Axcient today launched a Business Availability Suite for MSPs -- and effectively relaunched the company as a new business along the way, President Eric White tells ChannelE2E.

Axcient's new brand goal: Empower MSPs to protect everything for their clients. In other words, customer applications and data are always protected, always secured, and always recoverable when MSPs embrace Axcient's business availability suite, the company asserts.

The Axcient Business Availability Suite includes Replibit, BRC, CloudFinder, Anchor, Fusion, and the Axcient Cloud. Many of those offerings are familiar to MSPs, but the code and the underlying IT systems have been optimized as part of a $5 million infrastructure initiative at the company.

The Journey to This Launch

The early seeds for the "new" Axcient were planted when the company merged with eFolder in July 2017. But executives caution against comparing the new business to the former piece parts.

"If you look at the journey we've been on, this wasn't about one company buying or merging with another company," White asserts. "Today, this truly is a new company that has embraced some new ways of working."

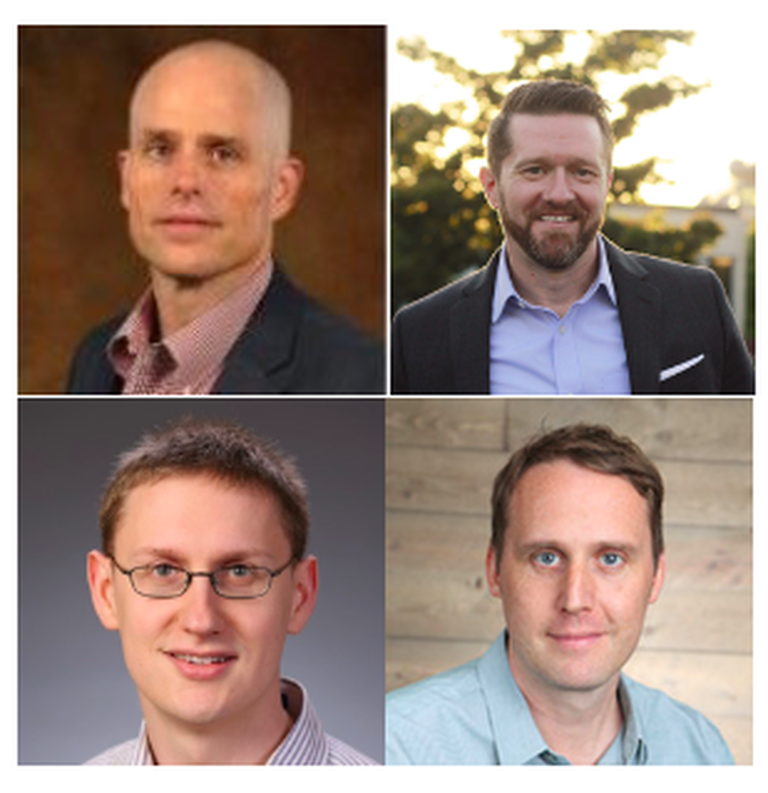

Among the key names to know: Chief Revenue Officer Jeff Cummings; Chief Marketing Officer Angus Robertson; and CTO Kevin Hoffman. Those executives along with White walked ChannelE2E through Axcient's market focus and business strategy ahead of this week's ConnectWise IT Nation Connect 2018 conference in Orlando, Florida.

Axcient Core Values

As part of the company launch, Axcient's 300 employees have embraced five core values. They are:

The core values are designed to extend across everything from Axcient R&D (where agile software development is now the norm) to sales, partner communications, support and more. The new approach means an end to so-called "hero ball," where an individual (consciously or subconsciously) tries to personally put out fires -- but fails to align with a more scalable approach to partner support and all components of the business.

In some ways, the core values sound Apple-inspired. Within Apple Stores, for instance, employees are empowered to take ownership of problems and fix them -- without needing to escalate the situation to in-store managers or Apple's corporate executives. In other ways, Axcient is the opposite of Apple. For instance, while Apple is mainly direct-sales driven, Axcient has vowed to sell entirely through partners.

