Will Microsoft Azure eventually leapfrog Amazon Web Services (AWS) as a public cloud service for businesses? That seams to be the conclusion of a CIO cloud adoption survey from Morgan Stanley.

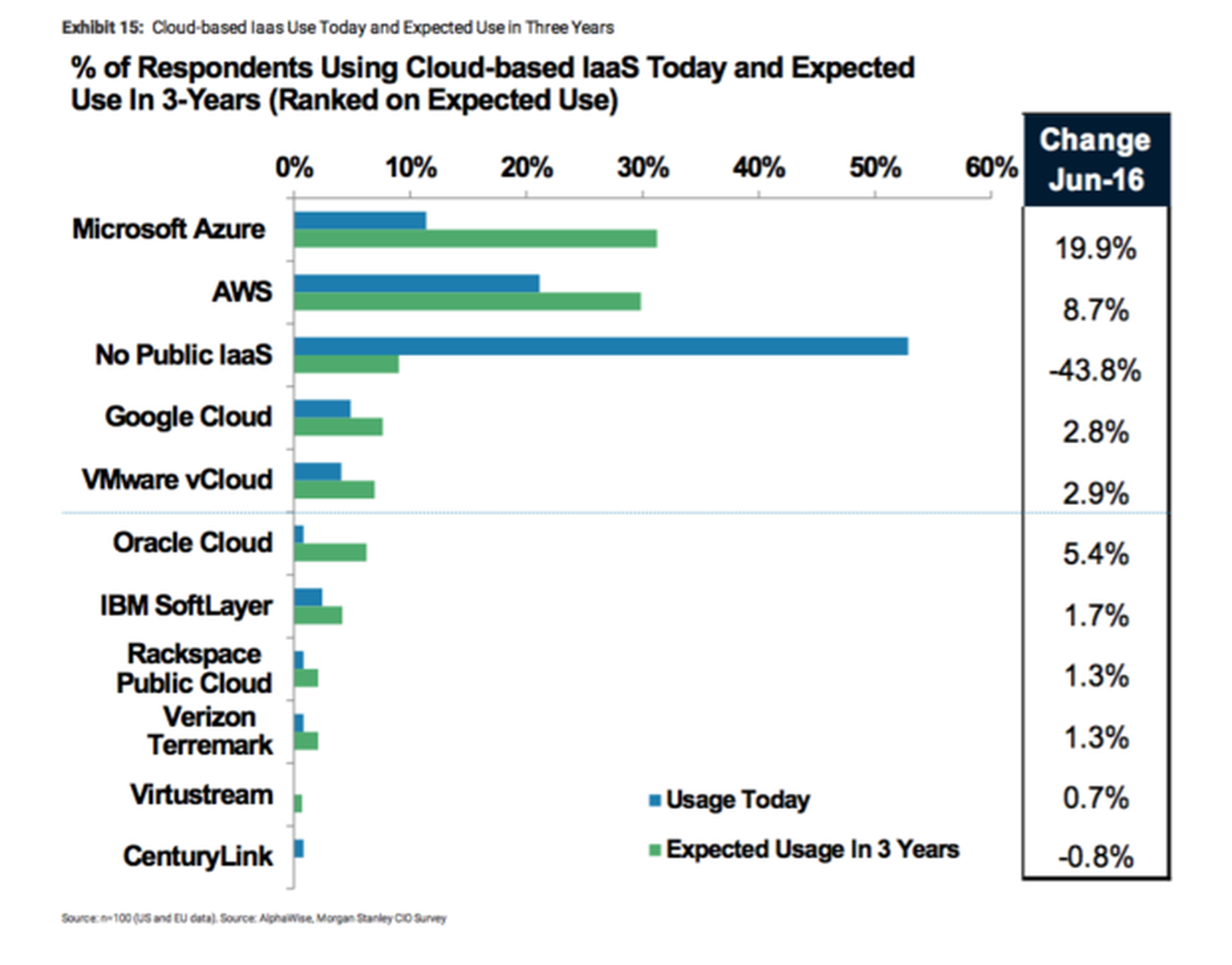

Roughly 20 percent of CIOs say their businesses run AWS today. And roughly 10 percent indicate that their companies currently run Azure. Fast forward three years to 2019, and those same CIOs say their Azure adoption (31 percent) will slightly outpace AWS (about 29 percent), Morgan Stanley reports.

The data points surface as Microsoft gets set to rally the channel at Microsoft Worldwide Partner Conference 2016 in Toronto. (Here are 10 WPC16 Partner Moves to Watch.)

Cloud Market Share: Oracle Gains, IBM Struggles?

There are some other interesting data trends in the survey. While Google Cloud Platform and VMware vCloud will also see growing adoption, the big winner among that group of second-tier players appears to be Oracle. IBM, by the way, is only expected to make marginal gains with its SoftLayer cloud, Morgan Stanley's survey revealed (see chart below).

Cloud Market Share Reality Check: AWS, Microsoft, IBM, Google

Still, the Morgan Stanley survey doesn't exactly align with third-party cloud market share research. For instance, Synergy Research Group says 2015 cloud market share looked like this:

- Amazon Web Services, 31 percent

- Microsoft, 9 percent

- IBM Cloud and SoftLayer, 7 percent

- Google, 4 percent

- Salesforce, 4 percent

Also of note: Microsoft's growing cloud momentum may also come at the expense of profit margins. Indeed, Microsoft officials during recent earnings calls described the difficulty they'll have predicting cloud margins as the company tries to balance data center deployments with customer and partner demand. During some quarters, cloud profit margins will drop as the company doubles down on certain infrastructure projects.

Amid the multiple research reports, there are some consistencies. For instance, both Amazon and Microsoft are widely viewed as the de facto public cloud IaaS leaders. But some folks -- particularly CIOs responding to Morgan Stanley's survey -- foresee a time when Azure may actually leapfrog AWS as the preferred cloud for business infrastructure.

Cloud Market Share: MSPs, CSPs and VARs

Gavriella Schuster

Gavriella SchusterOf course, one big wildcard involves channel partners. Microsoft has lined up thousands of Cloud Solutions Providers to promote Office 365 and Azure, Channel Chief Gavriella Schuster recently explained in a podcast with ChannelE2E and CompTIA. And additional partner moves will surface at WPC16 this week.

Meanwhile, Amazon has launched a range of MSP-centric partner programs -- many of which appear to be catching on. For more information, check out ChannelE2E's Top 50 MSPs partnering with Amazon Web Services.