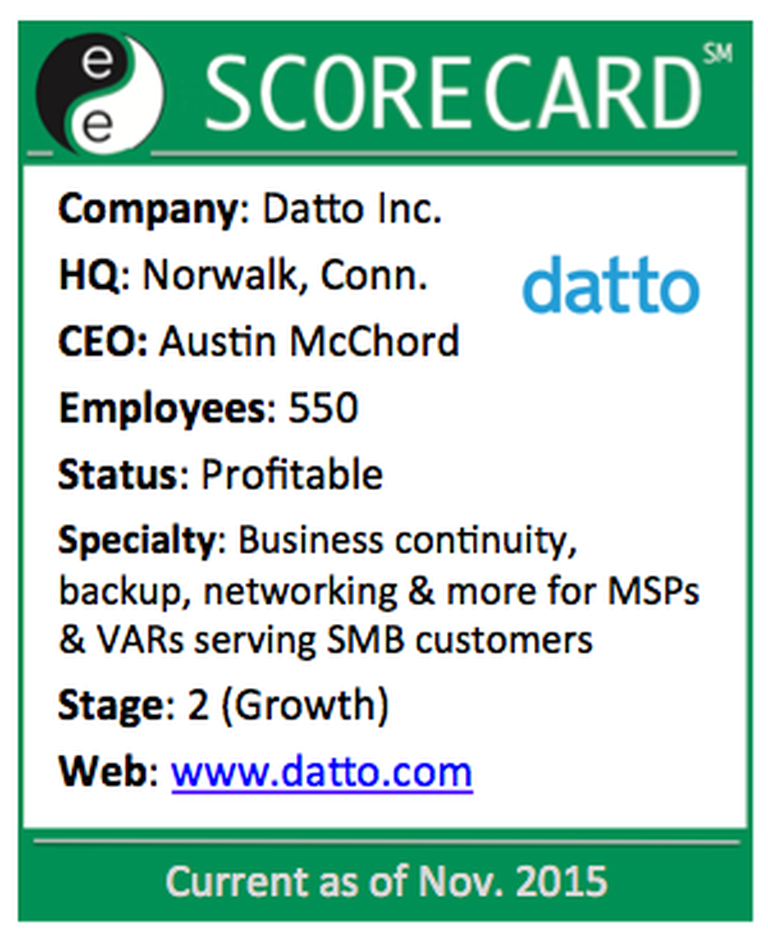

Update: Nov. 17, 3:00 p.m. ET: ChannelE2E just confirmed that Datto is a rare unicorn (definition: startup with a $1 billion-plus valuation) that's also profitable.

Datto confirmed the funding to a handful of business publications. ChannelE2E believes this is the second time the company has accepted venture-type money -- including $25 million from General Catalyst in 2013.

At the time, Steve Herrod, a managing director at General Catalyst, and Paul Sagan, the executive vice chairman of Akamai Technologies, joined Datto’s board, The New York Times reported. Herrod is a VMware veteran and Sagan is the former Akamai CEO who also worked at VMware and EMC Corp.

Datto Funding, Growth Updates

Datto CEO Austin McChord

Datto CEO Austin McChordThat 2013 move helped Datto to rapidly accelerate growth, acquire Backupify, and emerge as one of the top business continuity providers to MSPs. Fast forward to the present and Datto has grown to more than 550 employees worldwide -- up more than 200 people since December 2014. Moreover, headcount will increase another 25 percent to 30 percent next year, BostInno reported.

Datto CEO Austin McChord told BostInno that Datto is profitable, and plans to use the new funding for more R&D and international expansion.

On the R&D front, the company has been developing an SMB router called Datto Network Appliance (DNA). It was originally expected to ship around September 2015, but new WiFi-type capabilities pushed back the launch until January 2016.

Turning to Datto's international strategy, the company recently opened an Australian headquarters in Sydney. Watch for the Australia and New Zealand partner base to expand from 20 partners up to more than 100 partners (including VARs and MSPs) by the close of 2015.

With a rare combination of profits and venture capital dollars, does Datto also plan to make acquisitions? It sounds like the answer is a qualified yes -- if the right deal comes along. “We are profitable, but it’s nice to have cash to continue geographic expansion, develop new or make a strategic purchase,” McChord told TechCrunch.

I doubt a buyout would involve the traditional MSP software market (RMM, PSA, etc.). Instead, perhaps a technology that would further bolster Datto's cloud storage of emerging networking strategy -- or something else really close to home...

Funding MSP-Centric Companies

Software and cloud companies serving MSPs have raised money in a range of ways lately -- but many of the deals have involved private equity buyouts rather than venture capital dollars.

In terms of storage-centric MSP companies, Datto rivals like Axcient and eFolder are venture backed. Many MSP ecosystem cousins -- names like Autotask, Continuum, Kaseya, LogicNOW and SolarWinds N-able -- have focused on RMM (remote monitoring and management) and PSA (professional services automation) under private equity ownership. But a few of those cousins -- including Autotask and Continuum -- now have various storage offerings of their own. And one head-on rival -- Intronis -- was acquired recently by Barracuda Networks.

Meanwhile, ConnectWise recently reorganized, is profitable and has no debt. CEO Arnie Bellini doesn't sound like he'll ever go the private equity route, though I wonder if the company will pursue an IPO at some point.

As for Datto, I get the sense that the company's channel mission is starting to expand -- aggressively -- beyond MSPs. Indeed, VARs shifting to cloud computing -- including resellers that don't have PSA or RMM in place -- are another natural fit for the company's channel strategy.