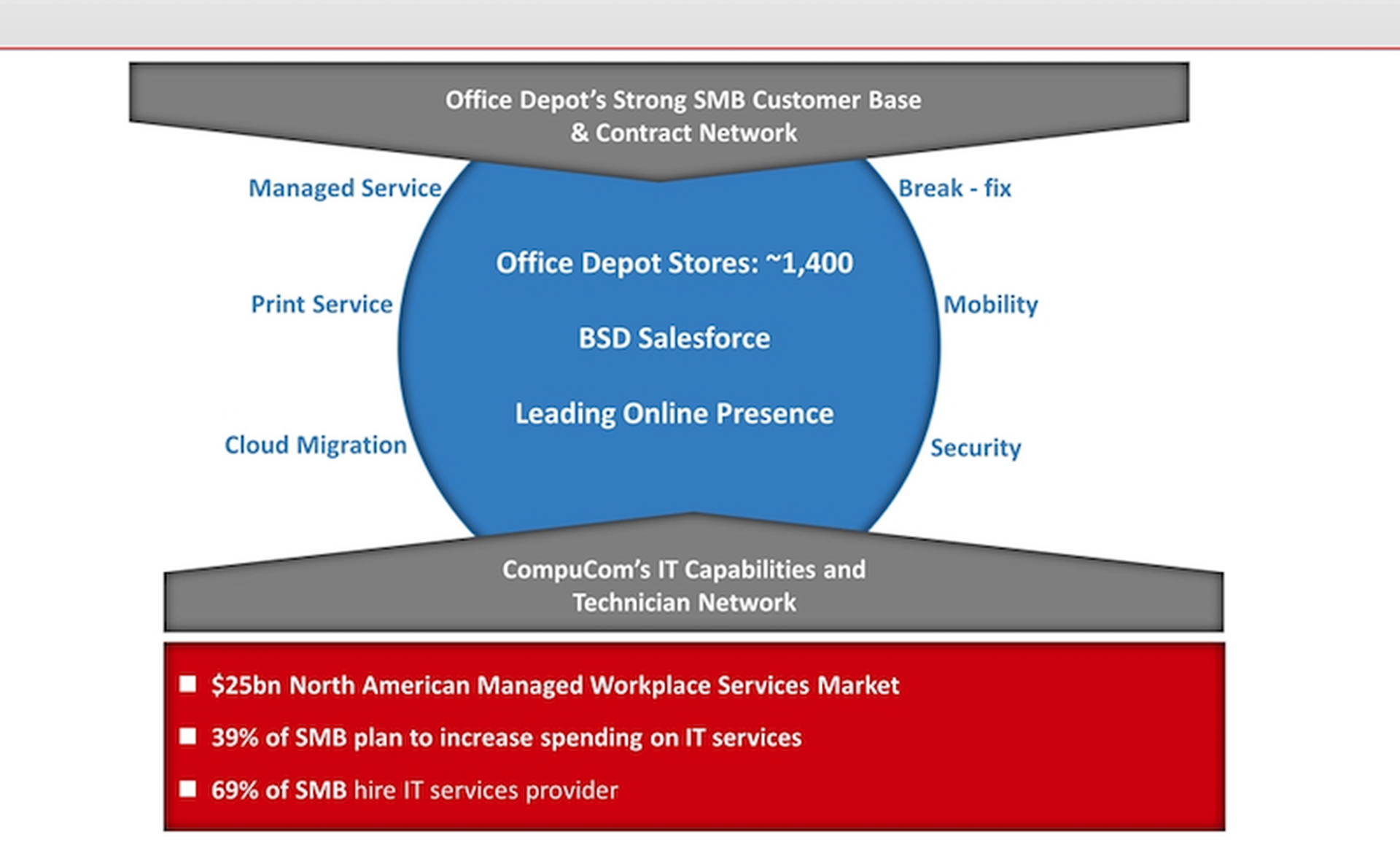

2. CompuCom Recurring Revenues

There are also managed services opportunities, and potential synergies across retail and IT services, as shown in the this graphic:

