If you run an MSP that's seeking to be one of the nation's top privately held businesses, you need to focus on M&A (merger and acquisition) strategies while also turning your attention to the Inc. 5000 list -- which tracks the fastest-growing privately held companies in the United States. That prestigious list, launched in 1982, identifies the nation's most successful private companies.

Today, the list is a distinguished editorial award, a celebration of innovation, a network of entrepreneurial leaders, and an effective public relations showcase. The Inc. 5000 ranks companies by overall revenue growth over a three-year period. All 5,000 honoree companies are individually profiled on Inc.com. The top 500 are featured in the September issue of Inc. Magazine, the leading entrepreneurial advocate for 38 years running. Inc. also ranks the fastest-growing companies by industry, metro area, revenue, and number of employees, and we also highlight women and minority-run companies. It’s also a prime hunting ground for acquirers targeting fast growing companies.

Somewhat similarly, ChannelE2E’s Top 100 Vertical Market MSPs list and research (hashtag: #MSP100) identifies and honors the top 100 managed services providers (MSPs) in healthcare, legal, government, financial services, manufacturing and additional vertical markets.

Scheduled to be announced on April 21, 2022 at 2pm ET, ChannelE2E’s seventh-annual Top 100 Vertical Market MSPs rankings will be based on ChannelE2E’s Q4 2021 and January 2022 readership survey, and ChannelE2E’s vertical market industry coverage. MSPs featured throughout the list and research leverage deep vertical market expertise to drive annual recurring revenues (ARR) in specific market segments.

History as Greatest Teacher to Top the Inc. 5000

If your goal is to top the Inc. 5000 list in 2022 start by putting on your buyer hat, and confirm your strategy will ultimately appeal to institutional investors (e.g. Private Equity) in these three ways:

- Start with a large TAM/Total Addressable Market (e.g. sandbox which never runs out of potential customers)

- Craft a plan to obtain recurring revenue and strong gross margins (and once acquired focus on revenue /logo retention)

- Join industry Peer Groups to both learn best practices, and build a M&A pipeline (e.g. IT National Evolve)

Next, surround yourself with like-minded professionals with a shared vision (e.g. they’re also keen on helping you increase your company’s notability on the Inc. 5000).

Meet the M&A Advisor and Firm Determined to Propel You to the Top

Abe Garver, IT Nation Connect 2021 ‘The State and Future of M&A: What's happening, what's coming, and how you should prepare.’ (Photo credit: Gregory Wostrel)

Abe Garver, IT Nation Connect 2021 ‘The State and Future of M&A: What's happening, what's coming, and how you should prepare.’ (Photo credit: Gregory Wostrel)Abe Garver leads the Managed Services Provider (MSP) Team at FOCUS Investment Banking, the #1-Ranked Lower Middle Market Investment Bank by Axial. Mr. Garver is a M&A investment banker, magazine contributor, television commentator and conference speaker (Wikipedia), who has published over 120 articles in numerous publications, including, FORBES, Seeking Alpha, ChannelE2E and Yahoo! Finance. Over the course of his career, he has worked on sell side, buy side and capital raise assignments with approximately 75 clients, including public, private, and Inc. 5000 fastest growing companies.

