Michael Dell introduced Dell Technologies to the world during a press and analyst conference call this morning. No doubt, the company has some growth opportunities for channel partners -- particularly around converged infrastructure and cloud offerings like VirtuStream and Pivotal. But the merged technology giant will face plenty of competitive and IT industry challenges. Among the key issues that emerged during the call: How will the organization remain nimble even as it becomes a far bigger company?

"We believe humanity is standing at the brink of the next Industrial Revolution," said Dell. The number of intelligent devices, he noted, is growing exponentially. Those connections will create massive sources of information. Gaining insights from that information is why the new, combined company has launched.

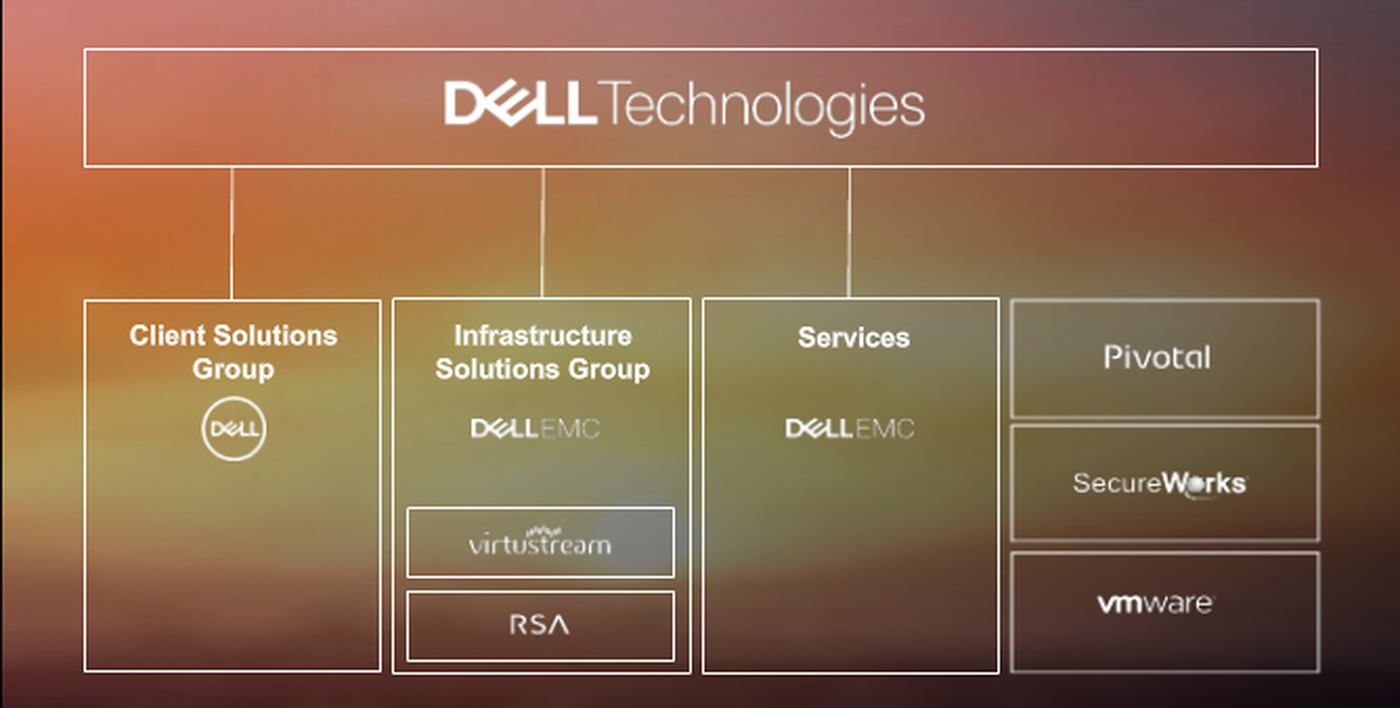

Dell Technologies Organization Chart

The business is organized as follows:

Dell says the company has prominent positions in 20 Gartner Magic Quadrants. He said the company will offer the best partner programs going forward, and dismissed third-party "FUD" (fears, uncertainty and doubt) about the company's debt load. He noted that the company's debt payments are less than rival share buyback costs.