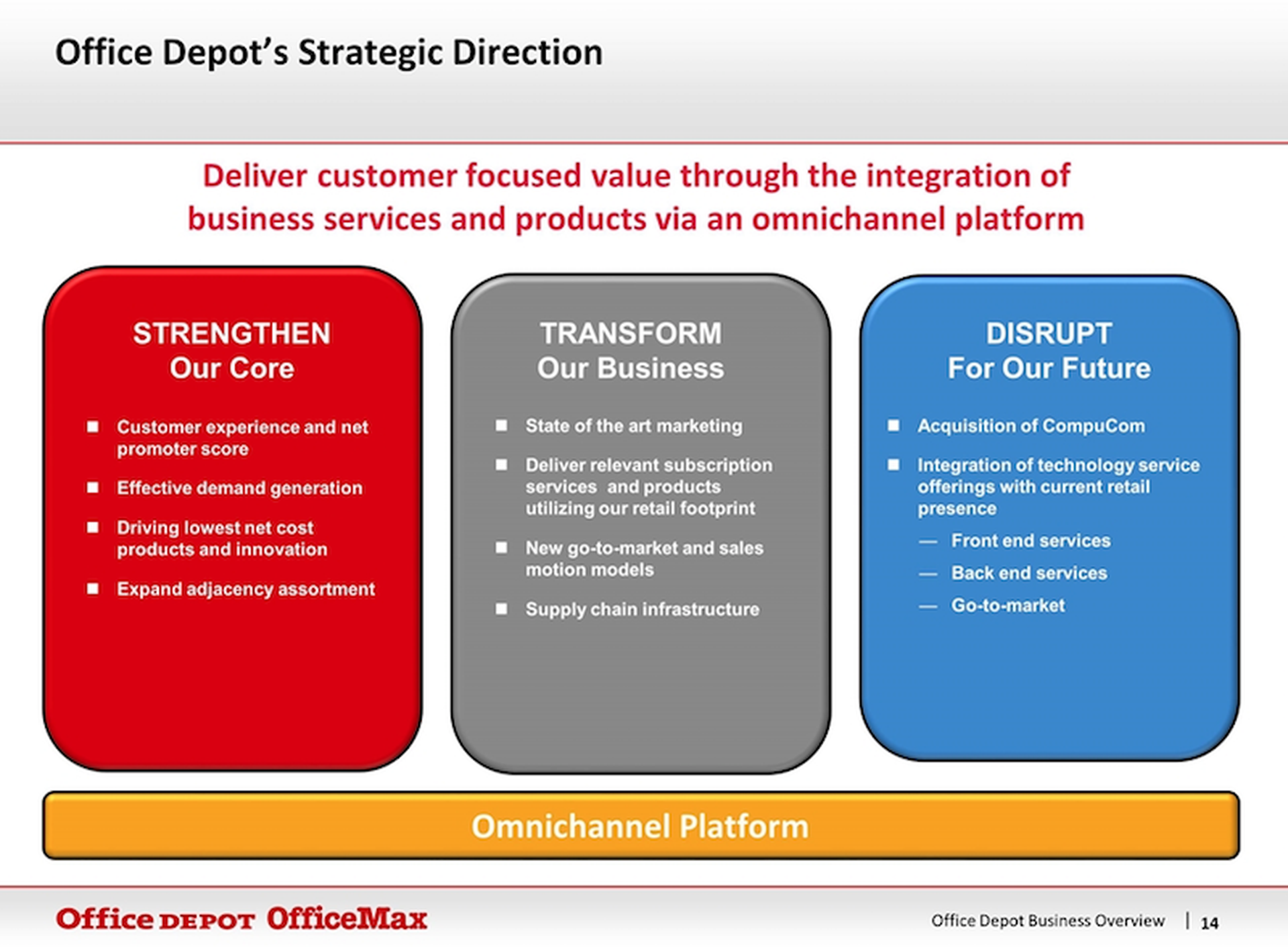

3. Strategic Direction

Overall, CompuCom strengthens Office Depot's strategic direction, the companies claim...

