In the cloud infrastructure services market, Amazon Web Services (AWS) continues to be the market share leader, followed by Microsoft Azure and Google Cloud Platform (GCP), according to Q3 2020 research from Synergy Research Group and somewhat similar data from Canalys.

Not by coincidence, AWS, Microsoft Azure and GCP each have fast-growing MSP partner programs, as tracked by ChannelE2E. Also of note: Both Google and Alibaba essentially leapfrogged IBM Cloud in the public cloud IaaS market over the past year or two, ChannelE2E estimates.

Instead of competing head-on against public cloud providers, IBM increasingly leverages the Red Hat acquisition to promote multi-cloud services across.

Cloud Infrastructure Market Share: Q3 2020

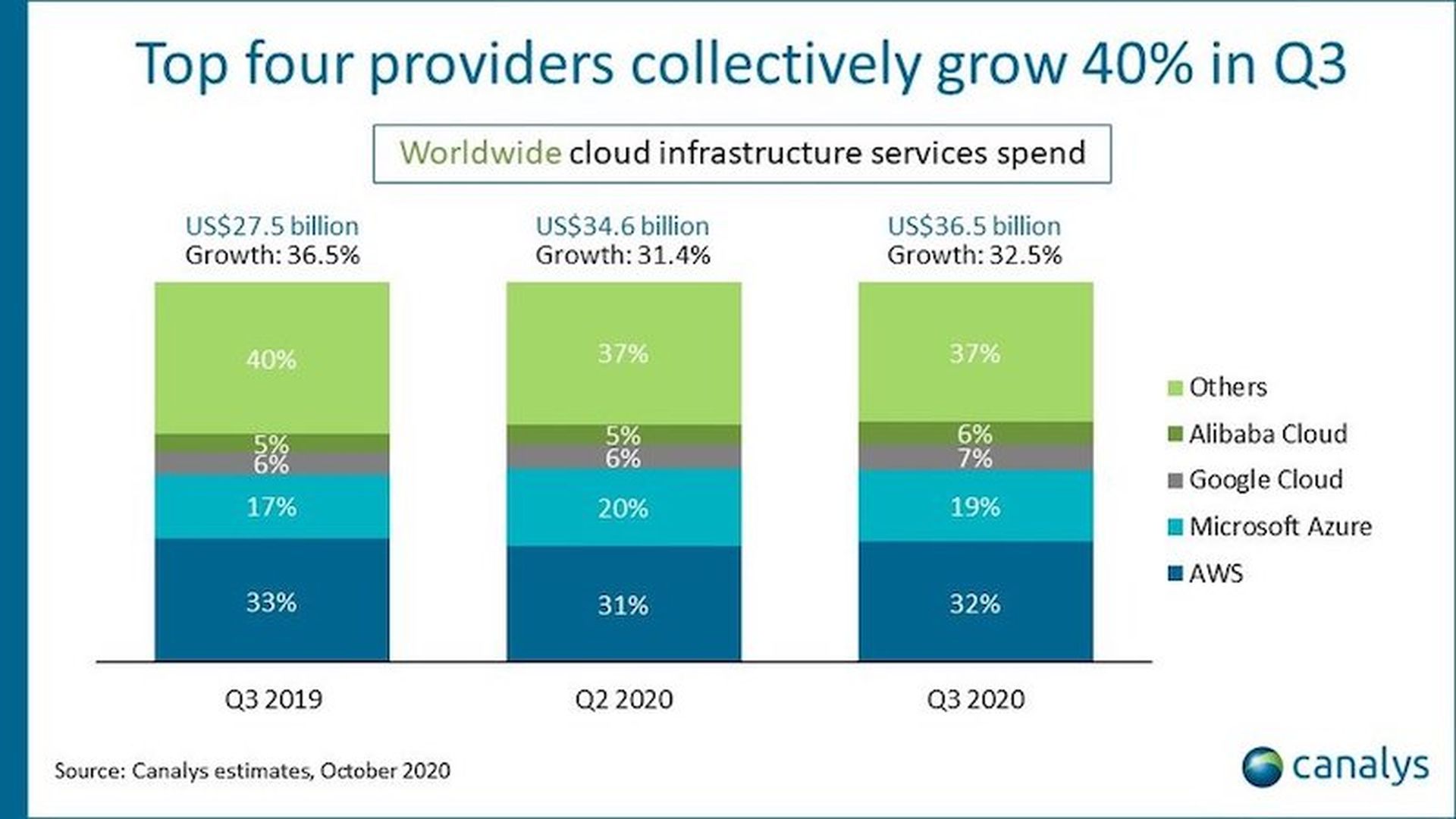

In Q3 2020, the top four cloud infrastructure service providers were AWS (32%), Microsoft Azure (19%), Google Cloud (7%) and Alibaba Cloud (6%), Canalys research finds (see chart below).

Meanwhile, data from Synergy Research Group shows that Q3 2020 enterprise spending on cloud infrastructure services were almost $33 billion, up 33% from the third quarter of 2019.

Other Synergy Research Group data points from Synergy for Q3 2020 include:

- Amazon and Microsoft continue to account for over half of the worldwide market.

- AWS has around 33% cloud infrastructure market share.

- Microsoft’s share was over 18%.

- Google, Alibaba and Tencent are all growing more rapidly than the overall market and are gaining market share. Together they account for 17% of the market.

- The other cloud providers in the top ten ranking are IBM, Salesforce, Oracle, NTT and SAP.

- In aggregate the top ten providers account for 80% of the worldwide market, with the remaining 20% coming from a long tail of small cloud providers or large companies with only a small position in the market.

Cloud Infrastructure Market Share: Q2 2020

In contrast to the information further above, Q2 2020 cloud infrastructure services market share figures -- spanning IaaS, PaaS and hosted private cloud services -- included:

- Amazon AWS at 33%

- Microsoft Azure at 18%

- Google Cloud Platform at 9%

- And others such as Alibaba, IBM, Salesforce, Tencent and Oracle also giving chase.

Key takeaways from Synergy Research's Q2 2020 findings include:

- Q2 cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were almost $30.5 billion, with trailing twelve-month revenues reaching $111 billion.

- Public IaaS and PaaS services account for the bulk of the market and those grew by 34% in Q2.

- The dominance of the top five providers is even more pronounced in public cloud, where they control almost 80% of the market.

- Geographically, the cloud market continues to grow strongly in all regions of the world.

Cloud Infrastructure Market Share and COVID-19 Pandemic

In a prepared statement about the Q2 2020 research findings, John Dinsdale, a chief analyst at Synergy Research Group, said:

“As far as cloud market numbers go, it’s almost as if there were no COVID-19 pandemic raging around the world. As enterprises struggle to adapt to new norms, the advantages of public cloud are amplified. The percentage growth rate is coming down, as it must when a market reaches enormous scale, but the incremental growth in absolute dollar terms remains truly impressive. The market remains on track to grow by well over 30% in 2020.”

Still, public cloud services growth rates at AWS and Microsoft Azure slowed a bit in each company's most recent quarters -- perhaps signaling that the major public cloud providers will potentially face "diminishing returns" because of the scale and scope of their existing installed bases, ChannelE2E suspects.