M&A Activity in the MSP Industry

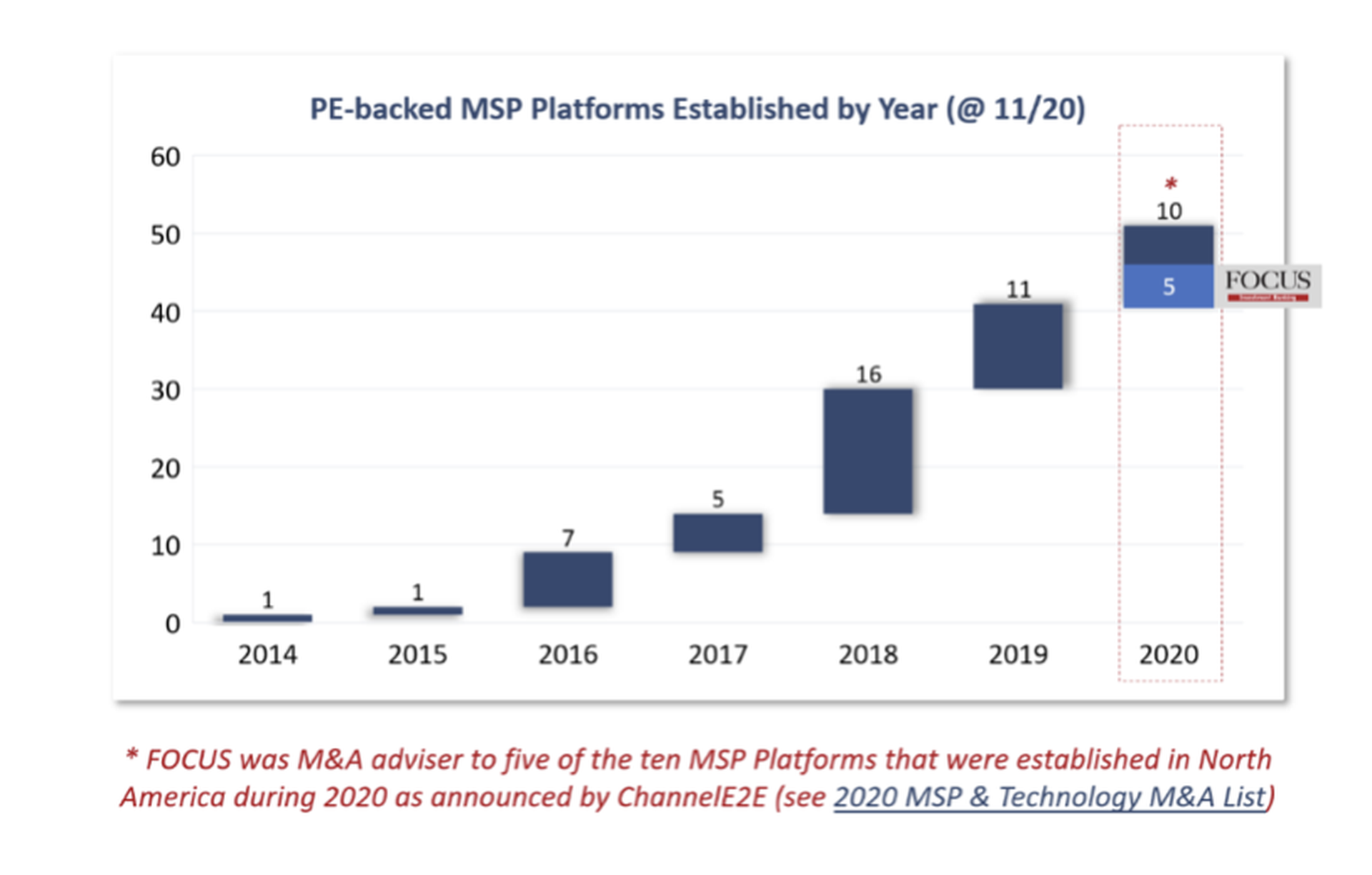

For the past several years, the MSP industry has been rapidly consolidating, as private equity firms buy up small IT firms and cobble them together into larger platforms.

In fact, over the past 24 months, Garver and the FOCUS Team have catapulted nine MSPs into “New Platforms” for private equity groups (PEGs), and recently helped seven more MSPs enter exclusivity (signed “letter of intent” pending close).

The start of something even bigger

Consistent with FOCUS’ vision to increase its client’s notability on the Inc. 5000 Fastest-Growing Companies & Best Workplaces Lists and work on transactions in which management teams are passionate about joining together, here are five transactions that FOCUS helped put together recently, all of which were just the start of even bigger deals to come.

Domain Computer Services completes four-way merger, rebrands as Integris

In 2020 FOCUS advised Chicago-based PE firm Frontenac on its recapitalization of Domain Computer Services, a New Jersey-based IT provider, as part of its merger with Maryland-based Tier One Technology Partners to form a national MSP platform. The two MSPs specialize in managing the cybersecurity and IT needs of professional services firms; Domain’s core business was the legal and financial services arena, while Tier One worked largely in the nonprofit sector. Domain offered on-site and remote support to clients in the New Jersey, New York, and Philadelphia metro areas. Tier One concentrated on the Maryland and DC metro region.

With Frontenac’s backing, the combined company positioned itself as a premium national provider of managed IT services that would partner with other MSPs with similar values, the company said.

On November 1, 2021, four MSPs—including Domain, Compudyne, ProviDyn and MyITpros—announced that they had joined forces to form Integris, a premium national MSP with a large focus on cybersecurity. All four companies specialize in IT, cybersecurity, cloud and network services of professional services firms. The combined company, which will have about 400 employees by the end of the year, will be led by Rashaad Bajwa, Domain’s CEO. Before the Integris announcement, Inc. magazine had recognized Domain as one of the top 250 fastest-growing private companies in the New York Metro area, ranking #96.