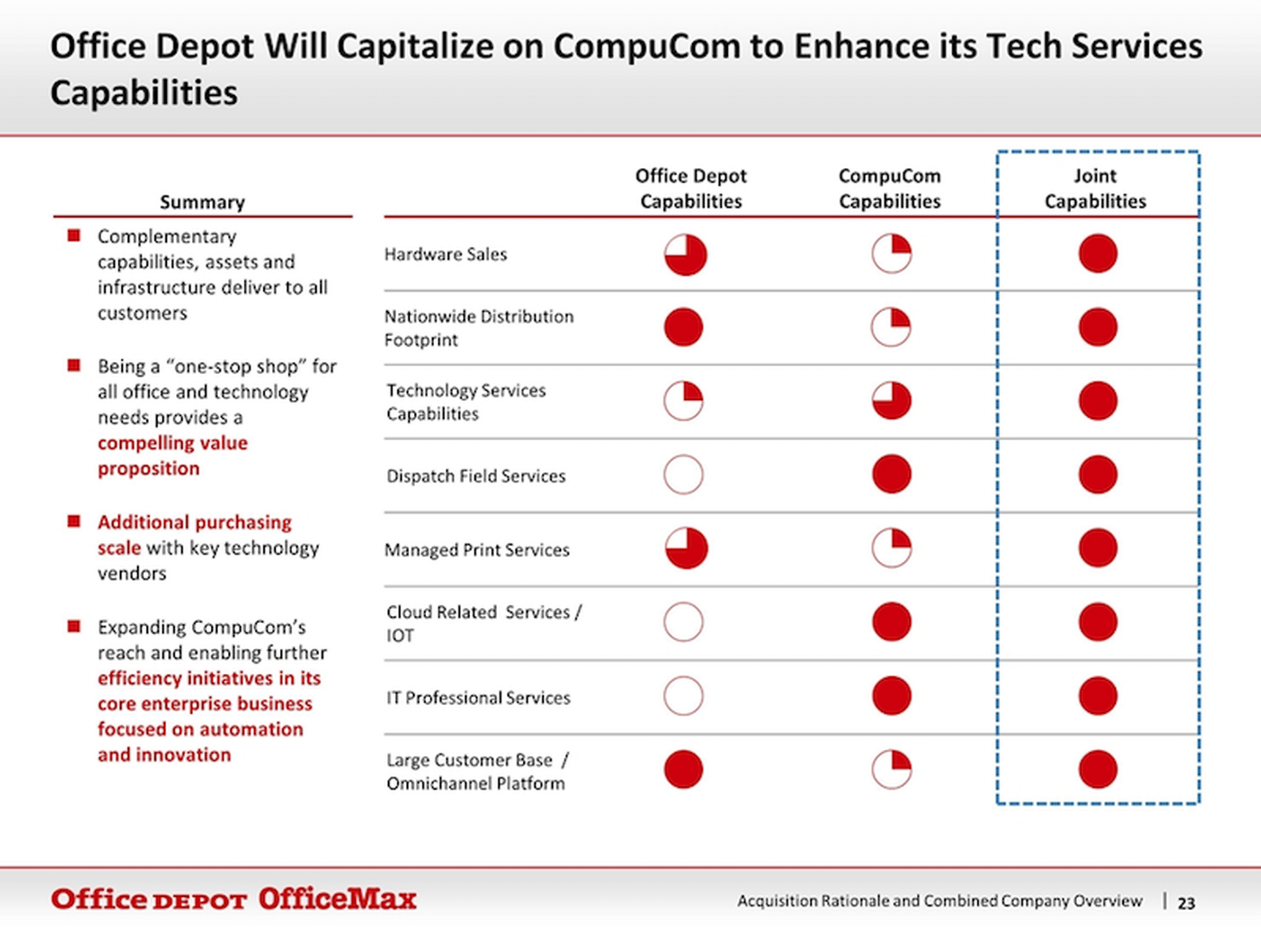

4. The Puzzle Comes Together

Office Depot even claims that the deal's puzzle pieces are a perfect fit for one another across these eight business areas...