"This is just the beginning. Dell Technologies will stand at the center of the action," he asserted, as customers seek to make sense of the information they're gathering and managing.

Dell Technologies CFO: Growth and 'Synergies'?

Tom Sweet

Tom SweetCFO Tom Sweet mentioned that the company was No. 1 or No. 2 in a range of markets -- from storage to data center infrastructure to PC devices. The overall company will have about $74 billion in revenue. Sweet also mentioned a range of "cost synergies" that the business combination will unlock -- though he didn't mention layoffs or specific headcount reductions.

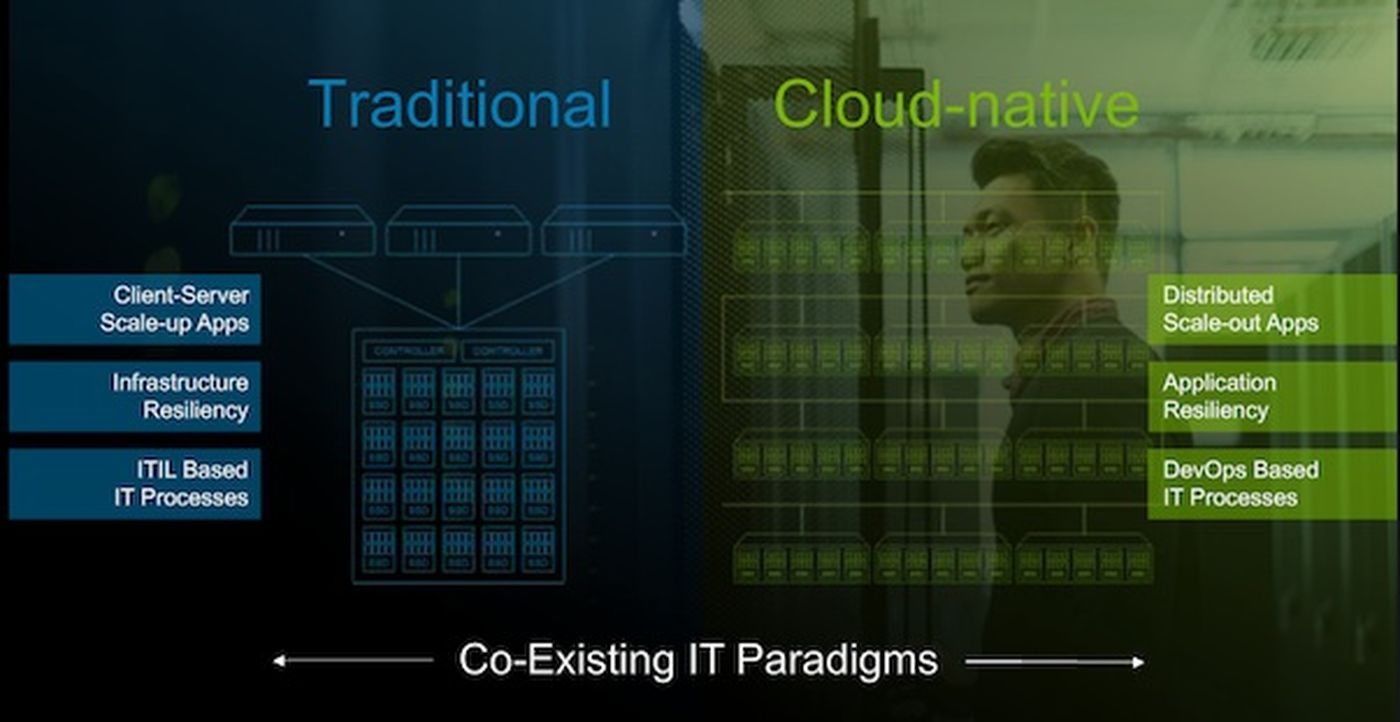

Next up was David Goulden, president of Infrastructure Solutions -- essentially the data center business (x86 servers, converged infrastructure and more). The company's strategy will allow businesses to run traditional applications even as the company helps customers to build out hybrid-cloud and scale-out solutions, along with pure cloud application, he asserted.