Some MSPs with long memories may recall that the old Axcient (before the eFolder merger in 2017) had a direct sales team. That model occurred under previous management, Cummings concedes, but he vows to drive a pure channel business model in the current company.

Among the key team members to know: VP of Worldwide Channels and Distribution Jason Bystrak, an Ingram Micro veteran with a strong reputation for pure channel sales models, strategic alliances, and associated partner support.

Axcient R&D, Infrastructure and Software Updates

The new company includes the largest R&D and customer-facing teams that Axcient has ever had, Hoffman adds. He's certainly qualified to know -- considering Hoffman co-founded the former eFolder in 2002.

Poke around the company's infrastructure, and you may also notice a $5 million upgrade to the firm's data centers and associated software. "The focus," Cummings notes, "is on scaling our products."

Traditional BDR -- backup and disaster recovery -- is incomplete, the company asserts. There are best-in-class offerings for individual pieces of the BDR puzzle. But Axcient wants to be best-in-class for every piece of the BDR puzzle.

The vision for those products, Robertson adds, is to protect everything -- meaning any type of data regardless of its physical location, whether it resides in the public cloud, on a private cloud, or on premises at a customer site.

To back up that effort, one-third of Axcient's spending flows directly to R&D, the company says. Another big investment area involves a Partner Success organization. That means heavier online and face-to-face interaction with partners -- to review where MSPs are succeeding with Axcient, and where Axcient can further improve its sales and support motion with partners.

Also, the company will strive to drive down the total cost of ownership for partners. The idea is to deliver a "painless, profitable, and proven experience for partners," the company says. A case in point: MSP trouble tickets to Axcient's help desk have dropped 30 percent in the past year -- even as partner deployments increased. That means partners are spending less time (and money) seeking support for Axcient's products.

Where else will Axcient drive improvements for partners? Among the examples:

Key Performance Indicators

Axcient, backed by K1 Capital, is profitable and growing, but the company's success is not measured in sales or profits, White asserts. Instead, Axcient's net promoter score (NPS) among partners is one of the company's major key performance indicators (KPIs). To drive NPS higher, White has vowed to plow more dollars into R&D and partner support -- even if such moves sacrifice the company's profits.

As net promoter scores climb higher, Axcient expects a highly reference-able partner base to emerge. That partner satisfaction, in turn, will drive even deeper partner engagements across the entire Axcient suite, he predicts.

Key Challenges, Competition

Of course, Axcient faces plenty of competition.

On the one hand, Datto is widely considered the largest provider of MSP-centric data protection solutions. And Datto's headcount (about 1,400 employees) is roughly four to five times the size of Axcient's workforce. And while Axcient's footprint is mainly U.S.-based, Datto has global reach across North America, EMEA (Europe, Middle East and Africa) and Asia Pacific.

Still, the Axcient vs. Datto debate isn't necessarily an apples-to-apples comparison. Many of Datto's employees, for instance, focus on areas outside of data protection -- including MSP-centric technologies for business management, monitoring, automation and networking.

There's also this market twist to keep in mind: Even amid Datto's rapid growth in recent years, the SMB-oriented backup and disaster recovery market remains highly fragmented. ConnectWise, for instance, resells at least six different BDR offerings to its partners. And up in the midmarket and enterprise, companies like Veeam, Cohesive, Rubrik and Druva are gaining momentum.

Learning from the Past, Partnering for the Future

Axcient, eFolder and their previous business iterations have tried multiple business models and leadership teams in years past.

That brings us to the new Axcient. During ChannelE2E's one-hour briefing with the executive team a few weeks ago, White and his lieutenants answered every question we threw their way. Instead of obsessing about rivals, the company seems keenly focused on partners. We'll be watching to see if Axcient truly connects the dots between net promoter scores, MSP success, and data protection market share.