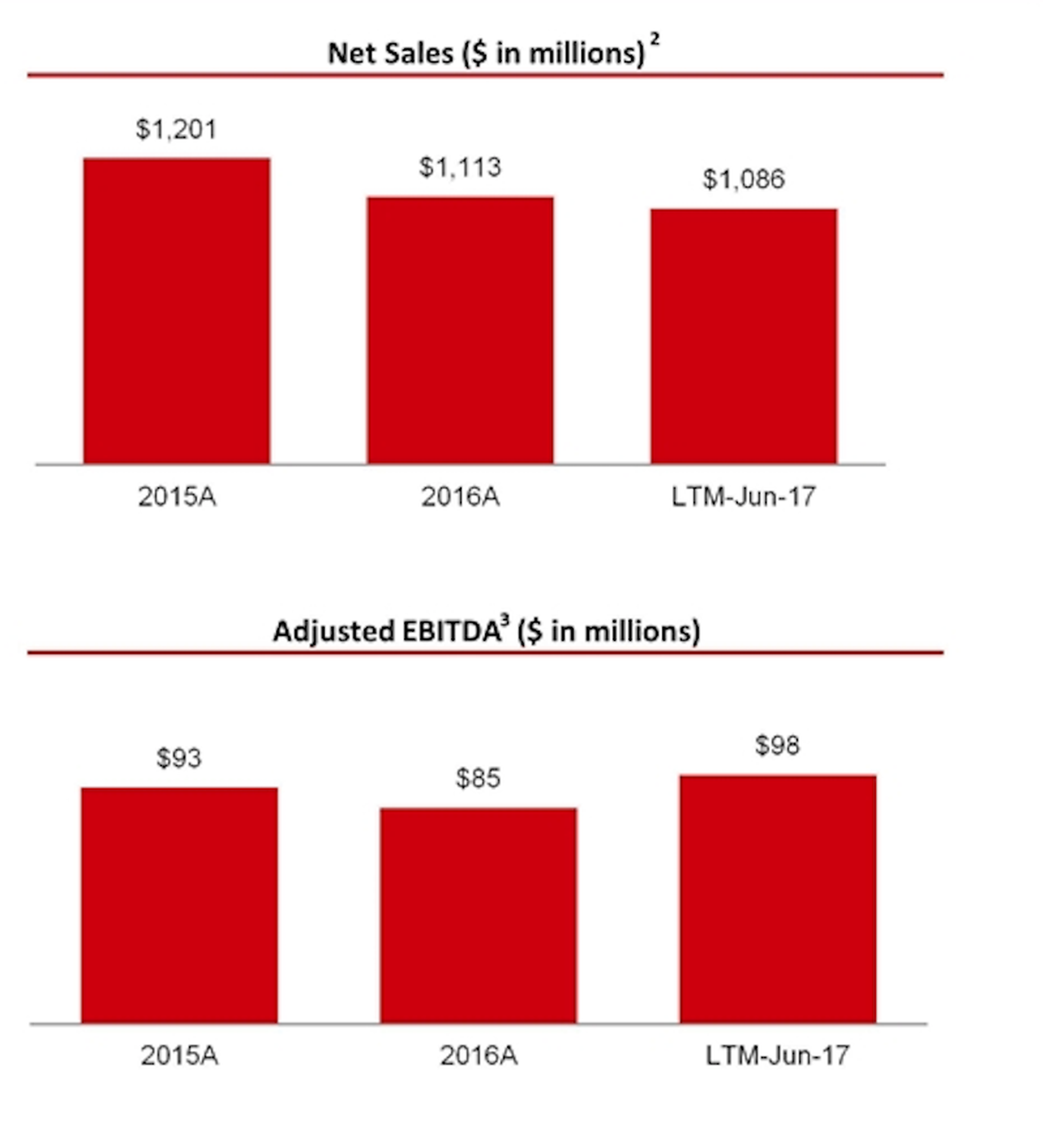

5. Office Depot Is Buying A Shrinking Company

Still, here's reality check part one -- first, the buyer in this deal (Office Depot) is shrinking. To transform the business, the company may need to over-spend on acquisitions. Office Depot points out that the CompuCom deal is only 7X EBITDA once cost synergies are realized -- down from the present 10X EBITDA valuation. Still, a 