He pointed to the company's ability to support traditional and cloud-native applications side-by-side:

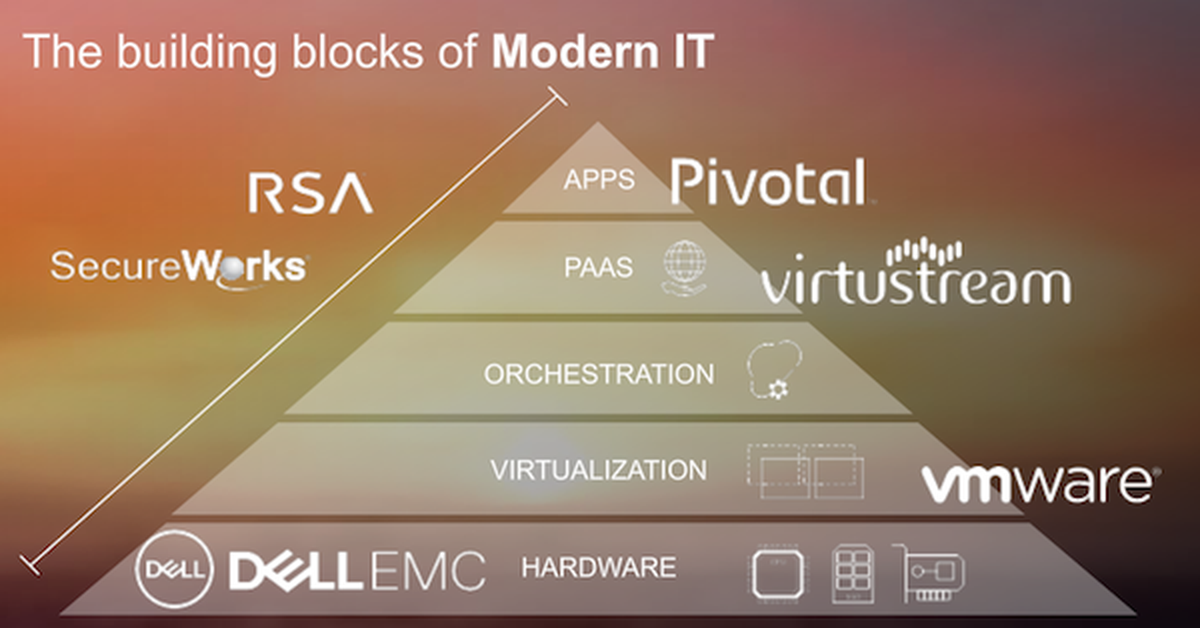

Next, Goulden displayed how the company's portfolio of solutions scale from infrastructure to applications:

Dell Technologies Q&A Session

Locations: A question and answer session (Q&A) opened with a very targeted question about the company's commitment to Research Triangle Park. Company officials indicated that they're committed to multiple regions and that the business is global in nature. It was a careful response to avoid pinpointing any potential locations for headcount cuts.

Hybrid Cloud: Goulden answered questions about cloud services by pointing to the hybrid cloud opportunity. He vowed that the company will pursue more partnerships, while also accelerating the Virtustream business. Michael Dell also pointed to infrastructure opportunities involving converged and hyperconverged offerings.

Speed to Market: The Boston Global ask how the company can get faster as it gets bigger. Michael insisted the company can remain nimble -- pointing to fast-growth areas like Pivotal and Boomi. Plus, he mentioned the company's supply chain expertise. Still, ChannelE2E notes, channel partners say the SonicWall business interactions with channel partners slowed down considerably under Dell's ownership (SonicWall is now being sold off to a private equity firm).

Speed to market will be the KEY theme for partners moving forward: Will Dell approve registered deals, adjust pricing and consult with partners quickly enough in the months and years ahead?

Cloud Overlap: Analysts questioned the potential overlap between Virtustream and VMware in the mission-critical cloud services market, but Dell said he had no plans to combine Virtustream with the VMware business, insisting there was plenty of room for both companies to thrive.

Overall, Dell's pitch was a familiar one. As were the potential concerns from analysts, some of which think the company will have a difficult time remaining nimble with such a complex, diverse product portfolio.