“Our budget when we started was to be $50 million in revenue by the end of 2022, but right now we are on pace to end 2021 at around $100 million and 400+ employees,” Bajway said. “The thesis of a people-focused premium MSP for premium clients was jump-started by Abe Garver’s introduction of Frontenac to us about 18 months ago, and ever since it has been nonstop pedal-to-the-metal growth. I like to say the consolidation of the best assets in our industry is a sprint, not a marathon – and that does not look to be slowing down going into 2022.”

ICS: Finding the perfect (ClearLight) Partners

In 2020 FOCUS served as the exclusive financial advisor to ICS in connection with ClearLight Partners’ investment in ICS. Then, in early 2021, FOCUS advised AKUITY Technologies in its acquisition by ICS, further expanding ICS’s managed IT services across New England.

ICS provides managed IT services, cybersecurity, cloud migration and other project-based services, as well as hardware and software reselling, with an emphasis on serving small and medium-size businesses (SMBs) within healthcare, financial services, professional services, manufacturing, and retail. It operates three branch locations in upstate New York and one in Massachusetts. AKUITY, based in Auburn, Massachusetts, operates in five New England states.

“When I decided that I wanted to do a PE deal back in 2019, I took the time to craft what was a perfect deal for me and the ICS team,” ICS CEO Kevin Blake said. “Finding a partner that would check all my boxes and continue to support the culture I had built was of the utmost importance. I had talked to a bunch of different PE and strategic buyers but none of them were meeting all my criteria.”

“I met Abe Garver with FOCUS and he said, ‘I know the perfect partner for you.’ Abe flew across the country with me for the introduction and he was right. Nearly two years later, I couldn’t be happier with my partnership with Clear Light Partners. We have nearly tripled the size of our company, growing organically and through M&A. I have been fortunate enough to work with Abe on both the sell side and the buy side. He represented AKUITY, which was our largest acquisition to date. The transaction went very smoothly, and we couldn’t be happier with the addition of AKUITY to our family. We should be closing soon on our seventh acquisition and are looking forward to growing the ICS family.”

General Informatics: Looking to keep growing

In December 2020 FOCUS advised General Informatics (GI), a Baton Rouge, LA-based full-service MSP, cloud services business and IT consultancy, in its recapitalization by Rosewood Private Investments (RPI), a Dallas-based private equity firm. As part of the transaction, in which RPI will own a majority stake in GI, Don Monistere joined GI as its new president. He worked closely with Mohit Vij, GI’s founder, and ultimately succeeded him as CEO.

The story of how FOCUS met GI founder Mo Vij was viewed more than 3,000 times in the first three days after it was posted on LinkedIn.

A little less than a year later, GI announced the acquisition of fellow MSP Versiant in the second of what may eventually become four acquisitions in 2021. FOCUS advised Versiant in this transaction. Versiant brings to GI a strong focus on data analytics and security services, as well as a geographic expansion into the Charlotte, N.C. area. Versiant was actually GI’s second acquisition of 2021 which followed the May 2021 tuck-in purchase of Emco Technologies‘ personal computer sales and managed services division. In addition, two more deals may get over the finish line before the end of the year.

With roughly 50 employees in 2020, that number cruised past 100 in 2021 according to Monistere. “In 12 short months the combined company has grown to about 120 employees and expects to be at 170 before the end of 2021”, said Monistere. Monistere and his leadership team continue to break sales and service delivery records, with quarter-over-quarter growth of over 300%. The Company has been featured six times in the Inc. Magazine 500 and Inc. 5000 list.

ECS and MyIT merge, acquire, and rebrand as The Purple Guys

In February 2020 FOCUS represented ParkSouth Ventures and Kian Capital Partners in the merger of Enterprise Computing Services (ECS) and My IT. The combined MSP, which was initially called My IT, pursued additional acquisitions through funding from ParkSouth and Kian. ECS, based in Shreveport, Louisiana, offered hosted cloud services, disaster recovery, virtual CIO and security services. My IT offered managed IT, hosted cloud services, disaster recovery, virtual CIO, VoIP and security services.

At the time Garver said, “The backing of Kian and ParkSouth will allow My IT to continue to invest in their compelling growth strategy, including additional acquisitions which will position them for a widened service area and additional services and capabilities,”

Indeed, in 2021, the combined company acquired The Purple Guys in Kansas City, KS, and Network Technologies in Olathe, KS, establishing the company as a market leader in Kansas City and the Midwest. The entire entity was then rebranded as The Purple Guys across all office locations.

“It’s been nearly two years since the combination of ECS and My IT, and we couldn’t be more pleased with where we are now and how our business is performing,” said Kevin Cook, CEO. “Today our team of more than 160 highly skilled professionals remains focused on building an industry leading IT service provider that provides best-in-class managed IT services, security and support to the SMB community.”

