When it comes to mergers and acquisitions across the IT service provider market, most buyers are typically company insiders, family members, peer companies or private equity firms. But here's a new twist on the old M&A discussion: Have you ever thought about selling to an MBA student?

Indeed, some MBA graduates should buy more small businesses rather than pursuing traditional career paths, a recent Harvard Business Review article suggests. At first glance, that’s a somewhat limited pool of buyers. But take a closer look and learn about so-called Search Funds, which often involve MBA grads.

A search fund is a pool of capital raised to support the efforts of an entrepreneur, or a pair of entrepreneurs, in locating and acquiring a privately held company for the purpose of operating and growing it, according to Stanford Graduate School of Business.

How A Search Fund Works

The lifecycle of a search fund tends to include four stages, the university notes:

- Fundraising: The initial search capital is raised to finance the search stage, that is, the identification, evaluation, and negotiation of an acquisition.

- Search and acquisition: There are multiple steps in this stage: Generating deal flow, screening potential candidates, assessing seller interest, performing due diligence on the target company, negotiating the terms of the acquisition, raising debt and/or equity capital, and closing the deal.

- Operation: After completing the acquisition, principals will recruit a board of directors for the company, which often includes substantial representation from the initial search fund investors. In the firstsix to 18 months after the acquisition, principals typically make few radical changes, opting instead to learn the business and gain management experience. After becoming comfortable operating the business, principals then begin to make changes to improve and further grow the business.

- Exit: Most search funds are established with a long-term outlook, often no less than five to seven years. A typical search fund entrepreneur may spend on average six years from the beginning of the search to an exit.

Search Funds: Past, Present, Future

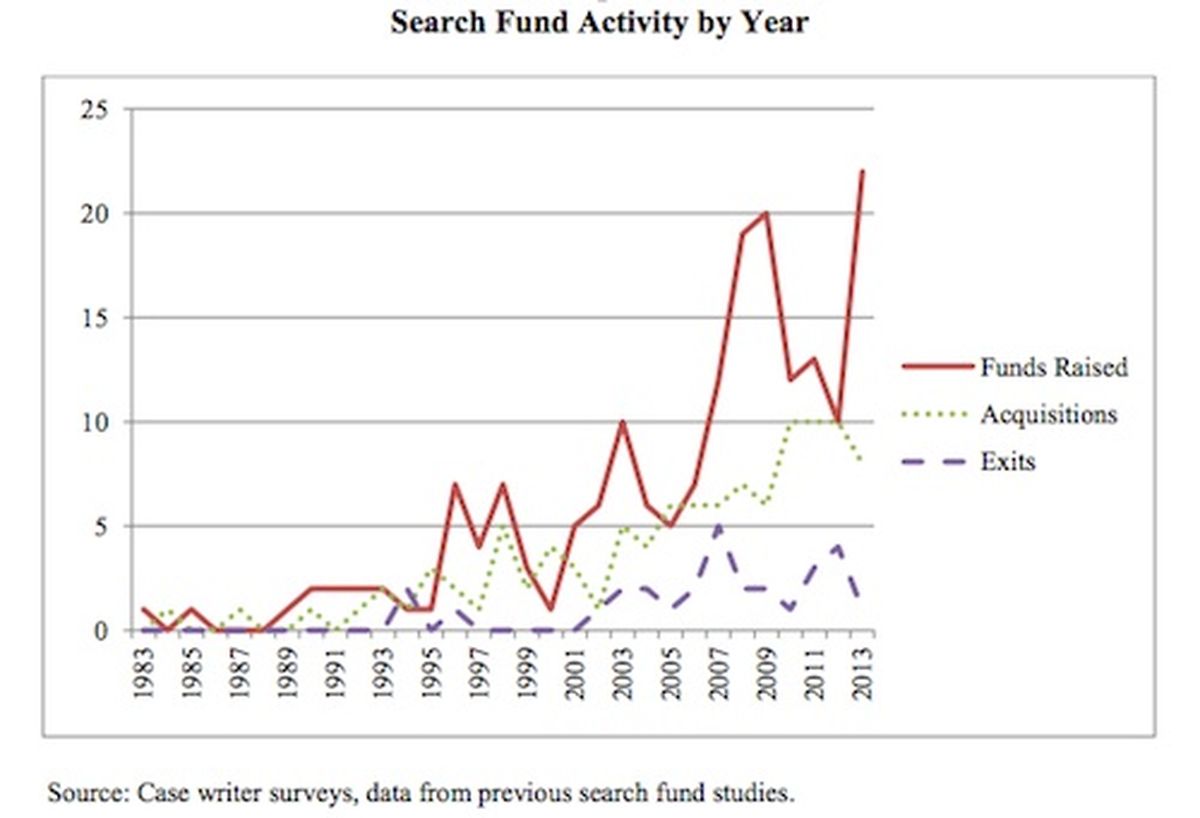

The first known search funds surfaced in 1983, and from about 2007 forward at least 10 search funds have debuted annually, Stanford says. Some years more than 20 funds are raised, but actual acquisitions per year tend to involve 10 or fewer companies (see chart, below), Stanford suggests.

The big question: Would a search fund ever really be interested in an MSP, VAR or IT services provider. At first glance, the answer is "highly unlikely." After all, search funds typically have an aggregate pre-tax internal rate of 34.9 percent, and the aggregate pre-tax return on invested capital is 10.0x, the Stanford case study says.

For those types of returns, it's a safe bet the investments involve some sort of defendable intellectual property rather than generic IT services offerings.

Still, the concept of a search fund intrigues me. And I'm wondering if we'll see some sort of trickling down into the IT channel -- eventually reaching VARs, MSPs and next-generation service providers.

After all, a growing supply of IT services providers will likely be on the market from now until at least 2022. With so much up for sale, new buy-side models could emerge... And maybe they'll emerge from the current Search Fund approach that some MBA graduate students have embraced.