Office Depot is shaking up CompuCom, hiring Mick Slattery as president of the struggling IT services business unit, effective immediately. The move comes only a few weeks after Office Depot disclosed disappointing financial performance at CompuCom.

Former CompuCom President Greg Hoogerland is no longer with the company, according to an Office Depot spokesperson. Details of his departure were not disclosed. Hoogerland led CompuCom for roughly a year. He previously was chief strategy officer and chief customer officer.

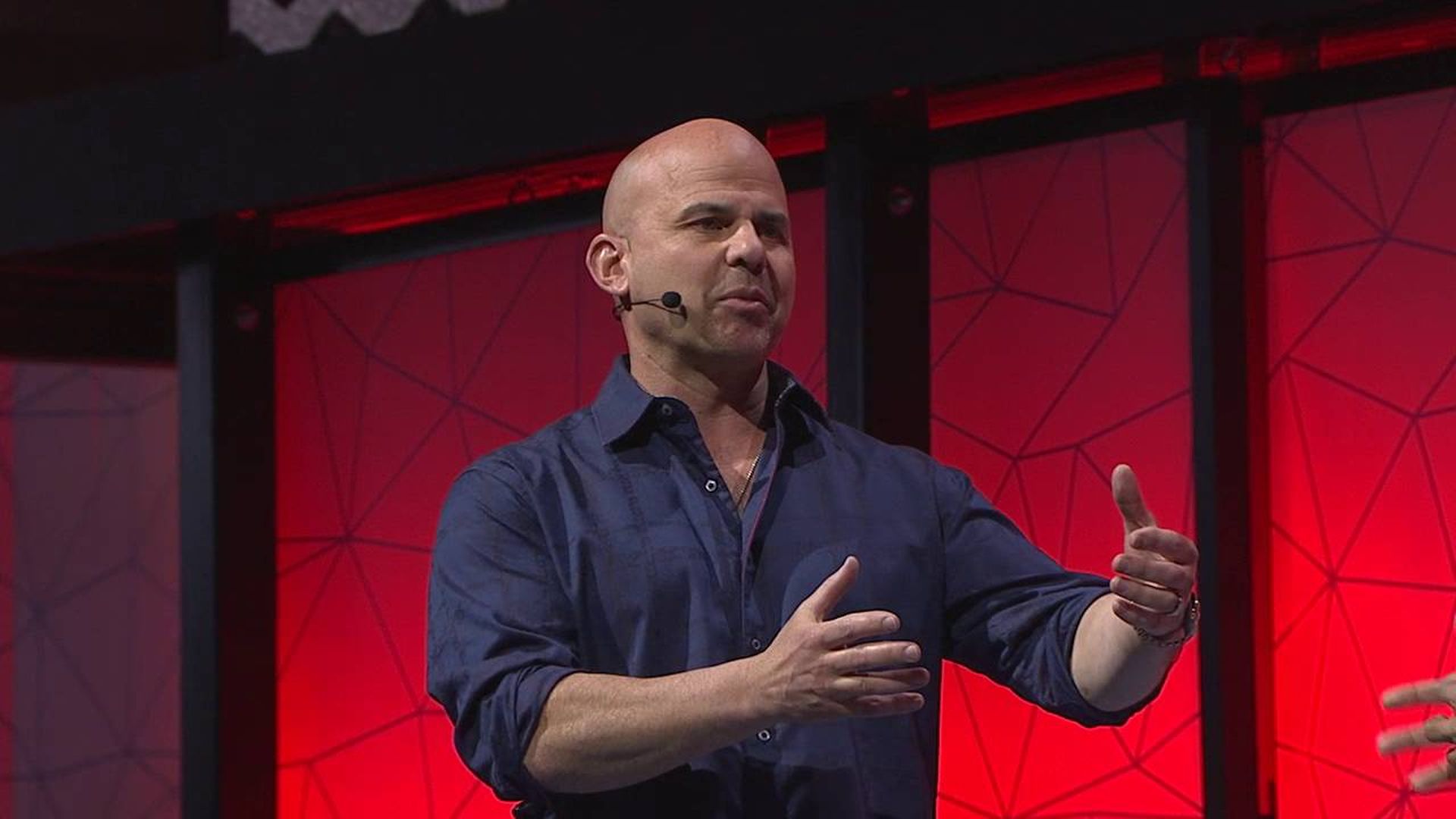

Hoogerland's successor, Slattery, most recently was CEO of Conduent Transportation, a division of Conduent Inc., a business process services company. Earlier, he held key posts at Avanade and Accenture.

Office Depot and CompuCom: Past, President, Future?

Office Depot acquired CompuCom for $1 billion in 2017. The pricey deal valued CompuCom at a lofty 10 times annual EBITDA (earnings before interest, taxes, depreciation and amortization). Most MSPs and IT service providers are valued at closer to four times to eight times EBITDA, ChannelE2E believes.

CompuCom appeared to perform reasonably well during the first few months under Office Depot's ownership. But the first business performance warning signs surfaced publicly in April 2019, and disappointing earnings arrived in May 2019.

In a May 2019 earnings statement, Office Depot CEO Gerry Smith said:

“Our first quarter results were disappointing driven primarily by poor performance at our CompuCom division. We are taking decisive actions and making numerous improvements in our sales and operational processes to place this business back on-target with its long-term expectations.”

The plan, Smith said at the time, included:

- A “zero-based budgeting approach” to reduce discretionary spending;

- cost savings of at least $40 million in the second half of 2019;

- achieving at least $100 million in annual run-rate costs savings thereafter.

CompuCom: New Leader, Better Results?

Fast forward to present day, and Slattery is now calling the shots at CompuCom, reporting directly to Smith. We'll be watching to see if or how CompuCom's business performance eventually justifies the 10X EBITDA buyout valuation.