Goodbye Hewlett-Packard Co. Hello HP Inc. (stock symbol HPQ) and Hewlett Packard Enterprise (stock symbol HPE). Meg Whitman's grand plan to break HP into two companies is now a reality. A done deal, effective Nov. 1. To understand the rather incredible implications for channel partners, consider these nuggets of financial information.

Let's start with Tech Data Corp., the technology distributor. In 2014, HP-related sales represented 20 percent of Tech Data's $28 billion in revenues, according to CEO Bob Dutkowsky, quoted in USA Today.

Check in with rival distributors like Avnet Technology Solutions, Ingram Micro and Synnex, and you'll find teams of executives, managers and employees dedicated to HP-oriented solutions. Those distributors, in turn, support thousands of HP resellers.

The Power of Two?

Actually, now those distributors support thousands of resellers focused on two separate Fortune 500 companies:

- Hewlett-Packard Enterprise, focused on servers, storage, networking and more.

- HP Inc., focused on PCs and printers.

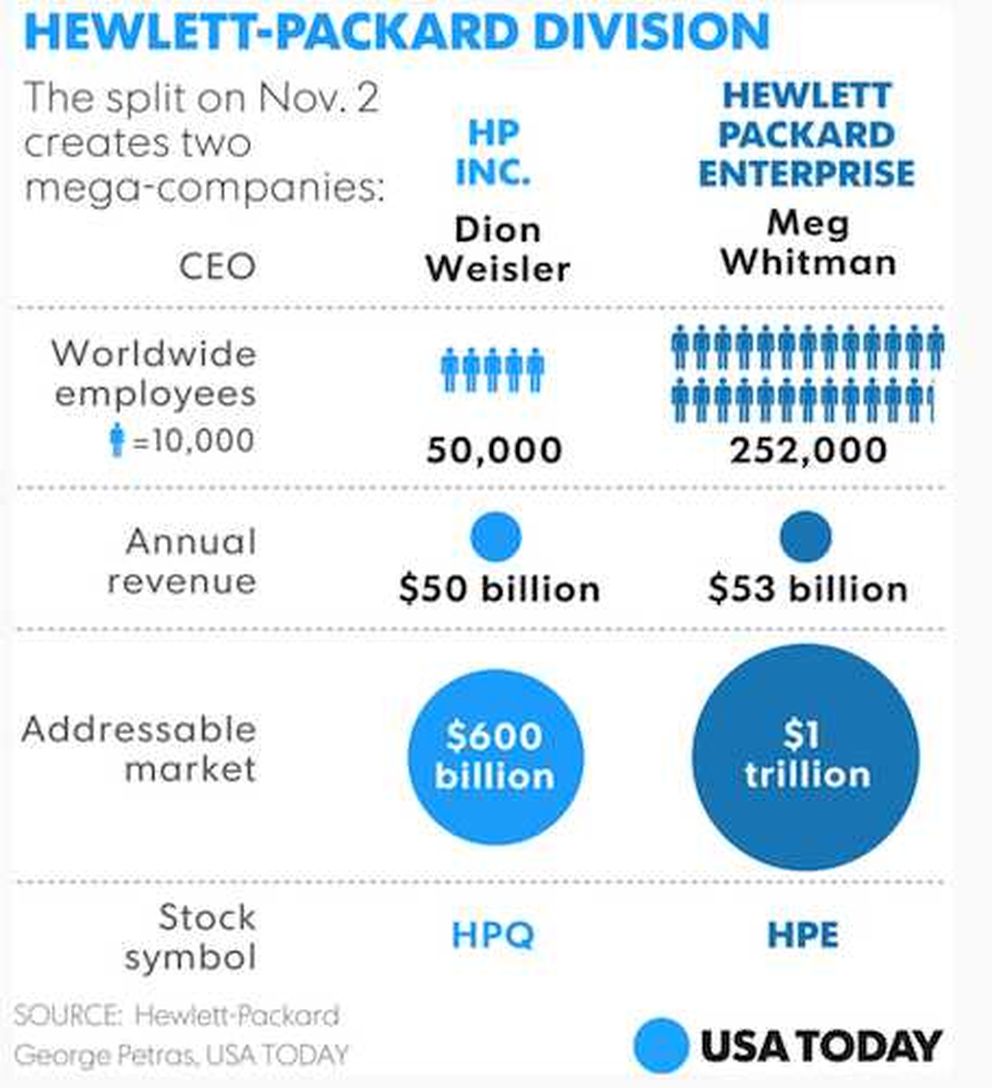

The numbers, even simplified in the following graphic from USA Today, are staggering:

Source: USA Today

Hewlett Packard Enterprise and HP Inc. -- Too Big to Fail?

Dion Weisler

Dion WeislerIn some ways, the two HP businesses are now too critical -- I.E., too big to fail -- across the IT channel. Hewlett Packard Enterprise CEO Meg Whitman and HP Inc. CEO Dion Weisler have got to execute to ensure their respective businesses, customers and partners continue to thrive.

But are the two HP's really too big to fail? After all, the vast majority of their partner networks involve classic reselling -- hardware moving from design and development to distribution, to retail or reseller, to end customer. Meanwhile, both of the new companies have largely missed the cloud computing and mobility waves (smartphones, tablets and apps).

Sure, Hewlett-Packard Enterprise sells plenty of infrastructure into the cloud market. But the company recently killed the Helion Public Cloud, and SaaS revenues have been flat or falling in recent quarters. Re-read that last sentence and let it sink in for a minute. As SaaS revenues skyrocket across the planet, Hewlett-Packard Enterprise's overall SaaS revenues are contracting.

In theory, breaking into two companies will allow both businesses to be more nimble -- to accelerate R&D in such areas as big data, mobile, social, cloud computing, the Internet of Things (IoT) and more.

Some Progress, But Where's the Growth?

HP was adrift in failed strategies and executive changes for more than a decade. After arriving as CEO in September 2011, Meg Whitman stabilized both sides of the house and ultimately sold Wall Street on her vision for a company breakup. Now, both Whitman and Weisler have to prove they can growth the two separate HP businesses.

I suspect both executives will make their latest case for success -- to partners and customers -- during the Hewlett Packard Enterprise Discover 2015 conference in London this December...