Prior to ECS and My IT’s acquisition, The Purple Guys was ranked ranked 4,425 by Inc.

Cantey Technology: Looking for nine more years on the Inc. 5000 list

In July 2021 FOCUS advised Cantey Technology Consulting and its Cantey EDU subsidiary in an investment from LNC Partners. Cantey Tech, founded in 2007, has made the Inc. 5000 list of fastest-growing privately-held companies for nine straight years, and aspires for nine more years on the list.

The LNC investment will allow Cantey Tech to efficiently pursue acquisitions. Cantey Tech’s areas of expertise include IT consulting services, help desk support, data security, cloud management, backup and disaster recovery, hosting, application support and vendor management. The MSP, based in Charleston, South Carolina, supports small and midsized businesses in the southeast United States. Its subsidiary, Cantey EDU, is a national provider of IT support services to the education market.

LNC Partners, based in Northern Virginia, has over $500 million of capital under management. The private equity firm typically provides between $5 million to $35 million of capital to companies that generate at least $2 million of EBITDA.

“The advice and support we got from FOCUS was great, and I thought it was going to end after the transaction closed,” Cantey CEO Willis Cantey said. “However, Abe and I continue to talk all the time, and we’re going to continue to talk all the time, and we’re going to do deals together, and we’re going to find great ‘fits.’ If you have an investment bank that is good, what they care about more than anything is their reputation, not their fee, because that will lead them to more financial success down the road.”

“The fit between the teams at Cantey Tech and LNC has been great, which has allowed us to collaborate well and get our partnership off to a fast start,” said Kevin Cunningham, managing director at LNC. “For Abe and FOCUS, the fit between parties is everything in a transaction and we are thankful to have found it here.”

On LinkedIn ahead of vCIOToolbox’s Learning Series in October of 2021 “The MSP Platform Journey of a 9x Inc. 5000 Fastest-Growing Peer (and Hunt to Find Exceptional Partners Like You)” Brian Doyle said, “It’s going to be a great session. Abe Garver educates and shares information that most of us struggle to find about the real world of MSP M&A. Willis Cantey will share the unique experiences of becoming a PE backed MSP and what they are looking for in an acquisition. Critical information if you are thinking about an exit. I wish Abe, we knew each other when I sold my MSP.”

“Since the closing, management has proposed numerous investments, which we have supported, to enhance the service offering for clients and to improve our employees’ experience,” Cunningham adds. “Cantey Tech could be a great home and partner for other MSPs in our region, ranging from Texas to Washington, DC, which are looking to exit. Despite all of this additional activity, we have been very impressed with the team’s seamless ability to remain focused on its core business, which has allowed the company to grow organically by well more than 20% over the past year. This is a great testament to the capability of Cantey Tech’s management team and quality of organization.”

Key Takeaways

An acquisition mindset can make you a better competitor – even if you want to remain independent. So if your goal is to top the list in 2023 start by putting on your buyer hat, and confirm your strategy will ultimately appeal to institutional investors (e.g. Private Equity) in these three ways:

- Start with a large TAM/Total Addressable Market (e.g. sandbox which never runs out of potential customers)

- Craft a plan to obtain recurring revenue and strong gross margins (and once acquired focus on revenue /logo retention)

- Join industry Peer Groups to both learn best practices, and build a M&A pipeline (e.g. IT National Evolve)

Surrounding yourself with like-minded professionals with a shared vision is also critical. The #1 Ranked Team at FOCUS Investment Banking is on a roll having propelled nine MSPs into “New Platforms” for private equity groups (PEGs) over the past 24 months.

FOCUS MSP Team’s threefold vision would appear to be the secret sauce to top various industry lists, such as the MSP 501 and ChannelE2E Top 100 Vertical Market MSPs:

- Integris is on pace to be at $100 million with 400+ employees (up from $10 million and 55 in 2019)

- ICS has nearly tripled the size of its company, growing organically and through M&A

- General Informatics has grown from 50 employees to 170 in 12 months with quarter-over-quarter growth of over 300%

- The Purple Guys has grown to 160 employees

- Cantey Tech is looking for nine more years on the Inc. 5000 list.

Notes: You may reach Mr. Garver at [email protected]. Also, register here to hear Mr. Garver speak at XChange March 2022 (Feb. 27 – March 1) or register here to hear Mr. Garver speak at the Channel Partners Conference & Expo (April 11-14, 2022 in Las Vegas).

By Abe Garver, MSP team leader & managing director at FOCUS Investment Banking. Read more guest blogs from FOCUS here. Regularly contributed guest blogs are part of ChannelE2E’s sponsorship program.