7X multiple is frothy for an IT service provider that's shrinking. Yes, those are CompuCom's financials below:

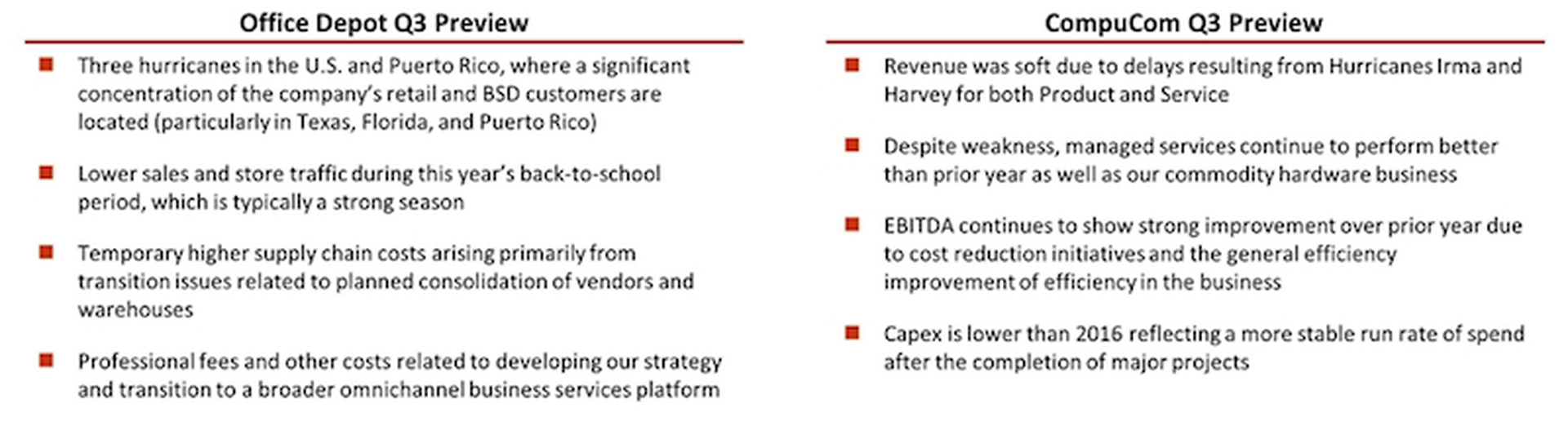

6. More Weakness At Both Office Depot and CompuCom

Maybe it's just a case of bad timing, but it sounds like both companies are experiencing more weakness than expected this quarter. Both companies blamed the recent hurricane activity for undermining revenues...

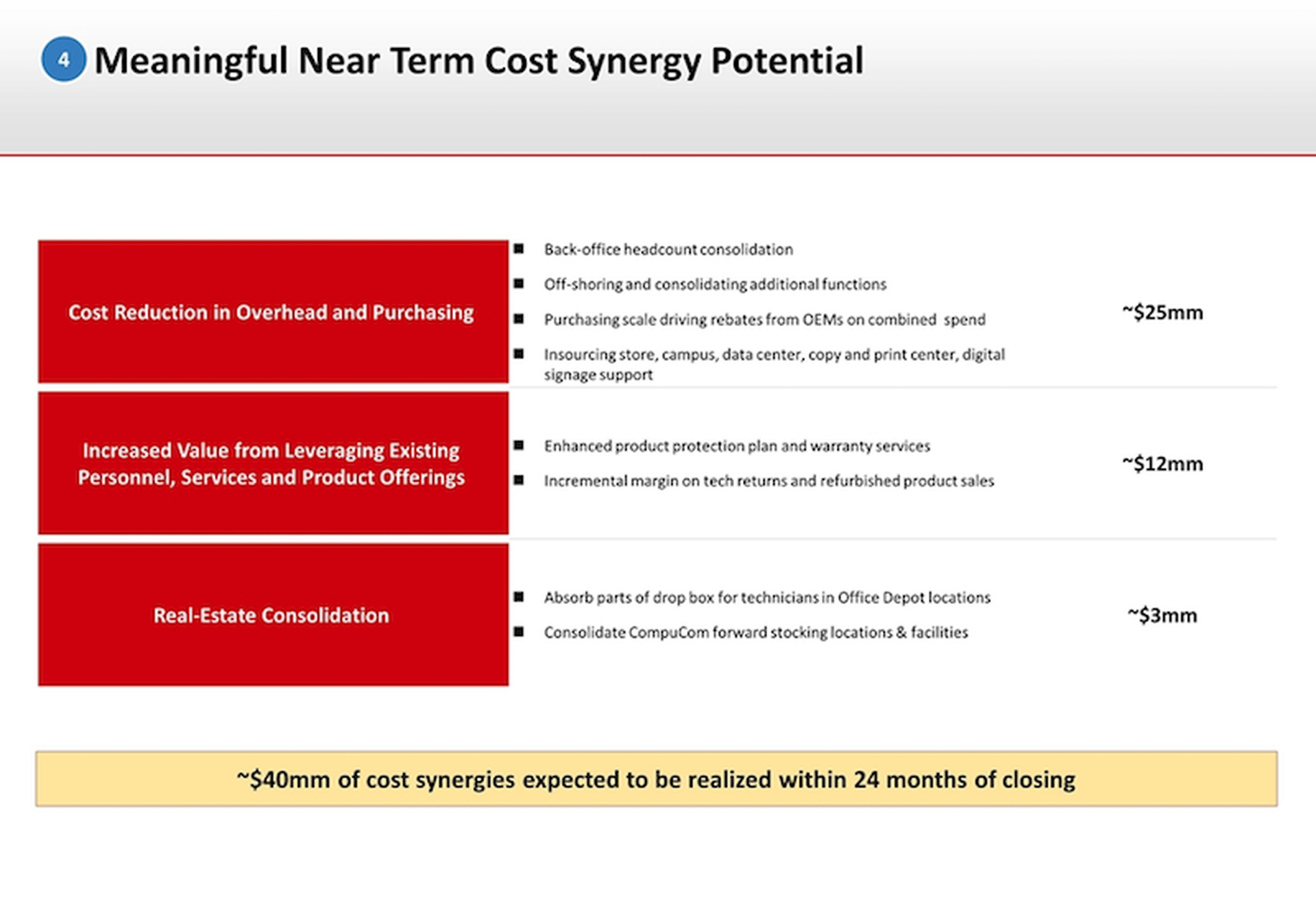

7. Profits Through Layoffs, Cost Cuts

Once the buyout is finalized, Office Depot certainly expects EBITDA to rise. But a portion of that financial boost will involve layoffs, office consolidations and more. Office Depot hasn't disclosed how many jobs will be eliminated as part of the business consolidation.

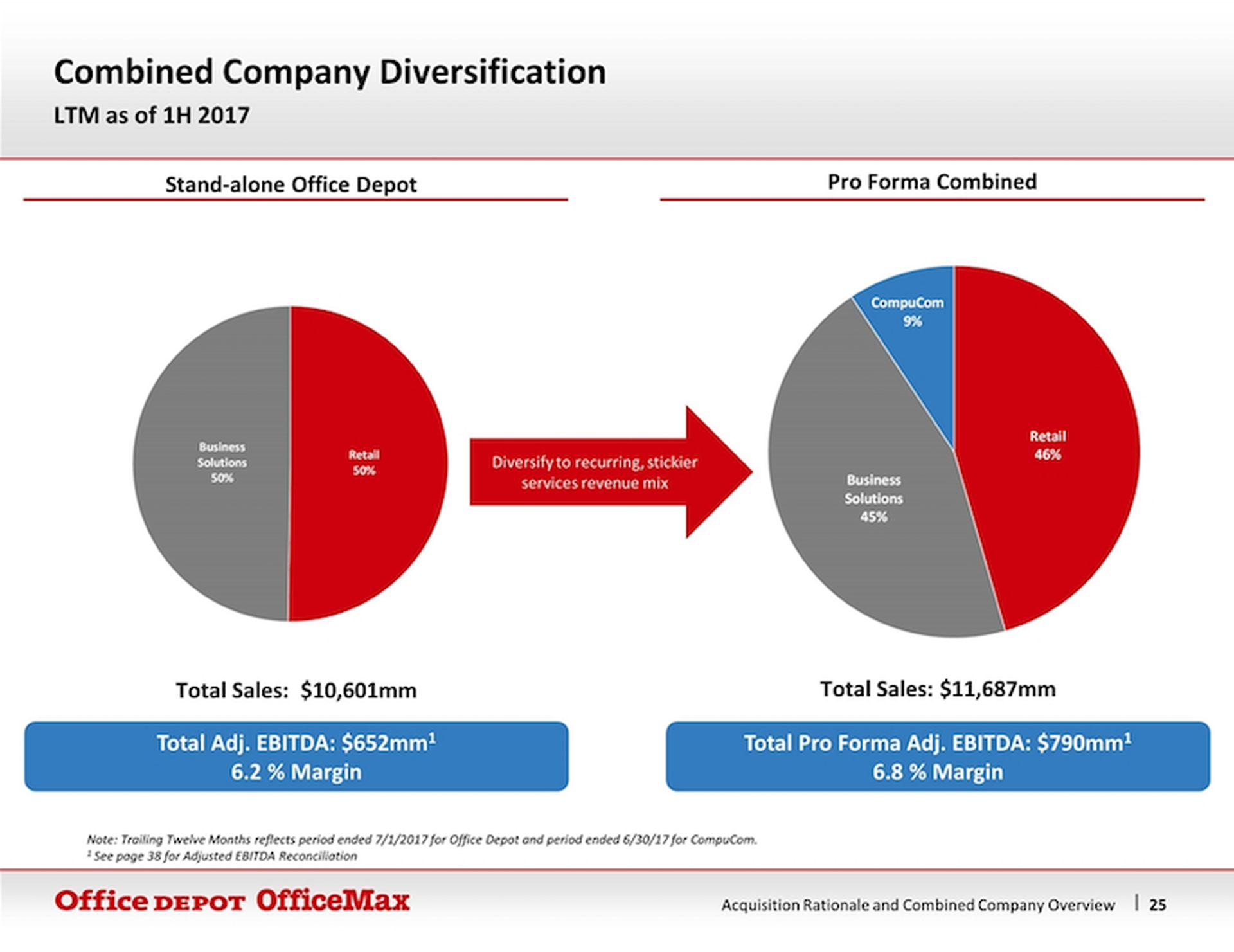

8. Better Revenue Mix

The true goal of the deal? A better, stickier revenue mix for Office Depot. But that doesn't mean overall company revenues will grow. This is not a growth play.

9. Final Reminder: Both Companies Are Shrinking

Last but not least, look at the combined financials for Office Depot and CompuCom. No doubt, CompuCom has done a solid job managing EBITDA amid revenue fluctuations. But how do you take two shrinking companies, put them together and talk so much about changing the world? The real story is potential deal synergy to squeeze out costs, create stickier customer relationships, and lift EBITDA margins a bit.

10. Bottom Line

Admittedly, my views could be biased. I've covered quite a few "big" M&A deals only to see them fizzle. Also, I've only offered you a few graphics from the 40 page Office Depot report. Take a look at the entire report and tell me what you think.